by Calculated Risk on 2/06/2016 08:11:00 AM

Saturday, February 06, 2016

Schedule for Week of February 7, 2016

The key economic report this week is January retail sales on Friday.

The focus will be on Fed Chair Janet Yellen's Semiannual Monetary Policy testimony to the Congress.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

9:00 AM ET: NFIB Small Business Optimism Index for January.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS.

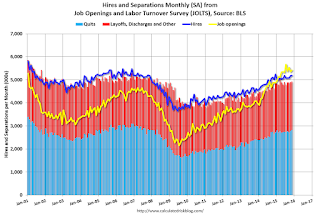

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in November to 5.431 million from 5.349 million in October.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 6% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: The Monthly Treasury Budget Statement for January.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 281 thousand initial claims, down from 285 thousand the previous week.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM ET: Retail sales for January will be released. The consensus is for retail sales to increase 0.2% in January.

8:30 AM ET: Retail sales for January will be released. The consensus is for retail sales to increase 0.2% in January.This graph shows retail sales since 1992 through December 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were down 0.1% from November to December (seasonally adjusted), and sales were up 2.2% from December 2014.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 92.5, up from 92.0 in January.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.1% increase in inventories.

11:00 AM: The New York Fed will release their Q4 2015 Household Debt and Credit Report