by Calculated Risk on 10/14/2014 12:41:00 PM

Tuesday, October 14, 2014

Mortgage Rates: Close to 4%, No Significant Increase in Refinance Activity Expected

With the ten year yield falling to 2.23%, mortgage rates should move lower. Based on a historical relationship (see 2nd graph below), 30-year rates will probably fall close to 4%.

However I do not expect a refinance boom due to lower rates.

Click on graph for larger image.

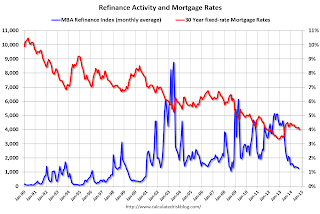

This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply last year when mortgage rates increased. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Borrowers who took out mortgages last year can probably refinance now - but that is a small number of total borrowers. For a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

The second graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Based on the relationship from the graph, it appears mortgage rates will be close to 4% soon.

However, to have a significant refinance boom, the 30 year mortgage rate (Freddie Mac survey) would be have to fall below the 3.35% of late 2012, and that means 10-year Treasury yields would have to fall well below 2%.

So I don't expect a significant increase in refinance activity any time soon.