by Calculated Risk on 9/02/2014 12:40:00 AM

Tuesday, September 02, 2014

Black Knight releases Mortgage Monitor for July

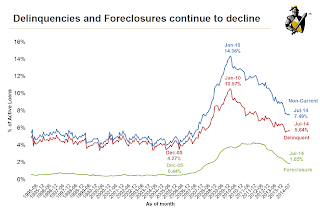

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for July today. According to BKFS, 5.64% of mortgages were delinquent in July, down from 5.70% in June. BKFS reports that 1.85% of mortgages were in the foreclosure process, down from 2.82% in July 2013.

This gives a total of 7.49% delinquent or in foreclosure. It breaks down as:

• 1,713,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,136,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 935,000 loans in foreclosure process.

For a total of 3,785,000 loans delinquent or in foreclosure in June. This is down from 4,599,000 in July 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

July’s data also showed continued improvement in new problem loans, which, at 0.6% of active loans, are now firmly back to 2005-2006 levels. Likewise, “roll rates” (the number of loans that shift from current into progressively more delinquent statuses) have been improving over the long term across all categories. Black Knight has observed roll rates increasing on loans shifting from 60 to 90 days delinquent and from 90 days to foreclosure over the last four months. It should be noted, however, that nearly 75 percent of 90-day defaults and almost 80 percent of foreclosure starts are from loans originated in 2008 and earlier.There is much more in the mortgage monitor.

emphasis added