by Calculated Risk on 4/04/2014 03:28:00 PM

Friday, April 04, 2014

Comment on Jobs Recovery and Policy

The U.S. achieved a minor milestone today with the number of private sector payroll jobs finally exceeding the pre-recession peak. This raises a few of key points:

1) This doesn't include growth of the labor force and population.

2) Total employment is still below the pre-recession peak because of all the public sector layoffs (see previous post for a table of annual public sector job losses). Total employment should be above the pre-recession peak this summer.

3) Even though it took 6+ years to exceed the previous employment peak, this is actually better than most recoveries from a financial crisis. (Note: this recovery was during a period of declining participation - partially due to demographics - and that makes this milestone even better).

From Josh Lehner today: Getting There. Financial Crises Edition.

From Josh Lehner today: Getting There. Financial Crises Edition.

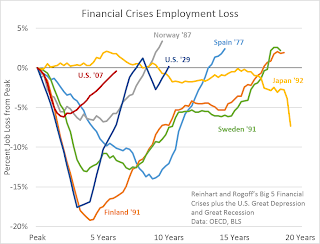

[T]he graph compares employment loss for Carmen Reinhart and Ken Rogoff’s so-called Big 5 financial crises with the U.S. Great Depression and Great Recession. Using Reinhart and Rogoff’s great work on historical financial crises, our office previously looked into comparing the Great Recession with these historical financial crises to see how the current cycle stacked up. Overall the Great Recession was your “garden-variety, severe financial crisis” as Rogoff once said, but in terms of employment, the U.S. has actually done fairly well when compared with these other, major crises. Not good enough overall to avoid mass unemployment and lackluster growth, but in the context of historical financial crises, the U.S. employment picture is better than most.Point 3 is critically important for policy.

In 2009, many of us argued the current recovery would be sluggish because of the causes of the recession (a housing bust that led to a financial crisis). This is why I never understood why projects needed to be "shovel ready" to be included in the early 2009 stimulus package. Look at the construction job losses in the previous post, clearly infrastructure investment could have been spread out over several more years.

Unfortunately, when the stimulus was being introduced, many opponents argued the economy would recover quickly without the stimulus (obviously poor economic analysis). Even the Obama administration mostly thought the recovery would happen sooner (hence the unfortunate pivot to austerity).

Even today some policymakers don't understand what happened. As an example, from U.S. Congressman Kevin Brady (R-TX), chairman of the Joint Economic Committee: “That it took six long years for America's economy to simply return to break even for Main Street jobs is compelling proof of President Obama's disappointing economic leadership." Unfortunately that shows the "chairman of the Joint Economic Committee" is ignorant of the nature of recoveries from a financial crisis. Very sad.

What we should actually be doing is asking why the recovery was this good relative to other financial crisis. What did we do correctly? And what did we do wrong?

Wrong is easy - some of the stimulus was a clear mistake. As an example, the tax credit for business investment - when there was already too much supply - was a mistake. And research by Atif Mian and Amir Sufi suggests that "cash for clunkers" wasn't effective:

[A]lmost all of the additional purchases under the program were pulled forward from the very near future; the effect of the program on auto purchases is almost completely reversed by as early as March 2010 – only seven months after the program ended. The effect of the program on auto purchases was significantly more short-lived than previously suggested. We also find no evidence of an effect on employment, house prices, or household default rates in cities with higher exposure to the program.And of course I vigorously opposed the expensive and ineffective housing tax credit that was originally proposed by Senators Johnny Isakson (R) and Joe Lieberman (I). I opposed the tax credit early and often. The tax credit for buying new homes was especially dumb. A key problem during the housing bust was the excess supply of vacant housing units, and incentivizing people to buy new homes (and add to the supply) made no sense at all.

But clearly most of the stimulus was effective, and I think more infrastructure investment (help with construction employment) - and more aid to states (keep more teachers, police and firefighters employed) - would have been very helpful.

Luckily the track record of the Federal Reserve was better than for fiscal policy makers. Although Bernanke was slow to recognize what was happening - and he underestimated the severity of the crisis (remember "contained to subprime"?) - when he finally understood what was happening, the Fed was very effective. Bernanke's critics argued that his policies would lead to inflation (wrong) and a collapse in the dollar against other currencies (also wrong).

The key points are this recovery is better than most from a financial crisis and policymakers did many of the correct things (although they could have done better).