by Calculated Risk on 1/14/2014 12:13:00 PM

Tuesday, January 14, 2014

Mortgage Monitor: 2013 Vintage "best-performing on record", Purchase Mortgages over 50% of originations

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for November today. According to LPS, 6.45% of mortgages were delinquent in November, up from 6.28% in October. BKFS reports that 2.54% of mortgages were in the foreclosure process, down from 3.61% in November 2012.

This gives a total of 8.99% delinquent or in foreclosure. It breaks down as:

• 1,958,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,283,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,256,000 loans in foreclosure process.

For a total of 4,497,000 loans delinquent or in foreclosure in November. This is down from 5,350,000 in November 2012.

Click on graph for larger image.

Click on graph for larger image.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

From BKFS:

• DQs following typical seasonal pattern, FCs continue to improve (with reduced holiday activity)Delinquencies and foreclosures are still high, but moving down - and might be back to normal levels in a couple of years. The judicial foreclosure states (like NJ and NY) are lagging behind.

• NJ and NY non-current rates are now on par with FL and NV, 2x rates in CA and AZ

From BKFS on originations:

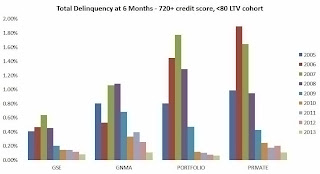

From BKFS on originations:• Originations are at the lowest levels since early 2010 with purchases over 50% of totalThe second graph from BKFS shows the total delinquency rate at 6 months after origination. the 2013 vintage is the best ever.

• Non-agency participation has increased relative to government

• 2013 originations are the best performing vintage on record

• Second lien prevalence is still low in recent vintages but HE originations are on the rise

“Looking at the most current mortgage origination data, several points become clear,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “First is that heightened credit standards have resulted in this year being the best-performing vintage on record. Even adjusting for some of these changes, such as credit scores and loan-to-values, we are seeing total delinquencies for 2013 loans at extremely low levels across every product category. Secondly, while overall volumes are down, we are seeing an increased proportion of the market being supported by non-agency (vs. government) lending – with the share nearly doubling as compared to 2010.

“Although tighter credit requirements, coupled with interest rate increases, have helped drive originations down to their lowest level since 2010, thanks to increasing home prices, we have seen a significant increase in home equity lending. While first mortgage originations are almost half the levels as one year ago, total home equity lending, including loans and lines, has increased by 70 percent, and originations of second lien home equity loans have more than doubled. Finally, in the first lien market, we also observed a 75 percent year-over-year increase in the share of non-agency jumbo prime lending. Notably, nearly all of these jumbo loans have been originated with no mortgage insurance, which may indicate an increased appetite for risk, as well as an opportunity to expand credit criteria, for originations within the private market.”

emphasis added

There is much more in the mortgage monitor.