by Calculated Risk on 10/28/2013 03:15:00 PM

Monday, October 28, 2013

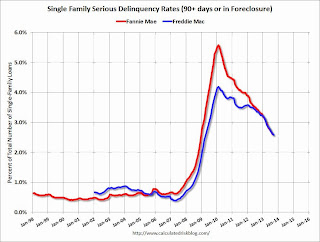

Freddie Mac: Mortgage Serious Delinquency rate declined in September, Lowest since April 2009

Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 2.58% from 2.64% in August. Freddie's rate is down from 3.37% in September 2012, and this is the lowest level since April 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I'm frequently asked when the distressed sales will be back to normal levels, and that will happen when the percent of seriously delinquent loans (and in foreclosure) is closer to normal. Since very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for September later this week.

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until late 2015 or 2016. Therefore I expect an above normal level of distressed sales for 2 or 3 more years (mostly in judicial states).