by Calculated Risk on 1/07/2012 01:16:00 PM

Saturday, January 07, 2012

Schedule for Week of Jan 8th

Earlier:

• Summary for Week Ending January 6th

Retail sales and the trade balance report are the key economic releases this week. Consumer sentiment might recover some more in early January.

Also several regional Fed presidents are scheduled to speak this week.

Note: Reis is expected to release their Q4 Mall vacancy rate report this week.

Note: German Chancellor Angela Merkel and French President Nicolas Sarkozy meet in Berlin.

3:00 PM: Consumer Credit for November. The consensus is for a $7.6 billion increase in consumer credit.

7:30 AM: NFIB Small Business Optimism Index for December.

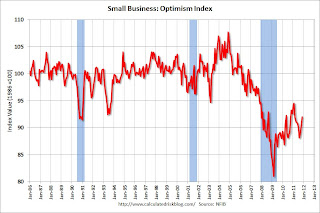

7:30 AM: NFIB Small Business Optimism Index for December. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 92.0 in November from 90.2 in October. This was the third increase in a row after declining for six consecutive months.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.5% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In general, the number of job openings (yellow) has been trending up, and are up about 13% year-over-year compared to October 2010.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index was especially weak last year, although this doesn't include cash buyers.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 375,000 from 372,000 last week.

8:30 AM: Retail Sales for December.

8:30 AM: Retail Sales for December. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 20.0% from the bottom, and now 5.5% above the pre-recession peak (not inflation adjusted) .

The consensus is for retail sales to increase 0.4% in December, and for retail sales ex-autos to increase 0.4%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for November. The consensus is for a 0.5% increase in inventories.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. Both exports and imports decreased in October. Imports have been mostly moving sideways for the past six months (seasonally adjusted). Exports are well above the pre-recession peak and up 12% compared to October 2010; imports have stalled recently but are still up about 11% compared to October 2010.

The consensus is for the U.S. trade deficit to increase to $45.0 billion in November, up from from $43.5 billion in October. Export activity to Europe will be closely watched.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for January.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for January. Consumer sentiment declined sharply in July and August - from 71.5 in June to 55.7 in August, but has mostly rebounded since then.

The consensus is for an increase in January to 71.5 from 69.9 in December.