by Calculated Risk on 1/09/2012 01:30:00 PM

Monday, January 09, 2012

Question #3 for 2012: Will foreclosure activity increase in 2012?

Earlier I posted some questions for next year: Ten Economic Questions for 2012. I'm trying to add some thoughts, and a few predictions for each question.

3) Distressed house sales: Foreclosure activity is still very high, although activity slowed in 2011 because of "foreclosure gate" issues. The number of REOs (Real Estate Owned by lenders) also declined in 2011. Will foreclosure activity increase in 2012?

This is a difficult question. There are several significant policy changes in the works: 1) a possible Mortgage Settlement, 2) HARP refinance (the automated program starts in March), and 3) a REO to rental program. (See: Housing Policy Changes). It appears the overall goal of these policy changes is to reduce the large backlog of seriously delinquent loans while, at the same time, not flood the housing market with distressed homes.

Note: Diana Olick at CNBC has an update on the REO to rental program today: Government Set to Sell Foreclosures in Bulk

The Obama administration, in conjunction with federal regulators and led by the overseer of Fannie Mae and Freddie Mac, is very close to announcing a pilot program to sell government-owned foreclosures in bulk to investors as rentals, according to administration officials.Here are some charts on REOs and delinquencies:

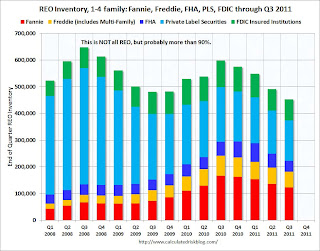

The first is just inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2011.

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. However there may be a new peak when the foreclosure dam breaks (after the settlement) - however I expect quite a few modifications as part of the settlement too, and also a bulk REO selling program from Fannie and Freddie.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.As Tom Lawler has noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the 1-4 family REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is just around 500,000 in Q3.

REO inventories have declined over the last year, however there are many more to come.

One of the key issues is the number of delinquent loans (and loans in the foreclosure process). I use the Mortgage Bankers Association (MBA) quarterly data and LPS Applied Analytics monthly data to track delinquencies.

One of the key issues is the number of delinquent loans (and loans in the foreclosure process). I use the Mortgage Bankers Association (MBA) quarterly data and LPS Applied Analytics monthly data to track delinquencies.This graph based on the MBA quarterly data shows the percent of loans delinquent by days past due. The MBA reported that 12.42 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2011 (delinquencies seasonally adjusted).

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages through November 2011.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages through November 2011.The total delinquent rate has fallen to 8.15% from the peak in January 2010 of 10.97%, but the decline has "halted". The in-foreclosure rate was at 4.16%, down from the record high last month of 4.29%. There are still a large number of loans in this category (about 2.21 million).

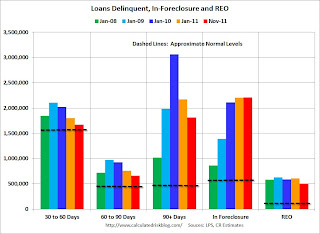

The last graph shows the delinquent and REO buckets over time. The delinquency data is from LPS, and the REO estimates are based on work by Tom Lawler and my own calculations.

The dashed lines are "normal" historical levels for each bucket. The 30 day bucket is only slightly elevated (as of November), and the 60 day buckets is somewhat elevated. But the glaring problems are in the 90 day and in-foreclosure buckets.

The dashed lines are "normal" historical levels for each bucket. The 30 day bucket is only slightly elevated (as of November), and the 60 day buckets is somewhat elevated. But the glaring problems are in the 90 day and in-foreclosure buckets.There are 4 million seriously delinquent loans (90 day and in-foreclosure). This is about 3 million more properties than normal. Probably when the mortgage settlement is announced, some of these loans will cure as part of the settlement with loan modifications that include principal reduction, but many of these properties will become REOs fairly quickly.

So even though REO inventory is declining, there are still many more to come - and this doesn't include all the homeowners with negative equity who may default in the future (although the refinance programs are aimed at keeping many of these borrowers from defaulting).

My guess is the policy changes will all be announced in the next few months, and that foreclosure activity will increase significantly. Some portion of these REO will be sold in bulk to investors and rented, so it is difficult to tell how many REOs will come on the market.

Earlier:

• Question #4 for 2012: U.S. Economic Growth

• Question #5 for 2012: Employment

• Question #6 for 2012: Unemployment Rate

• Question #7 for 2012: State and Local Governments

• Question #8 for 2012: Europe and the Euro

• Question #9 for 2012: Inflation

• Question #10 for 2012: Monetary Policy