by Calculated Risk on 6/15/2010 10:00:00 AM

Tuesday, June 15, 2010

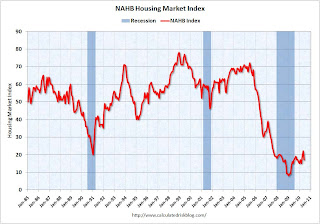

NAHB Builder Confidence declines sharply in June

Note: any number under 50 indicates that more builders view sales conditions as poor than good. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 17 in June. This was a sharp decline from 22 in May.

The record low was 8 set in January 2009. This is still very low ... This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the June release for the HMI and the April data for starts (May starts will be released tomorrow).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the June release for the HMI and the April data for starts (May starts will be released tomorrow).

This shows that the HMI and single family starts mostly move generally in the same direction - although there is plenty of noise month-to-month.

Press release from the NAHB: Builder Confidence Declines in June

Snapping a string of two consecutive monthly gains, builder confidence in the market for newly built, single-family homes fell back to February levels, before the beginning of the home buyer tax credit-related surge, according to results of the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI dropped five points to 17 in June.This suggests single family starts will decline sharply soon.

“The home buyer tax credit did its job in stoking spring sales and we expected a temporary pull back in the builders’ outlook after the credit expired at the end of April,” said NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Mich. “However, the reduction in consumer activity may have been more dramatic than some builders had anticipated, which resulted in their lower confidence levels.”

...

Each of the HMI’s component indexes recorded declines in June. The component gauging current sales conditions fell five points to 17, while the component gauging sales expectations for the next six months declined four points to 23 (from a one-point downward revised index level of 27 in May) and the component gauging traffic of prospective buyers fell two points to 14.

The HMI also posted losses in every region in June. The Northeast, which has the smallest survey sample and is therefore subject to greater month-to-month volatility, fell 17 points to 18 following a 14-point jump in May. The Midwest posted a three-point loss to 14, while the South also registered a three-point decline to 19 and the West fell four points to 15 from a revised May level of 19.