by Calculated Risk on 3/31/2009 09:00:00 AM

Tuesday, March 31, 2009

Case-Shiller: Prices Fall Sharply in January

S&P/Case-Shiller released their monthly Home Price Indices for January this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

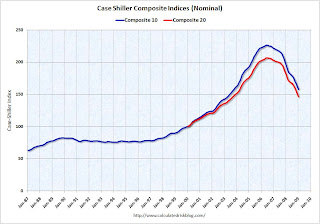

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.2% from the peak, and off 2.5% in January.

The Composite 20 index is off 29.1% from the peak, and off 2.8% in January.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 19.4% over the last year.

The Composite 20 is off 19.0% over the last year.

These are the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more almost 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% from the peak. Prices have declined by double digits everywhere.

In Phoenix, house prices have declined more almost 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% from the peak. Prices have declined by double digits everywhere.

Prices fell at least 1% in all Case-Shiller cities in January, with Phoenix off 5.5% for the month alone. Chicago and Minneapolis were off close to 5% for the month.

I'll have more on house prices including a comparison to the stress test scenarios.