by Calculated Risk on 12/12/2008 11:18:00 AM

Friday, December 12, 2008

Inland Empire Commercial Vacancy Rates Rise Sharply

California's Inland Empire is an interesting area to follow. During the housing boom, the local economy was heavily dependent on real estate related employment (see graph at bottom of post), and now, with the housing bust, the area is being devastated.

From the Press-Enterprise: Inland office, industrial space vacancies rise

Inland office vacancy rates reached 20 percent during the third quarter, according to the 2008 Southern California Office and Industrial Market Report, which was released Thursday by the Casden Forecast at the University of Southern California Lusk Center for Real Estate.No one could have predicted this .... oh wait, from one of my posts in 2005 (the graphics are better today!):

Almost 1.5 million square feet of office space was completed during the first nine months of this year, but demand for that property is so weak, mostly because of fallout from the region's housing slowdown, that most of that space remains vacant and is likely to be leased out slowly during the next 12 months, the report found.

...

The Inland industrial market also struggled during the first nine months of 2008, mostly because of the drop in imports at the ports of Los Angeles and Long Beach.

Industrial vacancy rates climbed from 4.9 percent during the third quarter of 2007 to 8.6 percent during this year's third quarter ...

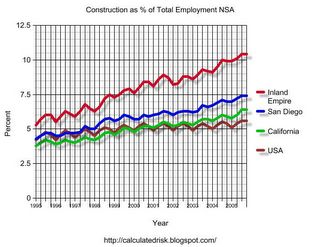

Of all the areas experiencing a housing boom, the areas most at risk have had the greatest increase in real estate related jobs. These jobs include home construction, real estate agents, mortgage brokers, inspectors and more. The following graph uses NSA construction jobs for comparison purposes.I'll post an update to the employment graph.Click on graph for larger image.

Not surprisingly, California has become more dependent on construction than the rest of the country, and construction has really boomed in San Diego. But San Diego has nothing on the Inland Empire.

I believe that areas like the Inland Empire will suffer the most when housing activity slows.