by Calculated Risk on 2/29/2008 09:06:00 PM

Friday, February 29, 2008

Leveraged Losses Lessons from the Mortgage Market Meltdown

From the 2008 U.S. Monetary Policy Forum

"Leveraged Losses Lessons from the Mortgage Market Meltdown" by David Greenlaw (Morgan Stanley), Jan Hatzius (Goldman Sachs), Anil Kashyap (Chicago GSB) and Hyun Shin (Princeton).

Hatzius summarizes (via email):

Our story is as follows. While the mortgage credit losses still don’t look huge relative to the size of the economy or the financial markets -- the baseline assumption in the paper is $400bn in losses ... they are nevertheless responsible for much of the financial and economic turmoil of the past 6 months. We estimate that roughly half of the total losses are likely to be borne by leveraged US financial institutions ... Assuming that these institutions will aim to lower their leverage by 5%, our baseline estimate is that they will scale back their lending by close to $2 trillion in response to these losses, even if we assume that they manage to “replace” 50% of the lost equity via inflows of unlevered capital, e.g. from sovereign wealth funds. Further, we estimate that just under $1 trn of this credit supply hit is a “ Main Street ” event and will hit unlevered entities such as households and nonfinancial businesses; the remainder is a “Wall Street” event and will hit other leveraged institutions. Finally, we (very tentatively) estimate that the credit supply hit could shave 1-1½ points from real GDP growth over the next year, over and above the “traditional” hit from reduced homebuilding demand, a negative wealth/MEW effect on consumer spending, and the multiplier effects working via the labor market.

Buffett's Letter

by Calculated Risk on 2/29/2008 04:49:00 PM

I’ve reluctantly discarded the notion of my continuing to manage the portfolio after my death abandoning my hope to give new meaning to the term “thinking outside the box.”Here is Buffett's letter to shareholders.

Warren Buffett, Feb 29, 2008

I should mention that people who expect to earn 10% annually from equities during this century – envisioning that 2% of that will come from dividends and 8% from price appreciation – are implicitly forecasting a level of about 24,000,000 on the Dow by 2100. If your adviser talks to you about doubledigit returns from equities, explain this math to him – not that it will faze him. Many helpers are apparently direct descendants of the queen in Alice in Wonderland, who said: “Why, sometimes I’ve believed as many as six impossible things before breakfast.” Beware the glib helper who fills your head with fantasies while he fills his pockets with fees.Numbers are fun. Let's see, 1.08 (8% price appreciation) for 92 years = 1188. Then multiply by 12,266 (today's close), and I only get 14.6 million on the Dow. Oh well ... underperforming Buffett again!

The actual number sounds huge, but much depends on the size of the economy - and that will be many many times larger in 92 years.

Buffett is always fun to read.

Economy.com's Zandi on Homeowners with Negative Equity

by Calculated Risk on 2/29/2008 03:47:00 PM

Last week, the NY Times mentioned the recent estimate from Dr. Mark Zandi, chief economist at Economy.com, of 8.8 million homeowers currently with zero or negative equity.

Here is an overview of the calculation from Zandi's Plan to Take Bolder Action on Mortgages (excerpted with permission from Mark Zandi):

By the end of March, an estimated 8.8 million homeowners, equal to 10.3% of the single-family housing stock, are expected to have zero or negative equity. This calculation is based on estimates of homeowner equity across more than 40,000 Zip codes nationwide. The amount of first and second mortgage debt outstanding, including both home equity lines of credit and closed-end second loans, is derived from credit file data. The estimates of housing values are based on repeat-sale house price indices from Fiserv Case Shiller, which are benchmarked to house prices available from the 2000 Census. In those Zip codes where repeat sales price data are not available, Moody’s Economy.com's estimates of county house prices are used. The current distribution of homeowner equity across Zip codes also highlights the risks posed by further price declines. If prices fall 20% from their peak to their expected trough next spring, some 13.8 million households will be under water by then, equal to 15.9% of the stock.The following graph shows my estimates from last December of the number of homeowners with zero or negative equity based on several different price declines. This was based on data from First American.

At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).

At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).By the end of 2007, I calculated the number would have risen to about 5.6 million. However, prices fell further than I expected in 2008, and this actually is very close to Zandi's estimate for the end of March 2008.

With a 20% price decline (peak to trough), I calculated 13.6 million homeowners with zero or negative equity; Zandi's updated numbers put that at 13.8 million.

Zandi didn't provide an estimate for a 30% peak to trough price decline, but my 20 million estimate is probably pretty close. Note: I calculated the percent of homeowners with mortgages with no or negative equity; Zandi calculated the percent of the total single-family housing stock.

S&P: 1,887 Classes of Alt-A MBS may be Downgraded

by Calculated Risk on 2/29/2008 01:58:00 PM

From MarketWatch: S&P may downgrade 1,887 classes of Alt-A mortgage securities (hat tip crispy&cole)

Standard & Poor's said on Friday that it may downgrade 1,887 classes of mortgage securities backed by so-called Alt-A home loans. ... There's been a persistent increase in delinquencies on the loans underlying these securities, S&P said.From Reuters: S&P may cut $14 bln of subprime debt, eyes CDOs (hat tip Barley)

Standard & Poor's on Friday said it is reviewing $14 billion of subprime-related debt for a ratings cut and may act on related collateralized debt obligations within "days," the rating company said.

S&P took the action due to rising delinquencies on higher quality mortgage loans known as "Alt-A loans," ...

Fed's Poole: GSEs Too Big to Fail?

by Calculated Risk on 2/29/2008 01:41:00 PM

From St. Louis Fed President William Poole: Panel Discussion on Balancing Financial Stability, Price Stability and Macroeconomic Stability: How Important Is Moral Hazard?

We have known for many years that moral hazard is a potentially serious issue. If a firm believes that it will be bailed out if it gets into trouble, that expectation encourages excessive risk-taking and increases the probability of trouble. There are two complementary ways to deal with moral hazard. First, firms in trouble ought not to be bailed out, unless the bailout takes a form that imposes heavy costs on managers and shareholders. Second, firms subject to government regulation ought to be compelled to maintain adequate capital to reduce the probability of failure. U.S. banks entered the period of turmoil last year pretty well capitalized and have been able to withstand large losses.Note that Poole is no longer a voting member of the FMOC. He concludes:

I am more skeptical of the financial strength of the GSEs, and believe that we could see substantial problems in that sector. According to the S&P Case-Shiller home value data released earlier this week, as of December 2007 average prices had declined by 15 percent or more over the past 12 months in Phoenix, San Diego, Miami and Las Vegas. We can add Detroit to the danger list as the home price index for that city is down by almost 19 percent over the 24 months ending December 2007. With house prices falling significantly in a number of large markets, many prime mortgages issued a few years ago with a loan-to-value ratio of 80 percent may now have relatively little homeowner equity, which increases the probability of default and amount of loss in event of default.

As I emphasized some time ago, GSE losses will depend on the variance as well as the mean of changes in national home prices. Losses in markets with home prices falling more than the national average will not be offset by gains in markets with price changes above the national average. I do not have a new message here; we have known for a long time that advance preparation and a strong balance sheet are the keys to riding out a financial storm. As I have emphasized before, the Federal Reserve can deal with liquidity pressures but cannot deal with solvency issues. I do not have any information on the GSEs that the market does not also have. Nevertheless, in assessing the risk of further credit disruptions this year, I would put the GSEs at the top of my list of sources of potentially serious problems. If those problems were realized, they would be a direct result of moral hazard inherent in the current structure of the GSEs.

emphasis added

[A] financial firm cannot expect targeted aid for just the firms in trouble. An exception to this general statement is that, unfortunately, the GSEs probably can expect targeted aid. ... the GSEs ... might get assistance directly from Congress ...

MBIA Writing `Very Little' New Business

by Calculated Risk on 2/29/2008 10:51:00 AM

From Bloomberg: MBIA Writing `Very Little' New Business Amid Scrutiny

MBIA Inc. is writing ``very little'' new bond insurance business as borrowers balk at buying a guarantee from a money-losing company without stable AAA credit ratings.From the MBIA SEC from 10-K.

MBIA, whose AAA ratings were under scrutiny by Moody's Investors Service and Standard & Poor's until this week, said losses on mortgage-backed securities will probably increase this year and expand beyond subprime mortgages.

In the fourth quarter of 2007, the Company observed deterioration in the performance of several of its prime and near prime home equity transactions and established $614 million of case basis reserves for future payments. During the fourth quarter of 2007, the Company paid $44 million in claims, net of reinsurance, on seven credits in this sector. Additionally, in the fourth quarter of 2007, the Company established $200 million of non-specific unallocated loss reserves to reflect MBIA’s estimate of probable losses as a result of the adverse developments in the residential mortgage market related to prime, second-lien mortgage exposure, but which have not yet been specifically identified to individual policies. The Company expects that loss payments on its prime, second-lien mortgage exposure during 2008 will amount to a significant portion of its current reserves for such exposure.

Bernanke's tightrope act?

by Calculated Risk on 2/29/2008 10:36:00 AM

More great analysis from Professor Jim Hamilton at Econbrowser: Bernanke's tightrope act

Some analysts are saying that Fed Chair Ben Bernanke is walking a tightrope-- if he does not drop interest rates quickly enough, the U.S. will be in recession, but if he goes too far, we'll see a resurgence of inflation. I am increasingly persuaded that's not an accurate description of the situation.See Hamilton's excellent analysis. He concludes:

The Fed chief must be worried that a recession in the present instance would precipitate major financial instability, in which case perhaps the choice between paying now and paying later argues in favor of latter.I also think Bernanke has chosen a little more inflation: Inflation is Your (Ben's) Friend

In any case, the tightrope analogy seems a misleading way to frame the issue, in that it presupposes that there exists a choice for the fed funds rate that would somehow contain both the solvency and the inflation problems. In my opinion, there is no such ideal target rate, and the notion that we can address the difficulties with a sagely chosen combination of monetary and fiscal stimulus and regulatory workout is in my mind doing more harm than good. Better for everyone to admit up front just how bad the problem is, and acknowledge that there is no cheap way out.

No, I don't believe that Bernanke is walking a tightrope at all. But I do hope he's checked out the net that's supposed to catch him if he falls.

Fannie Mae HomeSaver Advance

by Anonymous on 2/29/2008 07:18:00 AM

There has been some concern in our comments and on other blogs about this bit in Fannie Mae's 10-K published Wednesday:

Beginning in November 2007, we decreased the number of optional delinquent loan purchases from our single-family MBS trusts in order to preserve capital in compliance with our regulatory capital requirements. Although this change in practice may affect our cure rates, it has had no effect on our loss mitigation efforts and, based on current market conditions, is not expected to materially affect the “Reserve for guaranty losses.” We continue to purchase delinquent loans from MBS trusts primarily to modify these loans as part of our strategy to mitigate credit losses and in circumstances in which we are required to do so under our single-family MBS trust documents. Because we are continuing our loss mitigation efforts for delinquent loans, with a primary goal of permitting borrowers to avoid foreclosure, we do not intend to defer purchases of delinquent loans until we are required by our MBS trust documents to purchase the delinquent loans from our MBS trusts. Although we have decreased the number of our optional loan purchases, the total number of loans purchased from MBS trusts may increase in the future, which would result in an increase our SOP 03-3 fair value losses. The total number of loans we purchase from MBS trusts is dependent on a number of factors, including management decisions about appropriate loss mitigation efforts, the expected increase in loan delinquencies within our MBS trusts resulting from the current adverse conditions in the housing market and our need to preserve capital to meet our regulatory capital requirements. For example, we recently introduced a new HomeSaver Advance(tm) initiative, which is a loss mitigation tool that we began implementing in the first quarter of 2008. HomeSaver Advance provides qualified borrowers with an unsecured personal loan in an amount equal to all past due payments relating to their mortgage loan, allowing borrowers to cure their payment defaults under mortgage loans without requiring modification of their mortgage loans. By permitting qualified borrowers to cure their payment defaults without requiring that we purchase the loans from the MBS trusts in order to modify the loans, this loss mitigation tool may reduce the number of delinquent mortgage loans that we purchase from MBS trusts in the future and the fair value losses we record in connection with those purchases. The credit environment remains fluid, and the number of loans that we purchase from our MBS trusts will continue to be affected by events and conditions that occur nationally and in regional markets, as well as changes in our business practices to respond to the current adverse market conditions.This seems to have a bunch of folks concerned that what Fannie Mae is doing is making unsecured loans to borrowers just so that Fannie doesn't have to buy the loan out of the pool and take a fair value write-down. What it says, of course, is that Fannie Mae certainly intends this program, if it is successful, to reduce the number of mortgages that have to be bought out of the MBS, because the point of the program is to avoid having to do a formal modification of mortgage. If that is successful, it should, in fact, reduce the number of loans Fannie buys out of pools for loss-mitigation purposes.

It does not say that the sole intent of the program is to avoid fair-market write-downs on loans bought out of pools. This mention of this program just appears in the part of the 10-K that deals with pooled loan repurchases. I see nothing here that says that the HomeSaver Advance loans do not involve an increase in reserves for guaranty losses or an increase in the fair value of guaranty obligations (see page 54ff for an explanation of how accounting for credit losses, actual and expected, on MBS loans is handled), instead of an FMV adjustment to an owned loan. Perhaps the question came up in the conference call; I didn't listen to it. I would certainly expect that these loans can be expected to result in higher guaranty costs in the future, and should be accounted for accordingly. The point is simply that as the loans remain in the MBS, they do not appear in the category of loans bought out of MBS and therefore requiring an FMV adjustment under the infamous SOP-03. The reduction to income (increase in reserves) would happen elsewhere in the financials, under guaranty costs.

All that may be too geeky for you; if so I congratulate you on being a normal human being. Getting beyond the GAAP issues here, I think people just really want to know what this HomeSaver Advance thingy is. According to Fannie Mae's website,

HomeSaver Advance, an unsecured personal loan, is a new loss mitigation alternative available to approved Fannie Mae servicers for eligible borrowers designed to bring a delinquent loan current without a formal loan modification. It provides funds to cure arrearages of principal, interest, taxes, and insurance (PITI), as well as other advances and fees as listed in the Highlights section below. HomeSaver Advance is documented by a borrower-signed promissory note, payable over 15 years at a fixed rate of 5% with no payments or interest accrual for the first six months.The general rules for borrower eligibility:

HomeSaver Advance is designed for qualified borrowers who have fallen behind on their mortgage, but are able to resume timely payments once their loan is brought current by the advance. It helps simplify and streamline the workout process for applicable loans, as it provides an option for earlier resolution of delinquent loans.

HomeSaver Advance Highlights

*Loan amount up to the lesser of $15,000 or 15% of the original UPB for delinquent PITI, escrow advances, and advances for attorney fees and costs and up to 6 months of unpaid HOA fees (12 months, where the HOA fee is paid once per year)

*Advances may not include late charges or other ancillary fees and costs

*The full loan amount is applied directly to arrearage (borrower never receives funds in hand)

*Truth in Lending Statement and unsecured promissory note are executed at time of agreement with borrower

*Note rate at a fixed rate of 5% with 6-month no-interest/no-payment period

*Amortization period of 14.5 years after the conclusion of the 6-month no-interest/no-payment period

*Workout fee paid to servicer is $600

*Fannie Mae will contract with a third party to service HomeSaver Advance promissory notes

• The mortgage is delinquent in an amount equal to or greater than two full payments of principal, interest, taxes and insurance;So what does all that mean? First, it doesn't mean that this is how Fannie will handle all troubled loan workouts; it is one possibility. The rationale for this kind of thing--which isn't unheard of, by the way, for banks and other portfolio lenders, although it's new as far as I know for Fannie Mae--is that if you have a borrower with a fairly modest past-due amount ($15,000 or less) and you have determined that the cause of the delinquency was short-term and is now fixed (like temporary job loss), you could find that the effort and expense of buying a loan out of a pool and doing a formal modification of mortgage to add this modest amount can cost you almost more than it's worth. An alternative is just to make an unsecured loan for the past-due amount, while leaving the existing loan's terms unchanged.

• The mortgage must be seasoned with a minimum of six monthly payments made since the date of loan closing;

The mortgage may secure a principal residence, second home, or investment property—owner occupancy is not required; and

• The mortgage may generally be any type of loan (i.e., fixed-rate, adjustable-rate, interest-only, bi-weekly or daily simple interest).

HomeSaver Advance does not have a loan-to-value restriction or property valuation requirement.

Borrower Eligibility

Servicers must also ensure their borrower meets the following qualifications:

• The borrower has successfully resolved the reason for delinquency;

• The borrower demonstrates a long -term financial capacity to resume making the payments on the first mortgage loan and all other debts, including any subordinate mortgage loans (verbal confirmation of financial capacity is acceptable);

• The borrower has surplus income to support an additional monthly payment of at least $200 but does not have the ability to cure the arrearage using a repayment plan within a period of not more than nine months;

• The borrower is willing to participate in HomeSaver Advance; and

• The borrower does not currently have an outstanding HomeSaver Advance note; the HomeSaver Advance option may only be used once during the life of the particular first mortgage loan.

Borrowers involved in an active bankruptcy proceeding or who have had the debt previously discharged in a bankruptcy action are not eligible for this loss mitigation option.

It's risky, of course, because you aren't securing the make-up loan amount; that means that you can't take that amount out of foreclosure recoveries, and if the borrower declares bankruptcy your make-up loan just gets tossed into the unsecured bucket with the credit cards and such. The idea is that you would only do this if the amount in question were modest enough that it's not worth the expense to secure it. It seems completely obvious to me that it's not always worth rewriting a $200,000 loan to secure another $1,000. Another $15,000? That seems rather high to me as a ceiling for this program. But cost-effectiveness is the idea here.

I would also have tightened up the verification requirements for this deal. I realize that Fannie Mae clearly has some ability to collect from servicers if they misrepresent on the borrower's situation; I am, however, getting more and more jaded by the minute about conducting these things on a rep-and-warranty basis. I'd want written documentation of the borrower's cause of delinquency and financial condition, not verbal.

However, I don't necessarily think this is a terrible idea, with the above caveats in mind. Of course it all depends on how good you are at targeting it to borrowers whom it will truly benefit. (Do remember that these are Fannie Mae loans, not those horrible subprime exploding ARMs and stuff. They aren't perfect, but they're not the worst loans in the bunch to start with.) A couple of our commenters have suggested that it seems like no more than a way to throw away $15,000 on every delinquent loan you have. I don't think it's that bad, so I thought maybe we could go through an example--and it's just an example, not a prediction--of how the math would work in deciding to offer a program like this.

Let's start by assuming we have a pool of 100 loans that are eligible for this treatment. We'll assume the average loan amount is $200,000, the average interest rate is 6.50%, and the loans are all interest only (mostly so I don't have to keep amortizing balances, but also because that gives you a slightly worse case in recovery from future foreclosure, and I'm not trying to build an optimistic scenario). I'll assume that the servicer waives all attorney's fees and there's no HOA looking for money, so all we have to work with is past-due interest payments and escrow account contributions. The average monthly interest payment on these loans is $1083, and we'll say the average monthly escrow payment is $417, since that gives us a nice round $1,500 monthly payment to play with.

If all the borrowers are six months past due--which is a lot--then the unsecured loan amount for each loan would be $9,000. Plus Fannie Mae pays $600 a pop to the servicer for the workout fee, so if we did this on all 100 loans, we'd end up with $900,000 unsecured money at risk on a $20,000,000 pool at a cost of $60,000. You can, if you want, assume that all of these loans are underwater--the math works the same way--but for convenience I will assume that the $200,000 balance represents 100% LTV (the property is valued today at $200,000).

Therefore, if we had added the $9,000 to the loan amount via a formal modification, we'd have ended up with an LTV of 104.5%. Because we didn't secure the loan, our LTV stays 100%. Remember that since the additional money is unsecured, there is less disincentive for the borrower to sell the property at break-even; the lien can be released without the additional loan amount being paid in cash at the closing table. So from a voluntary prepayment perspective, these loans should perform just like any other once-delinquent loan at 100% LTV.

Let's further assume that our estimated losses on this pool (net of mortgage insurance and including FC expenses), if we foreclosed today instead of doing this workout, are 30%. That means that foreclosing them all right now would cost us $6,000,000. If you assumed that 100% of these loans would be permanently cured and all those borrowers would pay back all of the unsecured as well as secured money, it's obviously a deal to do this.

Of course we won't assume for a moment that these will be 100% successful. Fannie Mae reported in the 10-K that of the loans it has done modifications on that have a 2-year history since the modification was put in place, going back to 2001, 60% were performing or paid in full 24 months later, and 9% had been foreclosed 24 months later (the rest were still on the books but had become delinquent again, just apparently not delinquent enough to mean foreclosure yet). We are going to assume that that is much better performance than our workouts are likely to get, even though, if the program requirements are truly fulfilled, these HomeSaver Advance deals ought to perform better than your average workout (because they're supposed to involve true "temporary" situations and clear financial capacity to carry the payments).

We will assume that after two years, only 20% of our loans are either still cured and paying as agreed, or paid in full including the unsecured amount. We'll assume another 10% of the loans paid in full (the borrower sold the home or refinanced), but the borrower stiffed us on the unsecured amount and we have to write it off.

Of the remaining 70%, we will assume that 50% end up in foreclosure after 12 months, and the other 20% end up in foreclosure after 24 months. We do that because we want to take into account the possible costs of delaying foreclosure. That is always the problem with workout calculations. It's one thing to compare the cost of a workout to the cost of foreclosure today, but if the loan re-defaults, it may end up costing you more, because foreclosure losses next year might well be worse than they are this year. For our example, we'll assume that losses in a foreclosure would be 30% today, 40% in 12 months, or 50% in 24 months. (This is an example, not a prediction, remember. I'm not building in any positive effect of my workout efforts, although logically I should; the more loans I can permanently cure, the better the recovery should be on the ones I do foreclose because it means less REO inventory.)

That gives us 20 loans with no losses except our $600 fee to the servicer or $12,000. The 10 loans that paid in full on the mortgage but stiffed us on the unsecured loans generated a $96,000 loss. The 50 loans we had to foreclose after a year generated a $4,480,000 loss ($200,000 times 50 times 40% plus $9,600 times 50). The 20 loans we had to foreclose after two years generated a $2,192,000 loss ($200,000 times 20 times 50% plus $9,600 times 20). Total losses: $6,780,000, or 34% loss severity after two years instead of 30% loss severity by foreclosing them all today.

I think it's fair to say that it doesn't take much to think we could break even here. For one thing, it's probably not likely that all loans would be six months past due; if you figured only 4 months past due, which is still severely delinquent, you get 33% loss severity after two years (because the unsecured loan amount is smaller). Add 10 loans to the mortgage paid but unsecured loan written off group and take 10 out of the foreclosure after 12 months group, and you've actually got losses at 24 months at 29%, or just slightly better than foreclosing today.

My point is that you have to remember with workout calculations that while delaying foreclosure might increase the severity of loss on the foreclosures, you do save a lot of money on the ones you cure, and that offsets the calculations on an aggregate level. In practical terms, a program like this is just a lot faster and easier than the buy-loan-out-of-pool-modify-mortgage thing, and it's fair to count in the plus column the extent to which that frees up resources to work with the loans that don't qualify for this kind of deal (the ones that you'll have to do a full-blown mod on). Of course, you have to add back the fact that anything that's faster and easier is going to suffer from adverse selection problems--it does tend to be the lazy, cheapskate servicer's first choice of loss mit options even if it shouldn't be.

At the end of it, I think I'd say this isn't a terrible way to handle the workouts for those borrowers who were tight on mortgage affordability but not impossibly over their heads--say originally qualified at 42% DTI--and who therefore ended up several months past due after an incident (cut back on work hours, unforeseen medical expenses, that kind of thing) that would, in a less expensive relative to income housing cost environment, probably have been tolerable. As long as those borrowers are working with the servicer and want to hang onto the home, this gets them over the rough patch without raiding their retirement accounts or borrowing from the local loan shark, and I can get behind the wisdom of that, at least.

I don't think most troubled borrowers are necessarily in that situation--too many, sadly, are really in over their heads. But if you limit the HomeSaver Advance thing to the salvageable borrowers, you salvage those borrowers quickly and fairly cheaply, freeing up your real effort and expense for dealing with the much more troubled cases. So if that's what they're up to, I guess it's OK with me--not like they asked my opinion--but I do hope OFHEO is keeping an eye on this kind of thing for us, and that we all get to see some periodic reporting about how well this initiative is working out.

As far as the cynical view that this is just a way for Fannie Mae to avoid buying mortgages out of MBS? Doesn't everyone want them to limit their portfolio expansion? As long as they're accounting properly for the increased guaranty obligation here, why not leave the loans on the MBS's books?

Ruthless Defaults in the MSM

by Calculated Risk on 2/29/2008 01:35:00 AM

Here are a couple of interesting articles on "walking away", aka jingle mail, or more technically "ruthless defaults".

From Ruth Simon and Scott Patterson at the WSJ: Borrowers Abandon Mortgages as Prices Drop

As home prices plummet, growing numbers of borrowers are winding up owing more on their homes than the homes are worth, raising concerns that a new group of homeowners -- those who can afford to pay their mortgages but have decided not to -- are starting to walk away from their homes.From John Leland at the NY Times: Facing Default, Some Walk Out on New Homes

...

A rise in the number of people choosing to default on their mortgages would represent a significant departure from past behavior of American homeowners, who during past housing downturns tended to walk away only as a last resort, often because they couldn't afford to pay because of unemployment, illness, divorce or other life-altering changes that reduce income.

...

What's different now, analysts and economists say, is that home prices have fallen so far so quickly that some homeowners in weak markets are concluding that house prices won't recover anytime soon, and therefore they are throwing good money after bad. Also, many borrowers who bought in recent years have put down little if any equity. "If they haven't lived in [the home] very long and haven't put any cash in it, it's a lot easier to walk away," says Chris Mayer, director of the Milstein Center for Real Estate at Columbia Business School.

You Walk Away is a small sign of broad changes in the way many Americans look at housing. In an era in which new types of loans allowed many home buyers to move in with little or no down payment, and to cash out any equity by refinancing, the meaning of homeownership and foreclosure have changed, economists and housing experts say.Unfortunately these articles don't really advance the ball. Tanta did an excellent job of suggesting some question the MSM media could ask: Let's Talk about Walking Away

...

“I think I could make a case that some borrowers were ‘renting’ (with risk), rather than owning,” Nicolas P. Retsinas, director of the Joint Center for Housing Studies at Harvard University, said

...

“When people don’t have skin in the game, they behave like they don’t have skin in the game,” said Karl E. Case, a professor of economics at Wellesley College

What we have, so far, is a series of industry insiders making a general claim that "ruthless default" is on the rise. What we do not have, so far, is any rigorous quantification of the extent of this problem, or even any really detailed definition of what "a borrower who could afford to pay" is. We have no one offering baseline measures (what, for instance, a lender's analytical models might have predicted is the "normal" level of walking away), and hence no clear sense of the magnitude of the "change" in borrower behavior and attitudes (not to mention much rigor in distinguishing between the two). Hence, we don't yet really know if it's a change in borrower behavior as much as a change in definitions, servicer data collection and interpretation, or media exposure. Or a handful of anecdotes that are being pluralized into "data."

Thursday, February 28, 2008

AIG: $11.1 Billion Write-down

by Calculated Risk on 2/28/2008 08:05:00 PM

From Bloomberg: AIG Posts Biggest Loss, Misses Analysts' Estimates

American International Group Inc., the world's largest insurer by assets, posted its biggest quarterly loss as a publicly traded company after an $11.1 billion writedown of guarantees sold to fixed-income investors.The losses keep adding up. The confessional is very busy.

The fourth-quarter net loss of $5.29 billion, or $2.08 a share, compared with profit of $3.44 billion, or $1.31, a year earlier, New York-based AIG said today in a statement.

... AIG guaranteed $62.4 billion in collateralized debt obligations that included subprime mortgages as of Nov. 25, securities that led to fourth-quarter losses for MBIA Inc. and Ambac Financial Group Inc., the largest bond insurers.

Wells Fargo: New Tighter Mortgage Guidelines

by Calculated Risk on 2/28/2008 04:25:00 PM

Blown Mortgage has the details: Wells Fargo Names Most of California Severely Distressed

Wells Fargo has named nearly every California county a “Severely Distressed Market” which requires LTV reductions of 5% for any conforming loan over 75% LTV and also eliminates financing over 75% LTV for any non-conforming loan. The Wells Fargo Mortgage Express product (which is Wells Fargo’s stated income/stated asset program) is also not permitted in “Severely Distressed Market” areas.And from the BizJournals.com: Wells Fargo tightens mortgage guidelines (hat tip Michael)

Look for the rest of the market leaders to quickly follow suit. This immediately puts a huge swath of the state with increasingly limited refinance options. A huge portion of California loans are of the non-conforming variety and well over the 75% LTV mark ...

The tougher lending standards take effect Feb. 29 ...

Twenty counties in California, including Los Angeles County and Orange County, are on the severely distressed markets list. At-risk markets around the country include 33 in Florida, 15 each in Michigan and Virginia, and 13 each in Maryland and Ohio. Many other states, including Arizona, Colorado, Connecticut, Louisiana, Massachusetts, Minnesota, New York, Nevada, New Jersey, Washington and Wisconsin had markets on the list.

Tim Duy's Fed Watch

by Calculated Risk on 2/28/2008 03:12:00 PM

From Dr. Tim Duy at Economist's View: This Train Doesn’t Stop

A choice has to be made in the short run. Focus on inflation, and hold policy relatively tight? Or focus on growth, hoping that soft economic growth will tame inflationary pressures? The Fed continues to choose the latter path.And on inflation:

...

The die is cast. Look for another 50bp in March and then two more 25bp cuts at subsequent meetings to bring the Fed Funds rate to 2%.

Inflationary pressures are building globally (note that China is completing the chain that leads to an inflationary spiral, setting the expectation that high inflation will be matched by higher wages), reflected in surging commodity prices and the freefall of the dollar. The former is weighing heavily on US consumers. Indeed, I am amazed that this story is only starting to capture the attention of the press. So much attention is placed on the housing market as the source of declining consumer confidence, but over the last three months, headline CPI has surged 6.8% annualized. Sure doesn’t look like nominal wages gains are keeping up. No wonder confidence is collapsing.Tim Duy is very good at looking inside the Fed's thinking. Unfortunately, the situation isn't pretty.

And I sense it’s going to get worse ...

Bankrate: Fixed Mortgage Rates at Highest Since October

by Calculated Risk on 2/28/2008 11:48:00 AM

From Bankrate.com: Fixed Mortgage Rates at 4-Month High

Fixed mortgage rates increased for the third week in a row, with the average conforming 30-year fixed mortgage rate now 6.41 percent.

(graphic from Bankrate.com)

Holden Lewis at Bankrate.com writes: Fixed rates up, ARMs decline

ARMs are becoming more compelling each week, and this week is no exception, as the most popular fixed rate went up while adjustable rates went down.From Chairman Bernanke yesterday: Bernanke says 'we have a problem' controlling long-term mortgage rates

The benchmark 30-year fixed-rate mortgage rose 4 basis points, to 6.41 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.4 discount and origination points. One year ago, the mortgage index was 6.2 percent; four weeks ago, it was 5.88 percent.

'We have a problem, which is that the spreads between the Treasury rates and lending rates are widening, and our policy is essentially, in some cases just offsetting the widening of the spreads, which are associated with signs of illiquidity,' Bernanke told the House Financial Services Committee.The Bernanke conundrum: In the short term, the more he cuts short rates, the more certain long rates may rise.

'So in that particular area, it's been more difficult to lower long-term mortgage rates through Fed action,' he said.

Freddie Mac: $2.5 billion Loss, CEO "Extremely Cautious"

by Calculated Risk on 2/28/2008 10:43:00 AM

From MarketWatch: Housing downturn leads to Freddie Mac losses

The weakened U.S. housing market took a toll on Freddie Mac's bottom line in the fourth quarter and for 2007 as a whole, the mortgage-finance giant said Thursday as it reported worse-than-expected financial results.

Richard Syron, Freddie Mac's chief executive, also said the company's "extremely cautious" as 2008 moves forward.

McLean, Va.-based Freddie posted a quarterly net loss of $2.5 billion ...The company is "extremely cautious" just as everyone is calling for an expanded role in mortgage lending for Freddie and Fannie. I expect more visits to the confessional.

Fannie Mae New Rules for Appraisals

by Anonymous on 2/28/2008 08:17:00 AM

To refresh memories: Last fall, New York AG Andrew Cuomo sued an outfit called eAppraiseIt and its parent company, First American, for conspiring with WaMu to pressure appraisers to produce inflated appraised values. WaMu was not part of the suit, since for legal reasons state AGs can't sue federally-chartered thrifts in state court. Fannie Mae and Freddie Mac were not being sued either, but they were quickly served with subpoenas for documentation involving inflated appraisals on loans they may have purchased. The GSEs quickly agreed to appoint independent examiners to review appraisal practices, with the direct threat that lenders would be forced to buy back loans that failed to meet existing GSE rules.

It appears that Fannie Mae has finished or nearly finished its review, and is about to ruin several very large aggregators' and thousands of pissant brokers' day with a new set of rules regarding how appraisals can be obtained and what affiliations between lender and appraiser are acceptable:

Feb. 27 (Bloomberg) -- Fannie Mae, the biggest source of financing for U.S. home loans, told lenders it will probably ban their use of appraisals by in-house employees or those arranged by brokers.My observations:

Fannie Mae distributed the proposal, a response to New York Attorney General Andrew Cuomo's yearlong mortgage probe, to lenders in a ``talking points'' memo this week, according to a person familiar with the document. The memo was published on American Banker's Web site yesterday.

``It would be a monumental change because it would require a shift in the way that the lending industry does business,'' said Jonathan Miller, chief executive officer of Manhattan-based appraisal company Miller Samuel Inc. and a longtime proponent of creating a firewall between residential appraisers and mortgage originators. ``I think it would be tremendous.'' . . .

``Fannie Mae wishes to cooperate with the New York AG's investigation and, as part of a cooperation agreement, will likely agree to a number of items,'' according to the memo.

The proposed changes include banning Fannie Mae's partners from using appraisers employed by their wholly owned subsidiaries. Mortgage lenders that own appraisal companies include Countrywide Financial Corp., the nation's largest home- loan originator.

The restrictions would apply to loans acquired after Sept. 1, according to the memo. Fannie also told lenders that an independent appraisal clearinghouse likely would be established.

`Laughable' Practice

About three quarters of residential mortgage appraisals are arranged through brokers who only get paid if a loan closes, Miller said today in a phone interview. He called the practice ``laughable'' because it creates a financial incentive for mortgage brokers to push appraisers toward higher valuations. Higher appraisals also mean more homeowners qualify to refinance their homes and take cash out, he said. . . .

Cuomo spokesman Jeffrey Lerner said today in an e-mail that that Cuomo, Fannie Mae and Freddie Mac hadn't reached an agreement.

``We have had ongoing discussions for several months,'' Lerner said. ``At the end of the process, we will either have agreements or we will take other appropriate action.''

Cuomo prefers to pursue cooperative resolutions before litigating, Lerner said.

``We are continuing our discussions and we are making progress,'' said Corinne Russell, spokeswoman for the Office of Federal Housing Enterprise Oversight, which oversees Fannie Mae and Freddie Mac. . . .

Freddie Mac hasn't sent any memo similar to Fannie Mae's, said company spokeswoman Sharon McHale.

``We are cooperating fully with the attorney general's investigation, but at this point it would be premature to speculate as to what the outcome will be,'' McHale said.

Countrywide spokeswoman Ginny Zoraster declined to comment on Fannie Mae's proposals.

``The company does not believe this case has merit and expects to present a vigorous defense,'' Zoraster said in an e- mailed statement.

1. So much for "synergy." I only hope that if this puts a stop to large lenders buying appraisal firms (and destroying appraiser independence), we can next move on to large lenders buying title companies (and destroying escrow officer independence).

2. Insofar as brokering of mortgages is going to survive this bust--and the indications are that any bank with a shred of sense right now is shutting down its wholesale division--they will go back to being application-takers, for which they will earn a modest fee. They will have a hard time maintaining their current pose of a "full-service lender" by also processing loans--including ordering appraisals, selecting a closing agent, etc.--which are a huge source of fees collected from consumers and which tend to give consumers the (false) impression that brokers are actually lenders.

What has been going on for some time now is that the massive failures in the wholesale model have forced the wholesale lenders to, in essence, redundantly process these loans, as everything the broker does has to be checked and rechecked and in some cases simply repeated. (You let brokers order appraisals, and once you get it, you order a second appraisal or field review appraisal or run an AVM in order to reality-check the appraisal you got. The process pretty much ceases to be efficient here.) If the GSEs just come out and force wholesalers to take control of the appraisal process from the very beginning, then the kabuki ends and we stop pretending that brokers are doing anything except bringing in a consumer willing to sign an application. The rest of the loan processing is turned over to the wholesaler.

3. An "independent appraisal clearinghouse" would, presumably, be intended to remove some of the problems I discussed in this post with individual lenders managing approved or excluded appraisal lists. Without details I can't really say what they're doing here, but it sounds like Fannie and Freddie are seriously considering getting into approving or excluding individual appraisers or appraisal firms. FHA has always done that in some fashion or another; the GSEs never have. That's a very substantial change to the way the GSEs do business with lenders.

Inflation is Your (Ben's) Friend

by Calculated Risk on 2/28/2008 12:31:00 AM

Here is partial excerpt from a great Saturday Night Live piece in the late '70s, with Dan Aykroyd impersonating Jimmy Carter:

Inflation is our friend.

For example, consider this: in the year 2000, if current trends continue, the average blue-collar annual wage in this country will be $568,000. Think what this inflated world of the future will mean - most Americans will be millionaires. Everyone will feel like a bigshot. Wouldn't you like to own a $4,000 suit, and smoke a $75 cigar, drive a $600,000 car? I know I would! But what about people on fixed incomes? They have always been the true victims of inflation. That's why I will present to Congress the "Inflation Maintenance Program", whereby the U.S. Treasury will make up any inflation-caused losses to direct tax rebates to the public in cash. Then you may say, "Won't that cost a lot of money? Won't that increase the deficit?" Sure it will! But so what? We'll just print more money! We have the papers, we have the mints.

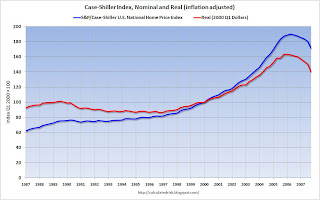

Click on graph for larger image.

Click on graph for larger image.And here is a graph of the Case-Shiller index in both nominal terms and real terms (adjusted using CPI less shelter).

In nominal terms, the index is off 8.9% over the last year, and 10.2% from the peak.

However, in real terms, the index has declined 12.9% during the last year, and is off 14.6% from the peak.

Inflation is helping significantly in lowering real house prices. If prices will eventually fall 30% in nominal terms, then we are only about 1/3 of the way there. But if the eventual decline is 30% in real terms, then we are about half way there.

Wouldn't you like to own a million dollar home? With 4% inflation per year, many people will.

Wednesday, February 27, 2008

Another Debt Markets Freezes

by Calculated Risk on 2/27/2008 11:48:00 PM

From the WSJ: New Monkey, Same Backs

A new round of higher debt costs confronts some states and cities as another usually humdrum part of the credit markets runs into trouble. This time, the culprits are variable-rate demand notes. And banks that guarantee they will act as buyers of last resort face something they never expected -- having to purchase many of them at once.Another borrow short, lend long (or invest long) strategy. New monkey, same backs. Great title.

Variable-rate demand notes let issuers borrow for long periods -- but at short-term interest rates. Like auction-rate securities, interest payments adjust on a weekly or even daily basis. The difference is that for variable-rate demand notes, securities firms sell the debt at whatever interest rate meets the market's demand.

The problem: Just like many issuers of auction-rate securities whose interest costs soared after auctions for some of their debt failed, an increasing number of municipalities are being hit with sharply higher interest on their variable-rate demand notes because dealers of the debt are having trouble selling it.

Last week, rates on $300 million of California's variable-rate demand notes rose to 8.25% from 2% the previous week.

Vallejo Close to Bankruptcy Filing

by Calculated Risk on 2/27/2008 07:20:00 PM

From Bloomberg: California City Moves Closer to Bankruptcy Filing

Vallejo, a city of 135,000 outside of San Francisco, moved closer to bankruptcy after negotiations with its labor unions collapsed.Many cities in California are struggling with falling revenue and rising pension costs. Vallejo is just the first in line.

Bondholders will likely be asked to sacrifice some of their investment if the city seeks bankruptcy protection, an attorney for the municipality said last night. Vallejo faces ballooning labor costs and declining housing-related sales-tax revenue, leaving budget officials projecting that money will run out within weeks.

The city council is scheduled to consider a resolution tomorrow to file for Chapter 9 bankruptcy protection, after negotiations with labor unions to win salary concessions broke down Monday.

``What happens in Vallejo is going to be the model for what happens across the state. It will have a big impact.''

[Clark Stamper of Stamper Capital & Investments]

New Home Months of Supply

by Calculated Risk on 2/27/2008 05:36:00 PM

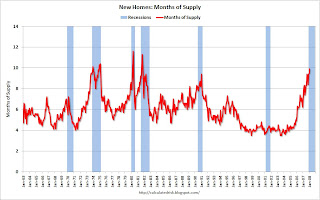

Another long term graph today - this one for New Home Months of Supply. Click on graph for larger image.

Click on graph for larger image.

"Months of supply" is at the highest level since 1981. Note that this doesn't include cancellations, but that was true for the earlier periods too.

The all time high for Months of Supply was 11.6 months in April 1980.

Once again, the current recession is "probable" and hasn't been declared by NBER.

Note: Months of supply is calculated by dividing inventory (seasonally adjusted) by sales (SAAR) and multiplying by 12 (to convert to months). As an example, Sales were reported at a Seasonally Adjusted Annual rate of 588K this morning. Inventory was reported at 483K. So 483K divided by 588K times 12 = 9.9 months.

S&P: Mortgage Delinquency Rates Climb

by Calculated Risk on 2/27/2008 04:00:00 PM

From AP: S&P: Mortgage Bond Credit Worsens (hat tip nades)

The good news is delinquencies for HELOCs issued in 2007 have moderated. That is probably a combination of tighter lending standards, and that the loans are new - the borrowers haven't run out of cash yet!

Roubini Testifies to Congress

by Calculated Risk on 2/27/2008 03:11:00 PM

Nouriel Roubini, Professor of Economics at at the Stern School of Business, NY University testified to the House of Representatives’ Financial Services Committee: The Current U.S. Recession and the Risks of a Systemic Financial Crisis

Thanks to Dr. Roubini for the kind mention!

New Home Sales: Cliff Diving

by Calculated Risk on 2/27/2008 02:20:00 PM

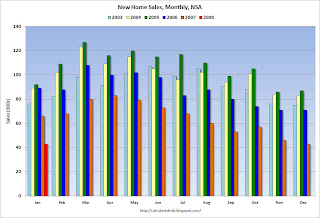

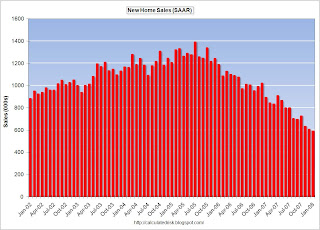

Click on graph for larger image.

Click on graph for larger image.

This graph shows New Home Sales vs. recessions for the last 45 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001.

Note that the escalation of the Vietnam War in the '60s kept the economy out of recession, even though New Home sales were falling. Although Chairman Bernanke didn't use the word "recession", it appears the U.S. economy is now in recession - possibly starting in December - as shown on graph.

This is what we call Cliff Diving!

The second graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red column in January 2008. This is the lowest sales for January since the recession of '91.

As the graph indicates, the next 2 to 3 months are critical for the homebuilders. Right now it isn't looking good. Toll Brothers CEO stated this morning:

“The selling season, which we believe starts in mid-January, has been weak ..."

Fannie Mae 10-K

by Anonymous on 2/27/2008 01:31:00 PM

Some snippets from the Fannie Mae 10-K, if for some reason you didn't eagerly read the whole thing as soon as it hit the SEC website . . .

On losses:

We have experienced increased mortgage loan delinquencies and credit losses, which had a material adverse effect on our earnings, financial condition and capital position in 2007. Weak economic conditions in the Midwest and home price declines on a national basis, particularly in Florida, California, Nevada and Arizona, increased our single-family serious delinquency rate and contributed to higher default rates and loan loss severities in 2007. We are experiencing high serious delinquency rates and credit losses across our conventional single-family mortgage credit book of business, especially for loans to borrowers with low credit scores and loans with high loan-to-value (“LTV”) ratios. In addition, in 2007 we experienced particularly rapid increases in serious delinquency rates and credit losses in some higher risk loan categories, such as Alt-A loans, adjustable-rate loans, interest-only loans, negative amortization loans, loans made for the purchase of condominiums and loans with second liens. Many of these higher risk loans were originated in 2006 and the first half of 2007. . . .On counterparty risk and the CFC-BoA merger:

We expect these trends to continue and that we will experience increased delinquencies and credit losses in 2008 as compared with 2007. The amount by which delinquencies and credit losses will increase in 2008 will depend on a variety of factors, including the extent of national and regional declines in home prices, interest rates and employment rates. In particular, we expect that the onset of a recession, either in the United States as a whole or in specific regions of the country, would significantly increase the level of our delinquencies and credit losses. Increases in our credit-related expenses would reduce our earnings and adversely affect our capital position and financial condition. . . .

The challenging mortgage and credit market conditions have adversely affected, and will likely continue to adversely affect, the liquidity and financial condition of a number of our institutional counterparties, particularly those whose businesses are concentrated in the mortgage industry. One or more of these institutions may default in its obligations to us for a number of reasons, such as changes in financial condition that affect their credit ratings, a reduction in liquidity, operational failures or insolvency. Several of our institutional counterparties have experienced ratings downgrades and liquidity constraints, including Countrywide Financial Corporation and its affiliates, which is our largest lender customer and mortgage servicer. These and other key institutional counterparties may become subject to serious liquidity problems that, either temporarily or permanently, negatively affect the viability of their business plans or reduce their access to funding sources. The financial difficulties that a number of our institutional counterparties are currently experiencing may negatively affect the ability of these counterparties to meet their obligations to us and the amount or quality of the products or services they provide to us. A default by a counterparty with significant obligations to us could result in significant financial losses to us and could materially adversely affect our ability to conduct our operations, which would adversely affect our earnings, liquidity, capital position and financial condition.On reserve calculations:

Our business with our lender customers, mortgage servicers, mortgage insurers, financial guarantors, custodial depository institutions and derivatives counterparties is heavily concentrated. For example, ten single-family mortgage servicers serviced 74% of our single-family mortgage credit book of business as of December 31, 2007. In addition, Countrywide Financial Corporation and its affiliates, our largest single-family mortgage servicer, serviced 23% of our single-family mortgage credit book of business as of December 31, 2007. Also, seven mortgage insurance companies provided over 99% of our total mortgage insurance coverage of $104.1 billion as of December 31, 2007, and our ten largest custodial depository institutions held 89% of our $32.5 billion in deposits for scheduled MBS payments in December 2007.

Moreover, many of our counterparties provide several types of services to us. For example, many of our lender customers or their affiliates also act as mortgage servicers, custodial depository institutions and document custodians for us. Accordingly, if one of these counterparties were to become insolvent or otherwise default on its obligations to us, it could harm our business and financial results in a variety of ways. . . .

Our ability to generate revenue from the purchase and securitization of mortgage loans depends on our ability to acquire a steady flow of mortgage loans from the originators of those loans. We acquire a significant portion of our mortgage loans from several large mortgage lenders. During 2007, our top five lender customers accounted for approximately 56% of our single-family business volume. Accordingly, maintaining our current business relationships and business volumes with our top lender customers is critical to our business. Some of our lender customers are experiencing, or may experience in the future, liquidity problems that would affect the volume of business they are able to generate. If any of our key lender customers significantly reduces the volume or quality of mortgage loans that the lender delivers to us or that we are willing to buy from them, we could lose significant business volume that we might be unable to replace, which could adversely affect our business and result in a decrease in our market share and earnings. In addition, a significant reduction in the volume of mortgage loans that we securitize could reduce the liquidity of Fannie Mae MBS, which in turn could have an adverse effect on their market value.

Our largest lender customer, Countrywide Financial Corporation and its affiliates, accounted for approximately 28% of our single-family business volume during 2007. In January 2008, Bank of America Corporation announced that it had reached an agreement to purchase Countrywide Financial Corporation. Together, Bank of America and Countrywide accounted for approximately 32% of our single-family business volume in 2007. We cannot predict at this time whether or when this merger will be completed and what effect the merger, if completed, will have on our relationship with Countrywide and Bank of America. Following the merger, we could lose significant business volume that we might be unable to replace, which could adversely affect our business and result in a decrease in our earnings and market share. . . .

As the housing and mortgage markets deteriorated during 2007, we adjusted certain key assumptions used to calculate our loss reserves to reflect the rise in average loss severities, which more than doubled from 2006, and default rates. Prior to the fourth quarter of 2006, we derived loss severity factors using available historical loss data for the most recent two-year period. We derived our default rate factors based on loss curves developed from available historical loan performance data dating back to 1980. In the fourth quarter of 2006, we shortened our loss severity period assumption to reflect losses based on the previous year rather than a two-year period to reflect a trend of higher loss severities. Given the significant increase in loss severities during 2007 resulting from the decline in home prices, in the fourth quarter of 2007 we further reduced the loss severity period used in determining our loss reserves to reflect average loss severity based on the previous quarter. Additionally, for loans originated in 2006 and 2007, we transitioned to a one-year default curve and subsequently to a one-quarter default curve to reflect the increase in the incidence of early payment defaults on these loans. Statistically, the peak ages for mortgage loan defaults generally have been from two to six years after origination. However, our 2006 and 2007 loan vintages have exhibited a much earlier and higher incidence of default.On the book of business:

Our conventional single-family mortgage credit book of business continues to consist mostly of traditional fixed-rate mortgage loans and loans secured by one-unit properties. Approximately 89% of our conventional single-family mortgage credit book of business consisted of fixed-rate loans, and approximately 96% consisted of loans secured by one-unit properties as of December 31, 2007. The weighted average credit score within our single-family mortgage credit book of business remained high at 721, and the estimated mark-to-market LTV ratio was 61% as of December 31, 2007.On workouts:

Approximately 20% of our conventional single-family mortgage credit book of business had an estimated mark-to-market LTV ratio greater than 80% as of December 31, 2007. Of that 20% portion, over 62% of the loans were covered by credit enhancement. The remainder of these loans, which would have required credit enhancement at acquisition if the original LTV ratios had been above 80%, was not covered by credit enhancement as of December 31, 2007. While the LTV ratios of these loans were at or below 80% at the time of acquisition, they increased above 80% subsequent to acquisition due to declines in home prices over time. There was no metropolitan statistical area with more than 4% of these high LTV loans; the three largest metropolitan statistical area concentrations of these high LTV loans were in New York, Detroit and Washington, DC.

The most significant change in the risk characteristics of our conventional single-family business volume for 2007, relative to 2006 and 2005, was an increase in the percentage of fixed-rate mortgages acquired and a decrease in the percentage of adjustable rate mortgages acquired, driven in part by the shift in the primary mortgage market to a greater share of originations of fixed-rate loans. Fixed-rate mortgages represented 90% of our conventional single-family business volume in 2007, compared with 83% in 2006. Additionally, based on the higher risk nature of interest-only and negative amortizing ARMs, we significantly reduced our acquisition of these loans to less than 7% of our business volume in 2007, from 12% in each of 2006 and 2005. We anticipate relatively few negative amortizing ARM loan acquisitions in 2008.

The most significant change in the risk characteristics of our conventional single-family book of business as of the end of 2007, relative to the end of 2006, was an increase in the weighted average mark-to-market LTV to 61% as of December 31, 2007, from 55% as of the end of 2006. This increase was driven by a decline in home prices across the country, particularly in states such as California and Florida, which had previously experienced rapidly rising rates of home price appreciation and are now experiencing sharp declines in home prices.

In recent years there has been an increased percentage of borrowers obtaining second lien financing to purchase a home as a means of avoiding paying primary mortgage insurance. Although only 10% of our conventional single-family mortgage credit book of business had an original average LTV ratio greater than 90% as of December 31, 2007, we estimate that 15% of our conventional single-family mortgage credit book of business had an original combined average LTV ratio greater than 90%. The combined LTV ratio takes into account the combined amount of both the primary and second lien financing on the property. Second lien financing on a property increases the level of credit risk because it reduces the borrower’s equity in the property and may make it more difficult for a borrower to refinance. Our original combined average LTV ratio data is limited to second lien financing reported to us at the time of origination of the first mortgage loan. . . .

Alt-A mortgage loans, whether held in our portfolio or backing Fannie Mae MBS, represented approximately 16% of our single-family business volume in 2007, compared with approximately 22% and 16% in 2006 and 2005, respectively. During 2007, private-label securitization of Alt-A loans significantly decreased and Fannie Mae assumed a larger role in acquiring Alt-A mortgage loans; however, the actual amount of our acquisitions of Alt-A loans decreased in 2007 from 2006. In order to manage our credit risk in the shifting market environment, we lowered maximum allowable LTV ratios and increased minimum allowable credit scores for most Alt-A loan categories. We also limited our acquisition of some documentation types and made other types ineligible for delivery to us. Finally, we implemented pricing increases to reflect the higher credit risk posed by these mortgages. As a result of these eligibility restrictions and price increases, we believe that our volume of Alt-A mortgage loan acquisitions will decline in future periods.

We estimate that Alt-A mortgage loans held in our portfolio or Alt-A mortgage loans backing Fannie Mae MBS, excluding resecuritized private-label mortgage-related securities backed by Alt-A mortgage loans, represented approximately 12% of our total single-family mortgage credit book of business as of December 31, 2007, compared with approximately 11% and 8% as of December 31, 2006 and 2005, respectively. The majority of our Alt-A mortgage loans are fixed-rate, and the weighted average credit score of borrowers under our Alt-A mortgage loans is comparable to that of our overall single-family mortgage credit book of business. . . .

We estimate that subprime mortgage loans held in our portfolio or subprime mortgage loans backing Fannie Mae MBS, excluding resecuritized private-label mortgage-related securities backed by subprime mortgage loans, represented approximately 0.3% of our total single-family mortgage credit book of business as of December 31, 2007, compared with 0.2% and 0.1% as of December 31, 2006 and 2005, respectively. . . .

We have also invested in highly rated private-label mortgage-related securities that are backed by Alt-A or subprime mortgage loans. As of December 31, 2007, we held or guaranteed approximately $32.5 billion in private-label mortgage-related securities backed by Alt-A loans and approximately $41.4 billion in private-label mortgage-related securities backed by subprime loans. These amounts include resecuritized private-label mortgage-related securities backed by Alt-A and subprime mortgage loans.

Of the conventional single-family problem loans that are resolved through modification, long-term forbearance or repayment plans, our performance experience after 24 months following the inception of these types of plans, based on the period 2001 to 2005, has been that approximately 60% of these loans remain current or have been paid in full. Approximately 9% of these loans were terminated through foreclosure. The remaining loans continue in a delinquent status.

OFHEO Lifts GSE Portfolio Caps

by Anonymous on 2/27/2008 11:10:00 AM

Fannie Mae published its timely, audited financial statement for 2007 today and Freddie Mac anticipates publishing its statement tomorrow. These steps constitute an important milestone in remediation of their respective operational and control weaknesses that led to multi-year periods when neither company released timely, audited financial statements."And the recent temporary expansion of their mission." It does sound like Lockhart is still pissed about the jumbo thingy.

Both companies have been operating under regulatory restrictions stemming from these past problems. These restrictions include growth limits on their retained mortgage portfolios, Consent Orders prescribing necessary remediation actions, and required 30 percent capital cushions above the statutory minimum capital requirements.

Mortgage Portfolio Growth Caps

In recognition of the progress being made by both companies, as indicated by the timely release of their 2007 audited financial statements, and consistent with the terms of the relevant agreements, OFHEO will remove the portfolio growth caps for both companies on March 1, 2008.

Consent Orders

Both companies have also made substantial progress with respect to completing the requirements of their respective Consent Orders. As each Enterprise nears completion, OFHEO is working with them to undertake a thorough review and validation of the completed work and will test the new systems and controls, as needed. To the extent that OFHEO finds the Enterprise has fulfilled the requirements of its Consent Order and the Enterprise has continued to file timely, audited financial statements, OFHEO will lift the Consent Order.

Fannie Mae has reported to us that its remediation activities under the Consent Order are nearing completion. Freddie Mac has completed most of the requirements under its Consent Order, but still faces the requirement of separating the CEO and Chairman position. Although not in the Consent Order, completion of the SEC registration process is a critical step.

OFHEO-Directed Capital Requirements

Since agreements reached in early 2004, OFHEO has had an ongoing requirement on each Enterprise to maintain a capital level at least 30 percent above the statutory minimum capital requirement because of the financial and operational uncertainties associated with their past problems. In retrospect, this OFHEO-directed capital requirement, coupled with their large preferred stock offerings means that they are in a much better capital position to deal with today’s difficult and volatile market conditions and their significant losses.

As each Enterprise nears the lifting of its Consent Order, OFHEO will discuss with its management the gradual decreasing of the current 30 percent OFHEO-directed capital requirement. The approach and timing of this decrease will also include consideration of the financial condition of the company, its overall risk profile, and current market conditions. It will also include consideration of the importance of the Enterprises remaining soundly capitalized to fulfill their important public purpose and the recent temporary expansion of their mission.

(Hat tip, bacon dreamz!)

January New Home Sales Fall Below 600K (SAAR)

by Calculated Risk on 2/27/2008 10:40:00 AM

According to the Census Bureau report, New Home Sales in January were at a seasonally adjusted annual rate of 588 thousand. Sales for December were essentially unchanged.  Click on Graph for larger image.

Click on Graph for larger image.

Sales of new one-family houses in January 2008 were at a seasonally adjusted annual rate of 588,000 ... This is 2.8 percent below the revised December rate of 605,000 and is 33.9 percent below the January 2007 estimate of 890,000.  The seasonally adjusted estimate of new houses for sale at the end of January was 482,000.

The seasonally adjusted estimate of new houses for sale at the end of January was 482,000.

The 482,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - my estimate is about 100K higher.  This represents a supply of 9.9 months at the current sales rate.

This represents a supply of 9.9 months at the current sales rate.

This is another VERY weak report for New Home sales. More later today on New Home Sales.

Bernanke: Economic Situation Distinctly Less Favorable

by Calculated Risk on 2/27/2008 10:14:00 AM

From Chairman Bernanke's Semiannual Monetary Policy Report to the Congress

The economic situation has become distinctly less favorable ...Sounds like a recession to me!

Many of the challenges now facing our economy stem from the continuing contraction of the U.S. housing market. In 2006, after a multiyear boom in residential construction and house prices, the housing market reversed course. Housing starts and sales of new homes are now less than half of their respective peaks, and house prices have flattened or declined in most areas. Changes in the availability of mortgage credit amplified the swings in the housing market. During the housing sector's expansion phase, increasingly lax lending standards, particularly in the subprime market, raised the effective demand for housing, pushing up prices and stimulating construction activity. As the housing market began to turn down, however, the slump in subprime mortgage originations, together with a more general tightening of credit conditions, has served to increase the severity of the downturn. Weaker house prices in turn have contributed to the deterioration in the performance of mortgage-related securities and reduced the availability of mortgage credit.

The housing market is expected to continue to weigh on economic activity in coming quarters. Homebuilders, still faced with abnormally high inventories of unsold homes, are likely to cut the pace of their building activity further, which will subtract from overall growth and reduce employment in residential construction and closely related industries.

Consumer spending continued to increase at a solid pace through much of the second half of 2007, despite the problems in the housing market, but it appears to have slowed significantly toward the end of the year.

...

Slowing job creation is yet another potential drag on household spending, as gains in payroll employment averaged little more than 40,000 per month during the three months ending in January, compared with an average increase of almost 100,000 per month over the previous three months.

...

The business sector has also displayed signs of being affected by the difficulties in the housing and credit markets. Reflecting a downshift in the growth of final demand and tighter credit conditions for some firms, available indicators suggest that investment in equipment and software will be subdued during the first half of 2008. Likewise, after growing robustly through much of 2007, nonresidential construction is likely to decelerate sharply in coming quarters as business activity slows and funding becomes harder to obtain, especially for more speculative projects.

emphasis added

Frank: Bailout-As-You-Go

by Anonymous on 2/27/2008 09:06:00 AM

This is what the Financial Times is reporting:

A leading Democratic lawmaker on Tuesday called for $20bn in public funds to be made available to the Federal Housing Administration to purchase and refinance pools of subprime mortgages. . . .So far this morning, my attempts to find more details on the Frank plan have not succeeded. I did, however, find this recently published statement of priorities for the House Committee on Financial Services, of which Frank is the chair:

Mr Frank said “we can do it through an existing vehicle rather than a new vehicle”. But the underlying logic of the two proposals is similar.

Mr Frank said that under his plan, the FHA would “buy up packages of mortgages but at a substantial discount”. It would then refinance the loans.

This would require about $20bn up front, but Mr Frank stressed that “the FHA would be repaid” as the loans were refinanced. The ultimate cost of the scheme to US taxpayers, under Congressional scoring practices, would probably be about $3bn to $4bn.

Mr Frank also called for between $5bn and $10bn in loans to the states, which would be used to purchase and refurbish foreclosed homes, and extra funding for counselling services.

Mr Frank said the “lesser efforts” to tackle the mortgage crisis to date “have not been very successful”. The housing crisis was “getting worse not better”.

The externalities involved in foreclosures justified the commitment of public funds. “We are talking about terrible impact on society.”

The main difference between the Frank plan and some of the other proposals circulating is the scale of the intervention envisaged.

Alan Blinder, a professor of economics at Princeton, has called for a new government vehicle modelled on the Home Owners Loan Corporation of the 1930s to borrow between $200bn and $400bn to buy up and restructure distressed loans.

Mark Zandi, chief economist at Moody’s Economy.com told the House financial services committee that it would take about $250bn in upfront funds to purchase all 2m loans expected to end in foreclosure by the end of this decade.

Mr Frank said “reality constrains” and his plan was limited to $20bn for the FHA because of the budget deficit and the need to meet pay-as-you-go spending rules.