by Calculated Risk on 9/29/2007 02:34:00 AM

Saturday, September 29, 2007

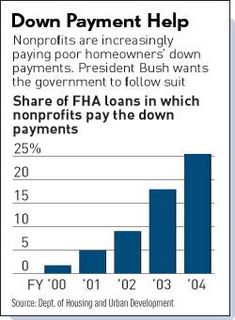

FHA to Ban DAPs

From the WaPo: FHA Down Payment Rule To Ban Seller Financing

The Federal Housing Administration will prohibit borrowers from using seller-financed down payment assistance programs that have helped hundreds of thousands of people buy homes but have come under the scrutiny of federal authorities.One of my earliest posts on this blog concerned credit quality and blasted DAPs. I wrote:

Such programs allow home sellers to give money to charities, which in turn assist buyers with their down payments. The sellers pay the charities a service fee, but often recoup the money by charging a higher price for the homes, usually 2 or 3 percent more, or an amount equal to the down payment, according to a 2005 study by the Government Accountability Office.

In a conference call with reporters, Federal Housing Commissioner Brian Montgomery said the FHA will publish its new rule in the Federal Register on Monday. The rule, which is little changed from a preliminary version put out for comment in May, will go into effect 30 days after publication.

FHA loans are about 10% of all mortgages. They offer a 3% down payment loan - and that is still too much. So non-profit organization step in and pay the downpayment ... OK, actually the seller donates the downpayment to the non-profit and the non-profit gives it to the buyer. Amazing. DAPs were essentially non-existent 4 years ago and now make up 25% of FHA loans! See this chart:Since that chart was published the percentage of FHA loans using DAPs has increased according to the WaPo:

"... seller-financed down payment assistance has accounted for 30 to 50 percent of FHA purchase loans in recent years."And it was over a year ago that the IRS called DAPs a 'scam'. From the WaPo in June, 2006: IRS Ruling Imperils 'Gift Fund' Charities For Home Buyers

A ruling by the Internal Revenue Service threatens to extinguish a fast-growing -- but controversial -- charitable industry that has funneled hundreds of millions of dollars in cash to first-time home buyers for their down payments.It is stunning that it has taken this long to ban this practice. I'm also amazed that the MBA would oppose this ruling:

...

The IRS called the programs "scams" in its ruling last month and said that by providing down payments, the charities actually inflated home prices, making it more likely that homeowners would default on their loans.

The Mortgage Bankers Association ... blasted the ruling. The programs provide "important assistance to cash-strapped borrowers," said Steve O'Connor, the association's senior vice president of public policy.Nonsense.