by Calculated Risk on 9/30/2007 04:46:00 PM

Sunday, September 30, 2007

WSJ: UBS Is Expected to Report Loss

From the WSJ: UBS Is Expected to Report Large Loss From Fixed-Income Unit

...UBS ... is projecting a third-quarter loss of ... ($510 million to $600 million) based on a writedown of 3 billion to 4 billion Swiss francs for fixed-income assets ...The confessional is now open.

...

Its losses resulted from applying sharply lower market values to asset-backed bonds ... Many banks had serious troubles with securities-tied to mortgages when liquidity dried up in the last quarter.

Morgenson Watch

by Anonymous on 9/30/2007 11:50:00 AM

I don't know how many posts I've written on Gretchen Morgenson's terrible reporting. I guess I'm going to have to start keeping score. "Can These Mortgages Be Saved?" Can this "reporter" be saved?

Her latest attempt to go after Countrywide, for sins real and imagined, contains the following "reportage":

But on the billions of dollars worth of mortgage loans that have been sold to investors in the last few years, it is not the banks or lenders like Countrywide that are hit with big losses when homes go into foreclosure. It is the sea of faceless investors who own pieces of these trusts. Also, under the trusts’ pooling and servicing agreements, Countrywide and other servicers typically recoup any costs they cover in the foreclosure process, such as legal and appraisal fees.I cannnot, literally, think of a better way to stir up sympathy for Countrywide than printing crap like this.

Borrower advocates fear that fees imposed during periods of delinquency and even foreclosure can offset losses that lenders and servicers incur. Few borrowers know, for example, that when they make only partial payments on their mortgages, servicers do not credit those payments against the principal or interest on their loan. Instead, the partial payments are deposited into a so-called suspense account. Servicers can dip into these funds and make use of them as interest-free loans, although the funds have to be accessible when the borrower becomes current on payments. In the meantime, borrowers — whether or not they know it — are still zapped with fees and charges for delinquent mortgage payments.

“The foreclosure process is a profit opportunity for servicers and lenders, but there is very little oversight of the fees imposed,” said Michael D. Calhoun, president of the Center for Responsible Lending. “There are a lot of folks trying to squeeze distressed borrowers.”

1. Servicers recoup foreclosure expenses because servicers are servicers. Investors are investors. Investors buy the credit risk; they therefore cover foreclosure costs. This is a perfectly normal arrangement. If you think there's a problem with it, can you explain how being reimbursed for an out-of-pocket expense, like a fee paid to a lawyer or an appraiser, is "making a profit"? Are you saying there's a markup in there? Do you have evidence for that?

2. Servicers are not now and have never been required to accept partial payments. Mortgage loans are not free-form Option ARMs where the borrower gets to decide how much principal or interest to pay this month; all of them, even the real OAs, have "minimum payments." If a distressed borrower talks a servicer into accepting a period of partial payments, to be made up later, that is called a payment plan or forbearance arrangement or some other "workout," and it takes the servicer's consent.

3. Putting partial payments in "suspense" means they don't get posted to the customer's account. It does not mean that the money goes into the servicer's own account. Those funds go into custodial accounts to which servicers cannot "dip in." Servicers do receive float income on those accounts, but of course in most cases they are also obligated to advance the full payment to the investor, out of their own funds, until it is collected from the borrower. So advances do offset the float. This entire paragraph is such an egregious mismash that it's unbelievable.

4. Foreclosure is a profit opportunity? What does that mean? That mortgage loan servicing--which unfortunately does include having to foreclose loans when they default--is a profitable business? Well, yes. That's why people engage in it. Is the claim here that an unfair or excessive profit is being made off of foreclosures (but not off of performing loan servicing)? How? Specifically? The "examples" in these three paragraphs don't make any sense.

And I cannot begin to make sense of the "Connor" loan example. With the hashed-up timeline and limited information given it's impossible to figure out. All I can say is bang-up job of reporting.

Ms. Morgenson, if you want to keep up on your mission to portray Countrywide in the worst possible light, you are going to have to get an education from a reliable source at some point about how the mortgage industry works.

Saturday, September 29, 2007

What's Really Wrong With Stated Income

by Anonymous on 9/29/2007 06:10:00 PM

I had pretty much decided that I had said all I have to say about stated income loans with this post, but now that, per Chevy Chase, IT'S BACK!, I'm going to say one more thing. Then I'm done.

Apologists for stated income always bring us back to this so-called "classic" loan involving a self-employed borrower who "needs" a stated income loan because income is hard to verify or, you know, the tax returns don't "show the whole picture." This is never, really, actually, an argument about why stating rather than verifying income is necessary, although it pretends to be. It's really about why people with volatile income or a preference for not paying taxes on their income should get the "benefit" of financing on the same terms as wage-slaves and people who don't cheat on their taxes. That argument will end just before the sun freezes, so I'm not at all interested in participating in it.

My big problem with stated income lending has never really been about the wisdom or importance or lack thereof of making mortgage loans to the self-employed. My problem has to do with elemental safety and soundness of lenders, in a way that may not be obvious, so I'm going to hammer it for a bit.

Let us take the "classic" stated income hypothetical loan: the borrower is self-employed, has been for years and years, is buying a house, and has some trouble verifying income. Imagine that everything else about the loan is just groovy: high FICO, big down payment, lots of cash reserves after closing, scout badges out the wazoo. I'm not "stacking the deck" here. This looks like a super loan in all respects, except that question about whether there is sufficient current income to service the borrower's debts, or reason to believe that current income will last long enough to get past payment three or so.

We can make this loan in one of two ways:

1. We go "stated income." The borrower provides no tax returns, and just happens to state income sufficient to produce a debt-to-income ratio of 36%, which just so happens to be the maximum traditional cut-off for "acceptable risk."

2. We go "full doc," and the underwriter does a complete income analysis. In writing, on the sacred 1008 (the Underwriting Transmittal in the file), the underwriter fully discusses the business and its cash flow, noting that a 24-month averaging of income is producing a DTI of 68%. However, the underwriter believes that cash flow trend is positive, that there are documented reasons to believe it will continue, that the borrower has sufficient personal cash assets not needed for the business to supplement income for debt service, and hence this high DTI is justified. The 1008 of course is countersigned by a senior credit officer, because it is an exception to normal lending rules--the DTI is too high--and also because we are doing our required Fair Lending monitoring, making sure that the exceptions we make are made fairly, not just to rich white folks or folks in certain zip codes, but to anyone who qualifies for them.

Either way, it's the same loan, but Number 1 was more "efficient." Same risk, right?

Wrong. The default risk of the individual loan is only one risk. There's another huge looming risk created in Number 1 that we keep ignoring.

What happens if the loan performs just fine for a while? Well, if it's held by a financial institution, that institution will be subject to periodic safety and soundness and regulatory compliance examinations. One major point of those exams is to make sure the institution is holding sufficient reserves and capital against its loan portfolio. Among other things, an examiner might look at some reports of loan activity. And on reports, Number 1 looks like a low-risk loan with a 36% DTI. Number 2 catches someone's attention.

But, you say, wouldn't an examiner's attention be caught by the fact that Number 1's "doc type code" is stated, making it the kind of apparent higher risk worth a look at the loan file? Well, not if we started this whole thing by having assumed that there's no additional risk in stated income if other loan characteristics are good enough. The whole circular argument--stated is OK for OK loans--means that this will be considered one of those "not high risk" stated income loans, because all the other data points (FICO, DTI, LTV, etc.) look good.

The odds, therefore, that Number 2 would get further review are high, because it stands out as an exception loan with a high DTI. The odds that Number 1 would get further review are no better or worse than random.

And for any other purpose, such as counterparty due diligence, investor approval, um, servicer ratings, etc., that relies on aggregated data, Number 1 isn't going to make the institution's average DTI look worse, while Number 2 will. It matters if you write enough of those loans.

And what does the institution risk by having an auditor or examiner take a look at the file for Number 2? Why, the risk is that the auditor or examiner will not agree with that analysis, or will find the documentation unconvincing, or will be troubled by an apparent over-willingness to make exceptions or something. This is how the game is played: the loan shows up on some examination problem report, management is forced to respond with a memo defending its underwriting practices, and possibly even more loans get reviewed as the examiners seek potential evidence that whatever they don't like about that file is part of a pattern. Any stray skeletons you might have in your loan file closet (and everyone has a few loans they rather wish they hadn't made, or had handled better when they made them) get dragged out onto the conference room table.

Number 1, in other words, doesn't attract scrutiny. And what happens if it actually goes bad?

Well, with Number 1, it's "clearly" the borrower's fault. He or she lied, and we can pursue a deficiency judgment or other measures with a clear conscience, because we were defrauded here. We can show the examiners and auditors how it's just not our fault. The big bonus, if it's a brokered or correspondent loan, is that we can put it back to someone else, even if we actually made the underwriting determination. No rep and warranty relief from fraud, you know.

With Number 2? There is no way the lender can say it did not know the loan carried higher risk. Of course, higher-risk loans do fail from time to time, and no one has to engage in excessive brow-beating over it, if you believed that what you did when you originally made the loan was legit. If you're thinking better of it now, at least with Number 2 you have an opportunity to see where your underwriting practice or assumptions about small business analysis went wrong.

For anyone using loan servicing databases to research risk factors, of course, Number 1 might cause the conclusion to be drawn that stated income is a risk independent of other loan features. Number 2 might cause the conclusion to be drawn that 68% DTIs just don't work out well on the whole. You could, of course, go back and update the system with Number 1, after it fails and your QC people get around to finding the true income numbers, so that the database will show the true ratio of 68%, but that gets you to the catching-examiner-attention problem above.

And what about Fair Lending compliance? Insofar as a lot of stated income lending is just a way around having to make a formal exception to your lending policies, it's a good way of hiding certain patterns in terms of who you let get away with what. We do ourselves no good by thinking that the current environment--in which any marginal risk can get a stated loan--is the permanent environment. Structural ways to avoid showing your exception patterns invite abuse.

I have said before that stated income is a way of letting borrowers be underwriters, instead of making lenders be underwriters. When I say make lenders be lenders, I don't mean let's not regulate them. I have no problem with regulatory examinations; far from it. I am someone whose signature (usually, in fact, as that second sign-off) has appeared on exactly these kinds of loans, and whose butt has been on the line for them. We all face having loans we approved go bad; the world works that way. What the stated income lenders are doing is getting themselves off the hook by encouraging borrowers to make misrepresentations. That is, they're taking risky loans, but instead of doing so with eyes open and docs on the table, they're putting their customers at risk of prosecution while producing aggregate data that appears to show that there is minimal risk in what they're doing. This practice is not only unsafe and unsound, it's contemptible.

We use the term "bagholder" all the time, and it seems to me we've forgotten where that metaphor comes from. It didn't used to be considered acceptable to find some naive rube you could manipulate into holding the bag when the cops showed up, while the seasoned robbers scarpered. I'm really amazed by all these self-employed folks who keep popping up in our comments to defend stated income lending. It is a way for you to get a loan on terms that mean you potentially face prosecution if something goes wrong. Your enthusiasm for taking this risk is making a lot of marginal lenders happy, because you're helping them hide the true risk in their loan portfolios from auditors, examiners, and counterparties. You aren't getting those stated income loans because lenders like to do business with entrepreneurs, "the backbone of America." You're not getting an "exception" from a lender who puts it in writing and takes the responsibility for its own decision. You're getting stated income loans because you're willing to be the bagholder.

And no, this doesn't particularly do much for my assessment of your business acumen. Frankly, I'd rather see your tax returns and your P&L and hear your story about how investments in the business you have made, with the intent to grow it wisely, have limited your income or made it highly variable, than to see you volunteer to risk prosecution for fraud because, you know, you really need to buy a house. Do you do business with people like that all the time? Are you typically attracted to deals that are claimed to be perfectly legitimate, except that it's important not to fully disclose certain facts to certain parties? Does that maybe explain some of your accounts receivable problems and your pathetic cash flow? It certainly seems to be explaining some lenders' cash-flow problems at the moment.

This isn't just an issue for regulated depositories. All those claims by securities issuers and raters about how we had no idea that gambling was going on in this joint are directly comparable. The tough news for the self-employed "respectable" borrower is that I don't care if you're individually willing to play bagholder: you can't afford to underwrite that collective risk. We have a major credit crisis that's proving that.

Saturday Rock Blogging

by Anonymous on 9/29/2007 07:58:00 AM

Because Nehemiah was a bullfrog, but it croaked! Wake up from the AmeriDream! Help us celebrate the Death of the the DAP by liberating your inner 70s dork. Don't go telling me you read an economics and finance blog on Saturday morning but you're too cool for this number--I think I see a few of you in the audience shots.

FHA to Ban DAPs

by Calculated Risk on 9/29/2007 02:34:00 AM

From the WaPo: FHA Down Payment Rule To Ban Seller Financing

The Federal Housing Administration will prohibit borrowers from using seller-financed down payment assistance programs that have helped hundreds of thousands of people buy homes but have come under the scrutiny of federal authorities.One of my earliest posts on this blog concerned credit quality and blasted DAPs. I wrote:

Such programs allow home sellers to give money to charities, which in turn assist buyers with their down payments. The sellers pay the charities a service fee, but often recoup the money by charging a higher price for the homes, usually 2 or 3 percent more, or an amount equal to the down payment, according to a 2005 study by the Government Accountability Office.

In a conference call with reporters, Federal Housing Commissioner Brian Montgomery said the FHA will publish its new rule in the Federal Register on Monday. The rule, which is little changed from a preliminary version put out for comment in May, will go into effect 30 days after publication.

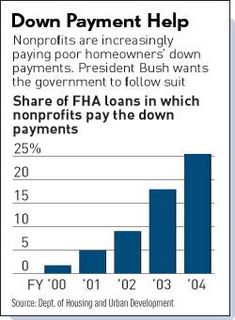

FHA loans are about 10% of all mortgages. They offer a 3% down payment loan - and that is still too much. So non-profit organization step in and pay the downpayment ... OK, actually the seller donates the downpayment to the non-profit and the non-profit gives it to the buyer. Amazing. DAPs were essentially non-existent 4 years ago and now make up 25% of FHA loans! See this chart:Since that chart was published the percentage of FHA loans using DAPs has increased according to the WaPo:

"... seller-financed down payment assistance has accounted for 30 to 50 percent of FHA purchase loans in recent years."And it was over a year ago that the IRS called DAPs a 'scam'. From the WaPo in June, 2006: IRS Ruling Imperils 'Gift Fund' Charities For Home Buyers

A ruling by the Internal Revenue Service threatens to extinguish a fast-growing -- but controversial -- charitable industry that has funneled hundreds of millions of dollars in cash to first-time home buyers for their down payments.It is stunning that it has taken this long to ban this practice. I'm also amazed that the MBA would oppose this ruling:

...

The IRS called the programs "scams" in its ruling last month and said that by providing down payments, the charities actually inflated home prices, making it more likely that homeowners would default on their loans.

The Mortgage Bankers Association ... blasted the ruling. The programs provide "important assistance to cash-strapped borrowers," said Steve O'Connor, the association's senior vice president of public policy.Nonsense.

Friday, September 28, 2007

From the Department of Credit Tightening

by Anonymous on 9/28/2007 06:35:00 PM

FDIC: Netbank Fails

by Calculated Risk on 9/28/2007 04:58:00 PM

From the FDIC: FDIC Approves The Assumption of The Insured Deposits of Netbank, Alpharetta, Georgia (hat tip Red Pill)

On September 28, 2007, NetBank, Alpharetta, Georgia was closed by the Office of Thrift Supervision and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. No advance notice is given to the public when a financial institution is closed.

...

NetBank, with $2.5 billion in total assets and $2.3 billion in total deposits as of June 30 ...

Estimating PCE Growth for Q3

by Calculated Risk on 9/28/2007 12:54:00 PM

The BEA releases Personal Consumption Expenditures monthly (as part of the Personal Income and Outlays report) and quarterly, as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next (several people have asked me about this). Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q3, you would average PCE for July, August and September, then divide by the average for April, May and June. Of course you need to take this to the fourth power (for the annual rate) and subtract one.

The September data isn't released until after the advance Q2 GDP report. But we can use the change from April to July, and the change from May to August (the Two Month Estimate) to approximate PCE growth for Q3. Click on graph for larger image.

Click on graph for larger image.

This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.92).

The two month estimate suggests real PCE growth in Q2 will be about 3.0%.

In general the two month estimate is pretty accurate. Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

Usually I go with the two month estimate (around 3%), however I think Q3 2007 might be one of the exceptions and real PCE growth could have slowed sharply in September (although maybe not until in October).

Housing: Starts, Sales and Forecasts

by Calculated Risk on 9/28/2007 12:00:00 PM

Hopefully this post will clear up some of the confusion regarding various housing statistics and forecasts. Take a look at the recent Goldman Sachs housing forecast - several people have asked if the numbers are consistent - can the excess inventory be worked off with New Home sales falling to 650K and starts "only" falling to 1.1 million units?

Here is a key point: New Home sales come from a subset of housing starts. Housing starts also include owner built units, rental apartments, and other units that would still not be included, if sold, in the New Home sales report. Click on graph for larger image.

Click on graph for larger image.

This graph shows total housing starts and new home sales for the last 30 years. Although there are timing problems comparing starts to sales, these are the two most mentioned housing statistics, and this graph clearly illustrates the key point above.

Perhaps it would be helpful to divide starts into two major categories: Starts for homes that will be included in New Home sales, and All Other Starts. Unfortunately the Census Bureau doesn't provide this exact breakdown. But we can estimate "All Other Starts" from the above graph: the median for the last 30 years was 750K, and the minimum was 505K (during the recession of '91).

So, ceteris paribus, if New Home sales fall to 650K, we would expect total starts to fall to 1.4 million units (650K + 750K).

Of course all else isn't equal these days in the housing market - the outlook is especially grim - but perhaps not as grim as some forecasts. I'll post more on this topic this weekend.

August Construction Spending

by Calculated Risk on 9/28/2007 10:15:00 AM

From the Census Bureau: August 2007 Construction Spending at $1,166.7 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2007 was estimated at a seasonally adjusted annual rate of $1,166.7 billion, 0.2 percent above the revised July estimate of $1,164.4 billion. The August figure is 1.7 percent below the August 2006 estimate of $1,186.3 billion.

During the first 8 months of this year, construction spending amounted to $768.0 billion, 3.3 percent below the $794.0 billion for the same period in 2006.

...

[Private] Residential construction was at a seasonally adjusted annual rate of $522.1 billion in August, 1.5 percent below the revised July estimate of $529.8 billion.

[Private] Nonresidential construction was at a seasonally adjusted annual rate of $353.4 billion in August, 2.3 percent above the revised July estimate of $345.5 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private construction spending for residential and non-residential (SAAR in Billions). While private residential spending has declined significantly, spending for private non-residential construction has been strong.

The second graph shows the YoY change for both categories of private construction spending.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.Right now the recent trend is holding: residential construction is declining, but private non-residential construction is still strong.

There's a New Nerd in Town

by Anonymous on 9/28/2007 09:46:00 AM

Via Mr. Coppedge, I see Accrued Interest has a nice UberNerd (AccruederNerd?) on CDO structures that I missed first time around, with a follow-up here that will warm the heart of any poor downtrodden credit analyst who got stomped on by the quants. I recommend it; it makes a point I've tried but dismally failed to make clearly, which is that the big issue for a lot of these deals is timing of default, not level of default. If you're still confused about how a relatively low level of early default can hurt much more than a comparatively higher level of later default on a structured security, this post will certainly help you.

For contextual purposes, here's a set of charts from Moodys that you may ponder. (These are MBS/ABS issues, not CDOs, but they'll be the collateral in a lot of CDOs.) Notice how the slope of the 2006 vintage changes in just six months, as more of the deals in that vintage get old enough. Notice also that this chart is based on original balance (so the numbers won't match anything you see quoted based on current balances), and that the comparison is the 2000-2001 vintage. That's a meaningful comparison because, until 2005-2006 came along, the 2000-2001 vintages were about the ugliest anyone had seen in a long time.

Thursday, September 27, 2007

First Data: $9.4 Billion Sold

by Calculated Risk on 9/27/2007 10:21:00 PM

From the WSJ: Bond Market Starts Showing Relief Signals

... Wall Street investment banks yesterday sold investors $9.4 billion in risky bank loans issued by First Data Corp. to finance its leveraged buyout.Selling loans for 96 cents on the dollar is considered good news in this environment. Maybe Credit Suisse and Citigroup can sell more, and make up the loss with volume!

It was the largest sale of leveraged loans since that of HCA Inc. last year. It was also nearly double the $5 billion in loans the banks said they were attempting to sell.

Still, the underwriters, which include Credit Suisse and Citigroup Inc., hold on their own books the bulk of the $24 billion in loan financing they provided for First Data.

The key number is the $14 billion or so in pier loans. The total deal value was $26 billion with $24 billion in debt. This is still larger than the Chrysler pier loans that were only $10 Billion.

Roubini: "Too Optimistic on Housing"

by Calculated Risk on 9/27/2007 03:03:00 PM

Professor Roubini write: I Was Way Too Optimistic on the Housing Recession...

In March of this year this author published a long paper (with Christian Menegatti) titled “The Housing Recession is Still Far from Bottoming Out” that predicted a much worsening housing recession through all of 2008. In that paper the prediction was that housing starts – that had already fallen by 38% by January of 2007 to a level of 1.4 million - would fall much further and would bottom out at 1.1 million in 2008. Indeed, by looking at previous housing recession – where the average fall in starts was 51% - it was sensible to be that pessimistic. Again those predictions were dismissed as too gloomy and pessimistic and unrealistic.To add to Roubini's comments, here is the current Goldman Sachs housing forecast (New Home sales falling to 650K units and starts falling to 1.1 million units).

But it turned out that I was way too optimistic about housing, not too pessimistic. As recently reported housing starts have now fallen by 42% and now JP Morgan – one of the most respected research houses on Wall Street and a persistent proponent until recently of the view that the housing recession would bottom out – is predicting that housing starts will fall another 25% to a cumulative fall of 56% from peak and will bottom out at 999 thousand units some time in 2008. Compared to my initial March prediction of a bottom at 1.1 million I turn out to be an optimist. And indeed many other research firms (including Goldman Sachs, Citibank and others) are now predicting the bottom of housing starts at 1 million to 1.1 million units. So what in March was considered as borderline lunatic is now becoming conventional wisdom.

...

Right now I see housing start falling more than the 1.1 million that Menegatti and I predicted in March as the housing market has deteriorated since then much more than our then dire predictions. Given the continued fall in building permits and in home sales and the massive excess supply of new and existing homes housing starts could bottom out at level close to previous housing recession, i.e. between 800k and 900k.

Since I predicted a fall in starts to 1.1 million units a couple of years ago, people are now asking if I was also "too optimistic". First, I don't measure my predictions to the WS forecasts, but to the actual numbers. Starts have fallen to 1.331 million units (SAAR) in the latest report, so it is still too early to count coup. Second, I wasn't trying to forecast the exact number, rather the general size of the down turn - IMO there is little difference between 1.1 million starts and, say, 1.0 or 1.2 million starts. The overall downturn is about the same.

However Roubini's new bottom forecast for starts (800K to 900K) is a significant downward revision from his previous forecast. I'll update my forecast at the end of the year (the housing market moves in slow motion, so there is no need to change forecasts frequently). Right now I think my number still looks about right.

Fannie Says Housing Slump to Last Beyond 2008

by Calculated Risk on 9/27/2007 02:46:00 PM

On Bloomberg Video: Mudd of Fannie Says Housing Slump to Last Beyond 2008.

Click image for video.

September 27 (Bloomberg) -- Fannie Mae Chief Executive Officer Daniel Mudd talks with Bloomberg's Peter Cook in Washington about the state of the U.S. housing market, the prospects for raising Fannie's mortgage portfolio cap and the outlook for legislation to create a new regulator for the government-sponsored enterprises. Mudd, whose government-chartered company is the largest provider of money for U.S. home loans, said the housing slump will last beyond next year. (Source: Bloomberg)

More on August New Home Sales

by Calculated Risk on 9/27/2007 11:03:00 AM

For more graphs, please see my earlier post: August New Home Sales Click on graph for larger image.

Click on graph for larger image.

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession - possibly starting right now!

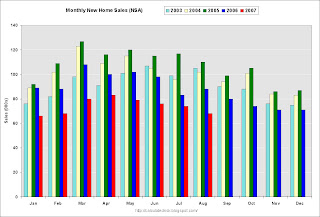

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through August.

Typically, for an average year, about 70% of all new home sales happen before the end of August. Therefore the scale on the right is set to 70% of the left scale.

It now looks like New Home sales will be in the low 800s - the lowest level since 1997 (805K in '97). My forecast was for 830 to 850 thousand units in 2007 and that might be a little too high.

A comment on revisions:

The Census Bureau revises the New Home sales number three times (plus annual revisions). During a housing down turn, most of the revisions from the Census Bureau are down. This is important to keep in mind when looking at a new monthly report. This chart shows the cumulative revisions for each month since sales activity peaked in July 2005 (annual revisions are not shown). The last time there was a positive cumulative revision (red column) was in September 2005.

This chart shows the cumulative revisions for each month since sales activity peaked in July 2005 (annual revisions are not shown). The last time there was a positive cumulative revision (red column) was in September 2005.

The median change for the first revision is a decline of 1.6% (average decline of 1.8%) over the last two years.

The cumulative median change for the second revision is a decline of 3.6%.

The cumulative median change for the third revision is a decline of 4.8%. Since the last upward cumulative revision (Sept 2005), the range has been from a small decline of 0.2% in Dec '05, to a decline of almost 11% for May '06.

The new homes sales number today will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.

August New Home Sales

by Calculated Risk on 9/27/2007 09:59:00 AM

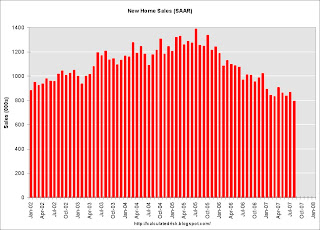

According to the Census Bureau report, New Home Sales in August were at a seasonally adjusted annual rate of 795 thousand. Sales for July were revised down to 867 thousand, from 870 thousand. Numbers for May and June were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in August 2007 were at a seasonally adjusted annual rate of 795,000 ... This is 8.3 percent below the revised July rate of 867,000 and is 21.2 percent below the August 2006 estimate of 1,009,000.

The Not Seasonally Adjusted monthly rate was 68,000 New Homes sold. There were 88,000 New Homes sold in August 2006.

Aug '07 sales were the lowest August since 1995 (63,000).

The median and average sales prices were down sharply. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in August 2007 was $225,700; the average sales price was $292,000.

The seasonally adjusted estimate of new houses for sale at the end of August was 529,000.

The 529,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - some estimate are about 20% higher.

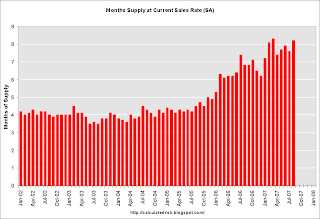

This represents a supply of 8.2 months at the current sales rate.

This is another very weak report for New Home sales. This is the first report after the start of the credit turmoil, and, as expected, the numbers are very ugly.

More later today on New Home Sales.

Who Should Pay the Rating Agencies?

by Anonymous on 9/27/2007 09:48:00 AM

From the International Herald Tribune, we see that Congress is getting up on its hind legs and barking over the perennial issue of who pays for bond ratings:

Democratic and Republican senators said they were particularly concerned with one aspect of the agencies' business models: They get paid by the companies whose bonds they rate. That is like a film production company paying a critic to review a movie, and then using that review in its advertising, said Senator Jim Bunning, Republican of Kentucky.Right. Because we all know that film critics' salaries are paid by surcharges on movie tickets, not newspaper advertising revenue. Whatever.

I really do want to know why those who believe that rating agency fees should be paid by investors, not issuers, believe that this is going to improve anything. I'm not defending the status quo; I'm legitimately curious. There's no context we can imagine in which, say, large institutional investors who pay the lion's share of those fees might not put pressure on the RAs to keep them from downgrading an outstanding issue, against which the investor doesn't really want to hold more reserves or capital? There are no transparency concerns when only those "accredited investors" who pay subscription fees can see rating benchmarks? (It's working so well for the hedge fund industry . . .) Issuers would somehow become unable to pressure the agencies for the "right" rating if they didn't directly pay those invoices? You know a clear, bright-line distinction between "issuers" and "investors" you could share with me? If Bear Stearns, say, buys tranches for its own trading account, and also issues them off its own shelf, what difference does it make which cost center cuts the checks to Moodys?

Let's contrast this situation with the highly satisfactory smooth working of consumer credit reports. The information in those reports is provided by creditors, not the individuals who are subject to them. The fee for use of that information is paid by subscribers--creditors, mostly--although they turn around and pass that cost onto applicants and borrowers. You pay the cost of lenders getting your credit report from a for-profit company who considers its information on you to be its property, not yours. In an environment of rampant identity theft and privacy violation--an environment caused, basically, by the existence of electronic repositories of sensitive data that consumers don't profit from, although they take the incalculable privacy risk--there can be no "transparency" of FICOs, and you wouldn't want there to be.

However, in an attempt to fight back, a whole industry of manipulating consumer credit ratings has sprung up, driven by both consumers wanting more or cheaper credit and lenders wanting more or more profitable borrowers. In all of this, the mortgage industry in particular is reeling from the results of its overreliance on FICOs, which were designed more for evaluating the risk of unsecured lending than mortgage lending, and that can rather easily be used to find not the most credit-worthy borrowers but the most profitable ones: those who do not default, but who run up balances sufficiently and pay enough periodic late fees to be a credit card issuer's dream come true. As more people are granted more unsecured credit by savy users of FICOs, the FICOs themselves "improve" for a class of borrowers who now want mortgage loans based on those FICOs.

Some of you may not know this, but there used to be a chronic problem with subprime mortgage servicers refusing to report data to the credit repositories. That meant that those borrowers who got a subprime loan and then paid it on time were not benefitting, since their credit record didn't show the on-time payments; when they went to refinance, they got put into another subprime loan. You would also find subprime servicers not reporting current balances, only original ones, making these borrowers look more indebted than they really were. It took Fannie and Freddie coming out with the declaration that they would no longer buy loans from seller/servicers who did not "full file report" to the credit bureaus to put a stop to this practice. Anyone who is convinced that users of ratings always have an interest in the accuracy of ratings should ponder this: there's always money to be made off of information asymmetry. It's fashionable these days to see bond investors as the hapless innocent victims of issuers and their lapdog rating agencies, but I'm old enough to have seen lenders who foot the bill for consumer credit reports going out of their way to make sure those reports didn't tell the whole picture.

I really want to know why we think subscriber-paid fees in the bond rating world is going to result in something we'll be happy with.

Thursday Close Harmony Blogging

by Anonymous on 9/27/2007 07:06:00 AM

I know, it's not Saturday yet, but CR's little caption contest below was just too tempting.

Wednesday, September 26, 2007

LA Times Photo Caption Contest

by Calculated Risk on 9/26/2007 09:06:00 PM

From the LA Times:

News item: "For 10 days now, a sagging house parked on the Hollywood Freeway's northbound shoulder in the Cahuenga Pass has had people gawking -- and talking."Some of the captions are great. My favorites:

"If you lived here, you'd be home now!"

Gary

"Halfway to Calabasas, Bob realizes his mistake and decides to mail in the keys instead."

Raughle

Subprime-Mortgage Defaults Increase

by Calculated Risk on 9/26/2007 08:50:00 PM

From Bloomberg: Subprime-Mortgage Defaults Rose Last Month, Data Show (hat tip John & Jim)

Late payments and defaults among subprime mortgages packaged into bonds rose last month ...

After August payments, 19.1 percent of loan balances in 20 deals from the second half of 2005 were at least 60 days late, in foreclosure, subject to borrower bankruptcy or backed by seized property, up from 17.5 percent a month earlier, according to a report yesterday from Wachovia Corp.

Prepayment speeds for the loans slowed, suggesting it's more difficult for borrowers to sell their homes or refinance, according to another report by New York-based analysts at UBS AG. Record levels of delinquencies and defaults on subprime mortgages are worsening as home prices decline and interest rates on loans adjust higher for the first time. As lenders tighten standards, borrowers are finding it harder to refinance into new mortgages with lower payments.

The ``reports showed the first inkling of the impact of shutdown of subprime market,'' the UBS analysts led by Thomas Zimmerman wrote late yesterday. ``In our opinion, the full impact is yet to come.''

Sallie Mae Deal in Trouble

by Calculated Risk on 9/26/2007 04:58:00 PM

From MarketWatch: Sallie Mae says deal to buy lender threatened

The group of investors that agreed to buy SLM Corp. has said that it can't close the deal under the agreed-upon terms, the giant student lender announced Wednesday.The NY Times had an article on the Sallie Mae deal last week: Deal to Buy Sallie Mae in Jeopardy

SLM, commonly known as Sallie Mae said that the group "has no contractual basis to repudiate its obligations" under the agreement, and pledged to pursue "all remedies available" to get the deal done.

While the group is hoping to renegotiate the price of Sallie Mae, these people said, it may also be willing to walk away and pay the $900 million breakup fee.The $900 million breakup fee is a little higher than the reported percentage writedowns at Lehman and Morgan Stanley. The total deal value is $25 Billion.

Graphing Housing Prices

by Calculated Risk on 9/26/2007 01:07:00 PM

My apologies to Tanta, this is my version of an UberNerd post: How to graph housing prices.

The NY Times included a graph of real house prices based on the Case-Shiller index in the following article: They Cried Wolf. They Were Right.

Click on graph for larger image in new window.

The graph has several interesting events annotated, including when economist Dean Baker sold his condo in May 2004, and Fed Chairman Ben Bernanke's comment in Feb 2006 that Fed policy makers "expect the market to cool but not to change very sharply".

Unfortunately I think this graph is somewhat misleading and technically incorrect. So I'd like to use this graph to illustrate how to graph housing prices.

This graph is based on the quarterly S&P/Case-Shiller® U.S. National Home Price Values. The S&P/Case-Shiller® index is for nominal house price (not adjusted for inflation).

To adjust for inflation, the NY Times used the CPI from the BLS. This is a slight technical error; an economist would adjust the Case-Shiller index using "CPI less shelter". Admittedly the differences are minor.

Setting Q1 1987 to 100, the NY Times calculated prices fell to 92 in Q4 1996. Using CPI less Shelter, prices would have only fallen to 93 (minor difference).

However, the NY Times calculated prices peaked at 171 in Q1 2006. Using CPI less Shelter, the peak was actually 176, about a 3% difference.

The other problem with the NY Times graph is the choice of scale without warning the reader. IMO the starting value for the y-axis should be clear. This graph is fine if the reader understands that the graph shows the changes in real values, but not the relative absolute values.

Click on graph for larger image.

Click on graph for larger image.The second graph shows the same data with the scale starting at zero (the blue line is the NY Times calculation of real values, the shaded area is the technically correct calculation).

But even this graph could mislead the reader. Will prices return to 100 (the Q1 1987 price)? Unlikely. First, 1987 was chosen because that is one the Case-Shiller index starts. We do not know from this chart if prices in 1987 were too high, too low, or just about right.

Second, real prices for houses do increase over time - perhaps on the order of 1% to 2% per year. Using 1987 as a starting point, a 2% real return would have put current real prices at 150; a 1% annual return would put the current value at 122.

What people really want to know is what will happen to nominal prices in the future. But the focus on real prices helps predict changes in future nominal prices. I'll have more on this later.

Modification Update

by Anonymous on 9/26/2007 11:19:00 AM

Many of our commenters have expressed concern over the possibility that servicers offering workout modifications will lead to "freeloading" by borrowers who could make their payment, but who wish to tell the servicer a sob story and get a rate break. I thought you might find the following from American Banker (subscription only) interesting:

In an interview this month, J.K. Huey, the senior vice president of home loan servicing at IndyMac Bancorp Inc., said that more than half of the borrowers who call the company for a workout or a loan modification do not qualify.The gist of the article is that modification rates are still very low relative to the number of troubled borrowers; Moodys estimates that about 1.00% of 2005-vintage ARMs have been modified this year.

"We want to help people stay in their home provided they have the financial ability to do so," she said. "But we have to make sure they're going to be successful and the loan is going to perform. We can't do a modification just for the sake of it."

Of those whose requests for relief are rejected, roughly 60% did not respond to written requests for financial information, such as the borrower's last two pay stubs, a W-2 form or the last income tax return. "A lot of people do not want to send the financial information needed to prove what their income is," Ms. Huey said. "They really don't want to take the time to work with us."

The other 40% of loans that are denied loss mitigation are to borrowers who are current on their mortgage payments but who contacted IndyMac in an effort to get a lower rate, she said.

"We do have some customers calling us that shouldn't be calling us," Ms. Huey said. After reviewing those customers' finances, "we say that they have a $4,000 surplus and are able to make their payments, and they say they just wanted to check."

For those interested in data sources, the article quotes a spokesman for First American Title indicating that requests for modification-related title updates are up about 40%. (A modification does not require a new title insurance policy, as a refinance does, but it does need a "date-down" endorsement to bring the mortgage date down to the modification date, which is much cheaper than a new refi policy.) So title update volume might be a useful proxy for modification activity outside the securitized sector (which a source like the investment banks or rating agencies will limit themselves to).

ARM Pain: Updated BofA Reset Chart

by Calculated Risk on 9/26/2007 10:26:00 AM

Mathew Padilla at the O.C. Register has an updated ARM reset chart from Bank of America analyst Robert Lacoursiere. Click on graph for larger image.

See Mathew's blog for more discussion and a comparison to the previous chart.

Some readers have noted that the BofA numbers are higher than the Credit Suisse and UBS reset numbers. CS and UBS are apparently only looking at securitized loans, and BofA includes unsecuritized loans.

Also, CS and UBS apparently only include the first reset when the loan goes from "fixed to floating". Perhaps BofA includes subsequent resets too, double counting some loans.

LIBOR or SLIMBOR?

by Anonymous on 9/26/2007 08:27:00 AM

Well, you know what's in your cornflakes--I hope. Do you know what's in your ARM index? According to the Financial Times, the London Interbank Offered Rate may well mean Selected London Inter-Marginal Bank Offered Rate:

“The Libor rates are a bit of a fiction. The number on the screen doesn’t always match what we see now,” complains the treasurer of one of the largest City banks.Almost all subprime ARMs, the vast majority of Alt-A ARMs, and a significant chunk of prime ARMs are indexed to 6- or 12-month (dollar-denominated) LIBOR in the U.S. (I'm still looking for a source of exact figures.) One of the ways LIBOR was "sold" to consumers who were used to old-fashioned indices like Constant Maturity Treasury (CMT) or Cost of Funds (COFI) was that it "lagged" these U.S.-centric indices on the upside, implying that LIBOR ARM rates would not rise as quickly. That was mostly nonsense then, and it may be pretty painful nonsense now if the interbank borrowing practices on which LIBOR is based shift such that it becomes a "penalty rate" for bank borrowing.

Such criticism is, unsurprisingly, rebuffed by those who compile the index each day. However, it highlights two other trends that have emerged in the money markets in recent weeks.

One of these is a growing divergence in the rates that different banks have been quoting to borrow and lend money between themselves.

For although the banks used to move in a pack, quoting rates that were almost identical, this pattern broke down a couple of months ago – and by the middle of this month the gap between these quotes had sometimes risen to almost 10 basis points for three month sterling funds.

Moreover, this pattern is not confined to the dollar market alone: in the yen, euro and sterling markets a similar dispersion has emerged. However, the second, more pernicious trend is that as banks have hoarded liquidity this summer, some have been refusing to conduct trades at all at the official, “posted” rates, even when these rates have been displayed on Reuters.

“The screen will say one thing but people are actually quoting a different level, if they are quoting at all,” says one senior banker.

Some observers think this is just a short-term reaction to the current crisis. However, it may also reflect a longer-term shift. This is because one key, albeit largely unnoticed, feature of the banking world in recent years is that many large banks have reduced their reliance on the interbank market by tapping cash-rich companies and pensions funds for finance instead.

The recent crisis appears to have accelerated this trend. In particular, it appears that some large banks have in effect been abandoning the interbank sector in recent weeks, turning to corporate or pension clients for funding by using innovative repurchase agreements.

This trend is bad news for smaller institutions, such as British mortgage lenders, because these, unlike large banks, generally do not have any alternative ways of raising funds outside the interbank world.

Prediction: If we "innovate" back to Treasury-based ARM indices (by pulling those dusty old CMT notes out of the drawer), it will be sold to you all on the basis that CMT is a "lagging" index.

Tuesday, September 25, 2007

Shiller Sees `Years of Decline' for U.S. Housing

by Calculated Risk on 9/25/2007 05:57:00 PM

On Bloomberg Video: Shiller of Yale Sees `Years of Decline' for U.S. Housing.

Click image for video.

September 25 (Bloomberg) -- Robert Shiller, chief economist at MacroMarkets LLC and a professor at Yale University, talks with Bloomberg's Kathleen Hayes from New Haven, Connecticut, about the state of the U.S. housing market, the outlook for home prices and the likelihood of a recession. Home prices in 20 U.S. metropolitan areas fell the most on record in July, indicating the threat to consumer spending was rising even before credit markets seized up in August, according to the S&P/Case-Shiller home-price index. (Source: Bloomberg)And check out the video on the Miami condo auction at the bottom of the posts.

More on August Existing Home Sales

by Calculated Risk on 9/25/2007 05:18:00 PM

For more existing home sales graphs, please see the previous post: August Existing Home Sales

Here are a few more graphs on inventory and months of supply. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the monthly inventory levels for the last four years. There is somewhat of a seasonal pattern, with inventory peaking in the summer months.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

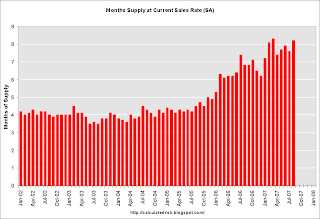

The second graph shows the monthly 'months of supply' metric for the last four years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the August inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the August inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.581 million is the all time record. The "months of supply" metric is 10.0 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the worst levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units.

Forecasts

The following graph shows the actual cumulative existing home sales (through August) vs. three annual forecasts for 2007 made at the beginning of the year (NAR's Lereah, Fannie Mae's Berson, and me).  My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

NSA sales are 4.074 million units through August. In a typical year, sales through August are about 69% of the sales for the year. So at the current pace, sales will be around 5.9 million. However sales have slowed, and will probably slow further in the months ahead.

To reach the NAR forecast, revised downward again on Sept 11th to 5.92 million units, sales would have to be at the 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say that even the September NAR forecast was too optimistic.

Undercapitalized Bond Insurers?

by Anonymous on 9/25/2007 02:49:00 PM

This is unpleasant news (from Bloomberg):

Sept. 25 (Bloomberg) -- Bond insurers, including those owned by AMBAC Financial Group Inc. and FGIC Corp., may need to raise capital to maintain their top credit ratings if losses worsen on subprime mortgage securities, Moody's Investors Service said.And this is a curious turn of phrase:

Under what Moody's called its most stressful scenario, losses on securities backed by subprime mortgages could reach 14 percent, causing AMBAC, FGIC, Security Capital Assurance Ltd. and CIFG Assurance North America Inc. to fall short of the capital needed to keep their Aaa ratings. The most likely source of losses would be from guarantees on collateralized debt obligations, which may be backed by subprime mortgage securities. The stress test is higher than Moody's expected loss rate of 10 percent under which the guarantors experience no material losses.

``Because ratings are so important to the industry's value proposition, the rating agency believes that a highly rated financial-guarantor with a strong ongoing franchise would likely take whatever action is feasible to preserve its rating during times of stress,'' Moody's analysts led by Stanislas Rouyer in New York wrote in a report released today.To which industry's "value proposition" are ratings so important? The bond insurers or the CDO managers?

August Existing Home Sales

by Calculated Risk on 9/25/2007 02:00:00 PM

Note: I'm posting from the local library. Here are a couple of graphs I uploaded before Time Warner crashed this AM. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. Usually August is a stronger month than July, but this year NSA sales were essentially flat from July to August.

For existing homes sales are reported at the close of escrow. So August sales were for contracts signed in July and even June. Many of these transactions already had locked in their loans by the time the credit turmoil started at the beginning of August. Therefore I expect an even greater impact from tighter standards on reported sales in September. The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4,581,000 in August.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4,581,000 in August.

Total housing inventory rose 0.4 percent at the end of August to 4.58 million existing homes available for sale, which represents a 10.0-month supply at the current sales pace, up from a 9.5-month supply in July.This is basically the same inventory level as July, although the months of supply increased to 10 months because of the drop in sales.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

Hopefully my ISP will be back online soon. Best to all.

A Clockwork Mortgage

by Anonymous on 9/25/2007 10:51:00 AM

I made an idle threat a while ago to write something about the negative convexity of mortgages--and options theory generally--but I haven't gotten around to punishing you all like that. I looks like I should. Exhibit ZZ in my never-ending war on "economist-underwritten loans" showed up this morning, courtesy of our WaitingInOC, and it's a doozy: "Surprise: Toxic Mortgages Are the Best."

This is a summary of an academic paper by professors Tomasz Piskorski and Alexei Tchistyi, the full text of which I don't have. If any of you do and feel the need to forward it on to me, why, go ahead. It has to be more fun than a sharp stick in the eye. What I can glean from the Reuters paraphrase suggests that it's about a massive campaign of borrower re-education designed to convince you that giving up your option to prepay and your fixed rate protection in exchange for a couple of nickels of interest is in your best interest, since investors who suddenly experience positive convexity with MBS--it's like perpetual Christmas morning--will give up all the resulting price gains in rate concessions to you, and interest rate cycles will be repealed. Or something. Remember that I am working with a summary here.

Right now is not the moment for the major UberNerd treatise on convexity, so suffice it to say that the main issue is the imbedded options in mortgage loans. In options theory terms, a mortgage gives the borrower a put (the right to default or "send jingle mail") and call (the right to prepay the mortgage with proceeds of a refinance or any other funds). Although both options have costs--especially if you have a prepayment penalty on your loan--those costs can end up being much lower than the cost of keeping your current mortgage. Because the "strike price" of these options is so heavily dependent on local and national economic conditions, interest rate levels, and home price changes, it is notoriously difficult to predict for any given borrower over any given stated loan maturity.

The lender, on the other hand, is "long a bond, short an option." Mortgages cannot be called or accelerated by the lender, except in case of default. No lender can make you refinance (although loan terms can certainly be created that will make you see that as your best option). If you are given a 30-year fixed rate, the lender must allow you to keep that rate for 30 years, even if it subsequently becomes uneconomic for the lender, as market rates rise and new investments would return more. On the other hand, if market rates drop, you may exercise your right to prepay, which means that the lender loses your old higher-rate mortgage and must reinvest its funds at new, lower market rates.

All this produces some difficulty in valuation of mortgage securities, since mortgages have a tendency to prepay at the worst time for the investor and to extend durations--stay on the books--when prepayments would be best for the investor. The mortgage origination industry--as distinct, here, from the investment community--has a lot at stake in making refinances fast, cheap, and easy, as each new loan is a new fee opportunity. But the lower the option cost of the borrower's "call," the less valuable the loan is to the investor (and servicer). Prepayment penalties have become, basically, an attempt to put the genie back into the bottle.

We think of the ARM mania so much in terms of payment "affordability" that we forget why lenders like them: the idea of an ARM is that, subject to some lags due to adjustment frequency, caps, index volatility, and so on, the ARM is designed to keep "repricing" itself to current market rates. Theoretically--and we are definitely in the realm of theory here--ARMs obviate the borrower's refinance option because a refinance would offer no better rate, as long as the ARM is "at market" at any point in its life and the refi rate is "at market." In the real world, of course, we've created enough "inefficiency" here with teasers, discounts, "lagging" indices, long adjustment intervals, and cap structures to make sure there's still--or there was until recently--plenty of incentive for borrowers with an ARM to refinance. Not coincidentally, we have used the best technology we can buy to make refis fast and cheap in terms of transaction costs, which we're perfectly happy to finance if even low upfront costs bother you.

"Until recently" is a way to speak volumes about the flaw in this plan: the refinance option depends as much on the value of the collateral as on the availability of cheap, easily-obtained mortgage money, and we have a little bit of a problem right now with that. As the LTV rises on a loan, that other option, the borrower's "put," gets a whole lot cheaper for the borrower and more expensive for the lender. Theoretically, the "perfect" loan, for the investor, would be one with no or minimal options for the borrower to call or put, and with a rate adjustment mechanism with very short reset invervals, large caps, and a highly sensitive (not "lagging") index. This ideal loan would prohibit prepayment or make it terribly expensive, and also allow the payment to fluctuate such that borrowers in a bit of an income or expense jam are less tempted to put the thing back in periods of home price declines.

Well then why, you ask, have we not invented this perfect loan? Apparently we're nearly there:

If you had to name the most toxic, dangerous, foolhardy kind of mortgage loan that exists, you'd very likely pick a pay-option ARM, which lets borrowers get deeper into debt by paying less than the minimum interest they owe each month and adding the unpaid interest to the loan principal. Worse yet, you might say, would be a pay-option ARM with a very high penalty for prepayment so borrowers can't get out of it easily once they're in it. There's a move afoot to ban these worst-of-the-worst loans.It's the best, not the perfect, because even though we've managed to stick the most onerous prepayment penalties on these loans that the law allows, we have yet to find a legal way to extend them to the life of the loan at a high enough penalty rate to make Option ARMs permanent loans. If we did that, you see, these things would be a fabulous deal; we would need only to "educate" borrowers about how giving up options is handsomely repaid in lower interest rates forever, and we're nearly there.

Guess what? The worst is actually the best.

If the optimal loan really is better for homeowners who behave rationally, maybe it makes sense to get people to behave rationally through extensive, even expensive, consumer education. In an interview, Piskorski told me that by his rough calculation, the benefits of the optimal mortgage vs. a conventional mortgage amount to a least half a percentage point of interest -- namely, $50 billion or more a year for the U.S. as a whole. In other words, you could devote many billions of dollars a year to consumer education about these misused-but-potentially-valuable loans and still come out ahead.Anyone who can determine who "you" is in that last sentence wins a free subscription to Calculated Risk. When dollars are being proposed to be spent, it is always wise to ask whose those dollars are.

And why are Option ARMs, in a perfect world, "optimal" for borrowers?

-- The option to pay less than the minimum monthly interest owed on the loan is valuable for people with good self-control whose income fluctuates a lot. They can pay just a little in lean months and catch up in fat months. It's good for lenders, too, because they don't have to foreclose on people who fall behind, which is an expensive process. People with steady incomes don't need this feature, but having it doesn't hurt them.We must, of course, leave aside "good self-control," because that will undoubtedly be covered in "our" training program. We will have to content ourselves with asking how, in a perfect world, incomes "fluctuate." In some tight band around a mean to which they revert? In that case, why would you not qualify the borrower at an interest only payment at the "bottom" of the band, allowing for sporadic principal payments when times are "fat," but preventing negative amortization? Perhaps we are really talking about incomes that never quite "fluctuate" up to where they need to in order to retire the debt? And how does this option not hurt people who don't need it, when it comes at the cost of losing the right to prepay and the inflation-protection of a fixed rate?

-- The fact that the loan is an ARM -- namely, its rate fluctuates with market interest rates -- is especially valuable to lenders. This is a subtler notion, but the idea is that if there are going to be a certain number of defaults in a pool of mortgages because of random bits of bad luck like a job loss or a divorce, the lender would prefer that they be concentrated during periods of high interest rates. Why? Because when market interest rates are high, the lender that forecloses and gets back (most of) its money can redeploy the cash in high-yielding alternatives. The lender would prefer not to foreclose and get its money back when rates are low and other options are unattractive. An ARM loan achieves what the lender wants. Borrowers, meanwhile, are neutral about whether they default in periods of high or low market interest rates.So "lenders" don't want to foreclose because it's expensive, except for the fact that apparently investors would like to see foreclosures happen when rates are high. Whether the additional cost of foreclosure in a high-rate environment doesn't offset reinvestment gains is a good question. All that high past-due interest has to be recouped out of the liquidation of the REO, and there is a theory about connections among RE values, marketing time, and high interest rates, you know.

Similarly I'd like to know why borrowers are "neutral" about default in various rate scenarios. But I am most interested in the idea that lenders wouldn't want to foreclose on an ARM when rates are low. It's, um, an ARM. Why would the rate on a new loan be lower than the rate on an existing ARM, in our perfect frictionless world? If there is in fact some friction here--the ARM rate is still higher than market in this falling rate environment--then where is this "discount" that these consumers got in exchange for giving up the refi option?

-- Finally, the economists say the optimal loan contract would outright ban getting a new loan from a different lender. There are no such bans. But they say that the prepayment penalties that are common in subprime loans are a good second best. How could that be? Because lenders will offer more favorable terms if they know that they'll be able to hang onto the loan long enough for it to be profitable. If they fear that the borrower will refinance at the drop of a hat, they'll give less favorable terms.OK, guys. What are "more favorable terms" on an ARM? I mean, you do not have to have the cynical response that lenders who know you can never get out of the contract will be motivated to extract as much out of you as possible short of forcing you into foreclosure to wonder where the deal comes in without the offer of a fixed rate.

The problem with those subprime ARMs, of course, is that while the borrowers did get a "discount" on the initial rate in exchange for that prepayment penalty, it is not at all clear to informed observers that it was much of a discount: you have to rule out the possibility of predatory lending, and assume perfect pricing of credit risk, in order to say that no borrower got a "discounted" subprime ARM that involved a higher rate than that borrower would have paid on an undiscounted FHA fixed rate. You also have pretend we haven't been having a major affordability problem with home prices in order to understand rate discounts as something other than "qualification" games, or simply a matter of rate concessions the lender makes solely because the alternative is no loan at all if you have to qualify at a "market" interest rate. A "teaser" is not a simple discount in exchange for a prepayment penalty; it's a means of getting you into a loan you cannot afford, because lenders who do not own the loan forever just want to make lots of loans.

You can, of course, assume anything you want in a "perfect world," but I notice these helpful economists are not proposing a massive educational campaign designed to teach lenders and servicers and investors not to be greedy, sociopathic cretins. We are proposing that "we" spend "our" money to teach "you" to understand that what is in our best interest--all the options on our side, none on yours, except your "option" to get deeper in debt each month--is really in your best interest.

Says Piskorski: "Obviously people are to some extent irrational. But if you want to ban this type of contract, you should really weigh the benefits and the costs. How much could you educate people? Make people understand them. Provide them with software. Make a federal law that requires the lender to reveal what this contract is about."In other words, we need to keep our toxic products but fire these irrational borrowers, replacing them with some trainees who can be brought to have more rational points of view. I suggest issuing this software with applications for Social Security Numbers; as soon as you begin to work for money, you should begin the process of understanding how to become contributing members of the "free market" by handing over your "pricing power" and behaving the way the rentier class wants you to.

I am not, of course, suggesting that there's no room for improvement in borrower education. I certainly don't think your "refi options" are always more about saving your money than about handing over fees to an industry that loves to "help you out." Nor do I claim that these academics are mere useful tools of the mortgage industry. However, I am reaffirming an old conviction of mine: there is no fruitcake like academic fruitcake.

Existing Home Sales 5.5 Million

by Calculated Risk on 9/25/2007 10:50:00 AM

My Internet Connection (Time Warner) is down.

From NAR Press Release.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – were down 4.3 percent to a seasonally adjusted annual rate1 of 5.50 million units in August from a level of 5.75 million in July, and are 12.8 percent below the 6.31 million-unit pace in August 2006.Graphs will be posted soon (hopefully).

Sales: 5.5 Million SAAR.

Months of Supply: 10.0

Best to all.

Home Prices Post Biggest Drop in 16 Years

by Calculated Risk on 9/25/2007 09:37:00 AM

From AP: Home Prices Post Biggest Drop in 16 Years

The decline in U.S. home prices accelerated nationwide in July, posting the steepest drop in 16 years, according to the S&P/Case-Shiller home price index released Tuesday.

Home prices have fallen by more every month since the beginning of the year.

An index of 10 U.S. cities fell 4.5 percent in July from a year ago. That was the biggest drop since July 1991.

"The further deceleration in prices is still apparent across the majority of regions," MacroMarkets LLC Chief Economist Robert Shiller said in a statement.

Table from the WSJ: Home Prices Tumble, Case-Shiller Index Reports

Monday, September 24, 2007

Lowe's and Target Warn

by Calculated Risk on 9/24/2007 05:45:00 PM

From Reuters: Lowe's warns profit could trail prior forecast

The second-largest home improvement chain behind Home Depot Inc ... said "current sales are trending below" expectations as drought in the mid-Atlantic, Southeastern and Western parts of the United States hurt sales of outdoor products.From MarketWatch: Target cuts September sales outlook

Target Corp. on Monday evening cut its forecast for September sales at stores open more than a year to an increase of 1.5% to 2.5%, down from its previous forecast of 4% to 6%. In a recorded message, the Minneapolis-based discount retailer said there was weaker guest traffic in September than expected ...Is this the start of Hamlet Act V?.

Roubini on Housing

by Calculated Risk on 9/24/2007 04:13:00 PM

Here is a video of Nouriel Roubini on CNBC this morning.

Also, the Video of the Day (bottom of the posts) is a great interview with Alan Greenspan.

Housing: Soft "repairs, maintenance and improvement markets"

by Calculated Risk on 9/24/2007 02:44:00 PM

From The Times: Wolseley's fresh alert on US housing market

Wolseley, the plumbing and heating engineer, which makes half its income in America, gave warning today that revenues of its US building materials business have collapsed by almost 75 per cent.Real spending on home improvement has held up pretty well so far. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

It has eliminated 3,500 staff and shut 46 branches.

...

Chip Hornsby, the chief executive, said that there were no signs of a turnaround in the residential housing market and that "the repairs, maintenance and improvement market is now beginning to soften".

Click on graph for larger image.

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray (source: BEA)

Although real spending declined slightly in Q2 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

MMBS: Bikes on the Balcony!

by Anonymous on 9/24/2007 02:34:00 PM

Ye Gods. That's almost as bad as laundry in the backyard.

The Wall Street Journal treats us to "The Invasion of Renters." I for one am unable to determine how far my leg is being pulled here, or how seriously this reporter is taking his own story. We begin with the familiar narrative build-up:

Mark Spector was happy with his new neighborhood. Then the renters started moving in.I have no idea how Mr. Spector can keep tabs on the occupancy status of 750 homes; I'm just glad he isn't my neighbor. Anyway, you're wondering what happened next, right?