by Calculated Risk on 12/20/2006 12:10:00 AM

Wednesday, December 20, 2006

MBA: Mortgage Applications Decrease

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Decrease in This Week’s Survey Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 647.6, a decrease of 10.2 percent on a seasonally adjusted basis from 721.2 one week earlier. On an unadjusted basis, the Index decreased 11.6 percent compared with the previous week and was up 13.9 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally adjusted Refinance Index decreased by 14.6 percent to 1968.8 from 2304.4 the previous week and the Purchase Index decreased by 5.9 percent to 436.5 from 463.8 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.10 from 6.02 percent ...

The average contract interest rate for one-year ARMs increased to 5.82 percent from 5.76 ...

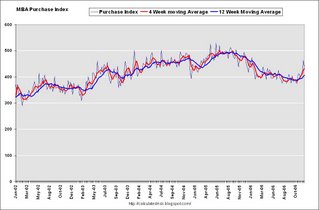

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 2.1 percent to 433.4 from 424.6 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 2.1 percent to 433.4 from 424.6 for the Purchase Index.The refinance share of mortgage activity decreased to 50.8 percent of total applications from 52.6 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 23.6 from 24.9 percent of total applications from the previous week. The ARM share is at its lowest level since October 2003.Last week Bank of America commented on the recent surge in refinance activity:

"Strong MBA application activity ... We think its just bringing forward ’07 refi’s and see little help for riskier credits."