by Calculated Risk on 11/27/2006 12:31:00 PM

Monday, November 27, 2006

Fed Expressed Concern About "Housing Bubble" in 2002

Via the WSJ Markebeat: Distant Early Warning (hat tip: K-Dawg)

The Federal Reserve had some idea of the problems posed by inflated housing values back in 2002, according to summaries of meetings held by the Federal Advisory Council, a group comprised of the Fed governors and a dozen representatives from regional and national banks. The FAC meets quarterly to discuss monetary policy, financial regulation and other matters — summaries are released with a three-year lag — and in December 2002, during Alan Greenspan’s tenure, the council was already warning of problems related to housing. Although the signs were limited, the summary shows that the Fed was already discussing the possibility of a housing bubble as much as four years ago, not long after the technology-stock bubble burst.

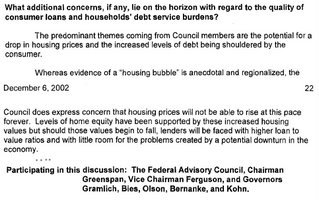

“Whereas evidence of a ‘housing bubble’ is anecdotal and regionalized, the Council does express concern that housing prices will not be able to rise at this pace forever,” the summary says. “Levels of home equity have been supported by these increased housing values but should those values begin to fall, lenders will be faced with higher loan to value ratios and with little room for the problems created by a potential downturn in the economy.”

Click on image for larger view.

Click on image for larger view.From Federal Advisory Council (FAC) minutes, December 6, 2002. Note: Paragraph on consumer credit removed.

The FAC included members of the banking industry and Wall Street. See document for members.