by Calculated Risk on 9/19/2006 02:27:00 PM

Tuesday, September 19, 2006

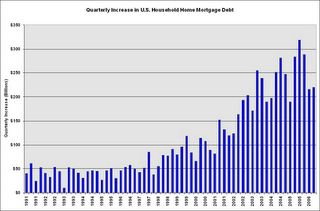

Fed: Household Mortgage Debt Increased $220 Billion in Q2

The Federal Reserve released the Q2 2006 Flow of Funds report today.

From MarketWatch (hat tip Paul): Household net worth up 0.1% in second quarter

The net worth of U.S. households increased 0.1% in the second quarter to $53.3 trillion, the slowest gain in nearly four years, the Federal Reserve said Tuesday.

After adjusting for inflation, net worth fell in the quarter.

...

Household assets grew by $332 billion to $66 trillion in the second quarter, while liabilities increased by $278 billion to $12.7 trillion. The value of real estate holdings increased by $402 billion ...

...

Owners' equity in their real estate fell to a record low 54.1% of market value from 54.4% in the first quarter and nearly 58% in 2000.

...

Mortgage debt increased 9%, the slowest pace since the recession of 2001.

Click on graph for larger image.

Click on graph for larger image.Household mortgage debt increased $220.3 Billion in Q2.

This increase in mortgage debt accounted for 80% of the increase in household liabilities for the quarter.

Even though the rate of increase of mortgage debt has slowed, mortgage debt is still increasing faster than GDP growth. So the ratio of mortgage debt to GDP is still increasing.

Even though the rate of increase of mortgage debt has slowed, mortgage debt is still increasing faster than GDP growth. So the ratio of mortgage debt to GDP is still increasing.Mortgage debt is now at a record 70.6% of GDP.

Look at these all time records:

1) Owner's equity, as a percent of market value, is at an all time low.

2) Mortgage debt, as a percent of GDP, is at an all time high.

3) Mortgage debt service, as a percent of disposable personal income, is at an all time high (from Q1 data, Q2 data will be released soon).

And, according to the Fed estimates, the value of household real estates was still rising in Q2, 2006. Imagine what happens when values start to decline.