by Calculated Risk on 9/26/2006 07:48:00 PM

Tuesday, September 26, 2006

Bernanke's Conundrum

Last December I suggested:

I think long rates will start to rise when the Fed starts cutting the Fed Funds rate.First, let's review the relationship between various interest rates and mortgage rates.

This will be Bernanke's "conundrum"! As the economy slows, this will reduce the trade deficit and also lower the amount of foreign dollars willing to invest in the US - the start of a possible vicious cycle.

Click on graph for larger image.

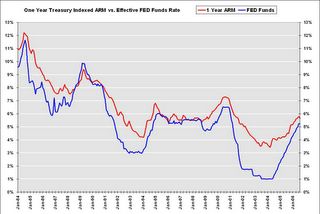

Click on graph for larger image.One of the most popular mortgages is the One-year Treasury-indexed ARM. When the Fed starts cutting rates, the rate on the one year ARM will probably also decrease. This might help the housing market a little, but ...

The most popular loans are still the 30 year fixed rate. Typically long rates start falling when the Fed starts cutting rates, but recently there has been a weakening of the link between long and short rates. What if the next time the Fed starts cutting rates, the long rate rises?

NOTE: Although long rates have fallen recently, rates are still well above the lows of the last couple of years.

Via Mark Thoma: Dallas Fed economist Tao Wu wrote about the weakening link, between the Fed Funds rate and long rates, in an economic letter this month: Globalization’s Effect on Interest Rates and the Yield Curve

Monetary policy’s effects on the economy stem largely from how long-term interest rates respond to central banks’ actions. In most industrialized nations, central bankers have direct control over short-term interest rates and use them as their main policy instrument. When central banks raise short-term rates, it usually leads to increases in market-determined long-term rates, including those for mortgages and commercial loans. Higher long-term rates curb aggregate consumption and investment, ultimately helping contain inflation. Cutting short-term rates, on the other hand, usually leads to lower long-term rates, providing a stimulus for economic activity. Any lasting changes in the links between short- and long-term rates will thus have important implications for the timing and impact of monetary policy actions.After a discussion on globalization, Wu concludes:

Central banks’ ability to affect long-term rates may be severely eroded, as we have seen in the recent "conundrum" period.And this takes us to Brad Setser's post today (caution: lots of numbers): The deterioration in the US income balance has just begun .... In the post, Dr. Setser outlines how the trade deficit could fall in '07, but the current account deficit could continue to rise. Many of the details are interesting, but an important conclusion is that long rates could rise even if short rates start to fall.

Consequently, the effects of monetary policy tightening or loosening may be substantially weakened. Because long rates are less sensitive to short rates, the response of aggregate demand to monetary policy moves may prove sluggish. One example is the lack of response in the mortgage and housing markets in 2004 and early 2005, when homebuyers’ borrowing costs changed little as the Federal Reserve tightened. Low rates kept the housing boom in high gear, stimulating sales and providing builders with incentives to expand operations despite the Fed’s attempt to slow the economy.

Globalization’s impact on the relationship between short- and long-term interest rates poses potentially formidable challenges for central banks around the world.

And finally, when might the Fed start to cut rates? According to the Cleveland Fed, market expectations have risen sharply for a rate cut in December (now at 28%):

Most market participants still expect no action in both October and December, but expectations are definitely rising for a cut in December.

Most market participants still expect no action in both October and December, but expectations are definitely rising for a cut in December.Interestingly this runs counter to recent Fed comments including Paul Volcker's comments yesterday. I recommend (again) Tim Duy's Fed Watch: Widening Disconnect.

So Bernanke might not be deciding between inflation vs. growth. Instead he might face a conundrum with a weakening economy: every time Bernanke cuts rates, long rates might rise (for a year or two). And it's long rates that matter - as Dr. Wu noted:

"Monetary policy’s effects on the economy stem largely from how long-term interest rates respond to central banks’ actions."As always there is the opposite view; several observers are forecasting much lower long rates: PIMCO's Bill Gross and Goldman, Merrill See Bond Rally; 2-Year Yield at 3.6%