by Calculated Risk on 4/20/2006 11:22:00 AM

Thursday, April 20, 2006

Rising Rents and Inflation

As the housing market slows, rents are starting to rise. The OC Register reports: No slowdown in O.C. rents

Apartment rents spiked 7 percent in the first quarter to $1,441 a month, compared to the year-ago quarter, said apartment tracker RealFacts in a report expected today.

...

Landlords say they are making up for the years after the '01 dot.com bust when a slowing economy flattened rates.

Rental growth slowed to under 5 percent from late 2001 to early 2005 ...

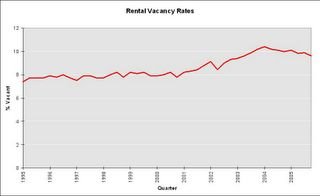

Click on graph for larger image.

Vacancy rates are declining, but are still above normal for recent years according to the Census Bureau. In regions with higher than normal vacancy rates, vacancies will probably keep rents from rising too quickly. However another concern is that a slowing housing market will lead to higher CPI due to rising Owners' Equivalent Rent. Dr. Altig touched on this yesterday.

"Mike [Bryan] notes that owners equivalent rent accelerated in March, something many folks have been concerned about for some time."

Here is a graph of the monthly changes for Owners' Equivalent Rent (OER). OER is the largest single component of CPI and many people have argued that OER was understated as house prices rose, and that OER would start rising as housing slowed - leading to higher reported inflation.

For those interested in how OER is calculated, here is a description from the BLS: Consumer Price Indexes for Rent and Rental Equivalence

A higher reported CPI might lead to higher rates and further impact the housing market.

UPDATE: Here is a writeup from Asha Bangalore and Paul Kasriel at Northern Trust: The FOMC Finds Itself in a Tight Spot. Excerpt:

"We need to watch the owner’s equivalent rent and rent of primary residence components of shelter costs which are showing an upward trend. Owner’s equivalent rent rose 0.4% in March, after a 0.3% increase in February and a 0.2% gain in January. Adjustments for utilities play a role in the computation of this component in addition to rental prices. The value of landlord provided utilities is subtracted from rent to obtain the “pure rent” measure of owner’s equivalent rent. In situations of rising natural gas prices a larger amount is subtracted to estimate pure rent vs. situations when natural gas prices are falling. The recent decline in natural gas prices could explain to some degree the upward trend of owner’s equivalent rent. In addition, the upward trend of the rent component of shelter costs also contributed to higher owner’s equivalent rent. Higher rents reflect demand pressures on rental property as rising mortgage rates could have priced out otherwise eligible potential home owners. The rent index moved up 0.4% in March after a 0.3% gain in February and a 0.1% increase in January."