by Calculated Risk on 1/17/2018 06:46:00 PM

Wednesday, January 17, 2018

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 261 thousand the previous week.

• Also at 8:30 AM, Housing Starts for December. The consensus is for 1.280 million SAAR, down from 1.297 million SAAR in November.

• Also at 8:30 AM, the Philly Fed manufacturing survey for January. The consensus is for a reading of 25.0, down from 26.2.

Fed's Beige Book: "Modest to moderate"expansion, "on-going labor market tightness"

by Calculated Risk on 1/17/2018 02:06:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Atlanta based on information collected on or before January 8, 2018."

Reports from the 12 Federal Reserve Districts indicated that the economy continued to expand from late November through the end of the year, with 11 Districts reporting modest to moderate gains and Dallas recording a robust increase. The outlook for 2018 remains optimistic for a majority of contacts across the country.

...

On balance, employment continued to grow at a modest pace since the previous report. Most Districts cited on-going labor market tightness and challenges finding qualified workers across skills and sectors, which, in some instances, was described as constraining growth. Several Districts noted elevated demand for manufacturing and construction labor. Most Districts said that wages increased at a modest pace. A few Districts observed that firms were raising wages in a broader range of industries and positions since the previous report. Some Districts reported that firms expect wages to increase in the months ahead.

emphasis added

NAHB: Builder Confidence decreased to 72 in January

by Calculated Risk on 1/17/2018 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 72 in January, down from 74 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Remains Strong as New Year Starts

Builder confidence in the market for newly-built single-family homes dropped two points to a level of 72 in January on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) after reaching an 18-year high in December 2017.

“Builders are confident that changes to the tax code will promote the small business sector and boost broader economic growth,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “Our members are excited about the year ahead, even as they continue to face building material price increases and shortages of labor and lots.”

“The HMI gauge of future sales expectations has remained in the 70s, a sign that housing demand should continue to grow in 2018,” said NAHB Chief Economist Robert Dietz. “As the overall economy strengthens, owner-occupied household formation increases and the supply of existing home inventory tightens, we can expect the single-family housing market to make further gains this year.”

...

The three HMI components registered relatively minor losses in January. The index gauging current sales conditions dropped one point to 79, the component charting sales expectations in the next six months fell a single point to 78, and the index measuring buyer traffic fell four points to 54.

Looking at the three-month moving averages for regional HMI scores, the West rose two points to 81, the South increased one point to 73, the Midwest inched up a single point to 70 and Northeast climbed five points to 59.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was slightly below the consensus forecast, and a strong reading.

Industrial Production Increased 0.9% in December

by Calculated Risk on 1/17/2018 09:26:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.9 percent in December even though manufacturing output only edged up 0.1 percent. Revisions to mining and utilities altered the pattern of growth for October and November, but the level of the overall index in November was little changed. For the fourth quarter as a whole, total industrial production jumped 8.2 percent at an annual rate after being held down in the third quarter by Hurricanes Harvey and Irma. At 107.5 percent of its 2012 average, the index has increased 3.6 percent since December 2016 for its largest calendar-year gain since 2010.

The gain in manufacturing output in December was its fourth consecutive monthly increase. The output of utilities advanced 5.6 percent for the month, while the index for mining moved up 1.6 percent. Capacity utilization for the industrial sector was 77.9 percent, a rate that is 2.0 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

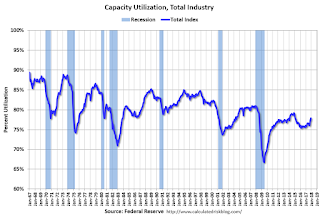

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.9% is 2.0% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 107.5. This is 23% above the recession low, and 2% above the pre-recession peak.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/17/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 12, 2018.

... The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 35 percent compared with the previous week and was 7 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since March 2017, 4.33 percent, from 4.23 percent, with points increasing to 0.54 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 7% year-over-year.

Tuesday, January 16, 2018

Wednesday: Industrial Produciton, Homebuilder Survey, Beige Book

by Calculated Risk on 1/16/2018 06:58:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still Working on That Ceiling

Mortgage rates didn't move much today. Most lenders were just slightly lower/better this morning, but mid-day market weakness prompted several of them to reissue higher rates. In the bigger picture, however, the past several days represent a welcome stint of relative calm. The general trend had been toward higher rates beginning in mid-December. [30YR FIXED - 4.125%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 77.3%.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 73, down from 74 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Update: Predicting the Next Recession

by Calculated Risk on 1/16/2018 01:59:00 PM

CR January 2018 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and in the summer of 2015, in January 2016, in August 2016, and in April 2017) because of all the recession calls. In late 2015, the recession callers were out in force - arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - would lead to a global recession and drag the US into recession. I didn't think so - and I was correct.

I've added a few updates in italics by year. Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR April 2017 Update: Now it has been over four years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

[CR January 2018 Update: Now it has been five years!]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2016 Update: The recent recession calls are mostly based on exogenous events: the problems in China and in commodity based economies (especially oil based). There will be some spillover to the US such as fewer exports (and an impact on oil producing regions in the US), but unless there is a related financial crisis, I think the spillover will be insufficient to cause a recession in the US.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2017 Update: Austerity was a mistake (obvious at the time). And it is possible that we will see serious policy mistakes from the new administration (a complete wildcard). And it is possible the Fed could tighten too quickly. ]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR January 2018 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. This still seems correct today, so no recession in the immediate future (not in 2018). ]

Q4 GDP Forecasts

by Calculated Risk on 1/16/2018 10:39:00 AM

The advance estimate of Q4 GDP will be released on Friday, January 26th.

Here are a few estimates, from Merrill Lynch:

The strength of the retail sales report [last Friday] lifted our 4Q GDP tracking estimate by 0.6pp to 2.8% qoq saar.From the Altanta Fed: GDPNow

emphasis added

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 3.3 percent on January 12, up from 2.8 percent on January 10.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.9% for 2017:Q4 and 3.2% for 2018:Q1.CR Note: It looks likely that GDP will be close or over 3% again in Q4.

NY Fed: "Business activity continued to grow at a solid clip"

by Calculated Risk on 1/16/2018 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity continued to expand strongly. The general business conditions index was little changed at 17.7. ... The index for number of employees fell nineteen points to 3.8, a level suggesting only a small increase in employment levels. The average workweek index fell to a level near zero, indicating that hours worked were unchanged.This was slightly below expectations, but still a solid report.

Looking ahead, firms remained optimistic about the six-month outlook. The index for future business conditions edged up two points to 48.6. The index for future inventories rose to 20.3, a record high, indicating that firms expect to build up inventories significantly in the months ahead. The index for future number of employees rose three points to 26.9, a multiyear high.

emphasis added

Monday, January 15, 2018

Monday Night Futures

by Calculated Risk on 1/15/2018 06:34:00 PM

Weekend:

• Schedule for Week of Jan 14, 2018

Tuesday:

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 18.6, up from 18.0.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 7, and DOW futures are up 160 (fair value).

Oil prices were up over the last week with WTI futures at $64.73 per barrel and Brent at $70.26 per barrel. A year ago, WTI was at $52, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.34 per gallon - so gasoline prices are up 20 cents per gallon year-over-year.