by Calculated Risk on 10/18/2017 07:00:00 AM

Wednesday, October 18, 2017

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 13, 2017. This week’s results included an adjustment for the Columbus Day holiday.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.14 percent from 4.16 percent, with points remaining unchanged at 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.

Tuesday, October 17, 2017

Wednesday: Housing Starts, Beige Book

by Calculated Risk on 10/17/2017 06:27:00 PM

Back in 2014, I wrote this ...

For amusement: Years ago, whenever there was a market sell-off, my friend Tak Hallus (Stephen Robinett) would shout at his TV tuned to CNBC "Bring out the bears!".Now the market is up about 80% since his 2012 prediction. I mention Faber - not because of his forecasting record - but because of his racist comments today (he will no longer be on CNBC).

This was because CNBC would usually bring on the bears whenever there was a sell-off, and bulls whenever the market rallied.

Today was no exception with Marc Faber on CNBC:

"This year, for sure—maybe from a higher diving board—the S&P will drop 20 percent," Faber said, adding: "I think, rather, 30 percent"And Faber from August 8, 2013:

Faber expect to see stocks end the year "maybe 20 percent [lower], maybe more!"And from October 24, 2012:

"I believe globally we are faced with slowing economies and disappointing corporate profits, and I will not be surprised to see the Dow Jones, the S&P, the major indices, down from the recent highs by say, 20 percent," Faber said...Since the market is up 30% since his 2012 prediction, shouldn't he be expecting a 50% decline now?

I guess CNBC has an opening for a permabear!

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for September. The consensus is for 1.170 million SAAR, down from the August rate of 1.180 million.

• During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/17/2017 01:21:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.38 million in September, up 0.6% from August’s estimated pace but down 1.6% from last September’s seasonally adjusted pace. Unadjusted sales should show a larger YOY decline, reflecting the lower business day count this September compared to last September. Hurricane Irma has a sizable impact on home sales in Florida, where I estimate sales were down by over 20% YOY. Surprisingly, however, residential sales in Houston were up 3.4% YOY, apparently reflecting the partial “spillover” in hurricane-related delayed closings in August (Harvey hit Houston in the latter part of August). For the combined August/September period home sales in Houston were down 12.5% from the comparable period of last year.

On the inventory front, local realtor/MLS data suggest that the NAR’s estimate of the number of existing homes for sale at the end of September will be about 1.88 million, unchanged from August’s preliminary estimate and down 7.4% from a year earlier.

Finally, realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price last month was up 6.0% from last September.

CR Note: Existing home sales for September are scheduled to be released this Friday. The consensus is for sales of 5.30 million SAAR.

NAHB: Builder Confidence increased to 68 in October

by Calculated Risk on 10/17/2017 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in October, up from 64 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Rises Four Points in October

Builder confidence in the market for newly-built single-family homes rose four points to a level of 68 in October on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This was the highest reading since May.

“This month’s report shows that home builders are rebounding from the initial shock of the hurricanes,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “However, builders need to be mindful of long-term repercussions from the storms, such as intensified material price increases and labor shortages.”

“It is encouraging to see builder confidence return to the high 60s levels we saw in the spring and summer,” said NAHB Chief Economist Robert Dietz. “With a tight inventory of existing homes and promising growth in household formation, we can expect the new home market continue to strengthen at a modest rate in the months ahead.”

...

All three HMI components posted gains in October. The component gauging current sales conditions rose five points to 75 and the index charting sales expectations in the next six months increased five points to 78. Meanwhile, the component measuring buyer traffic ticked up a single point to 48.

Looking at the three-month moving averages for regional HMI scores, the South rose two points to 68 and the Northeast rose one point to 50. Both the West and Midwest remained unchanged at 77 and 63, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

Industrial Production Increased 0.3% in September

by Calculated Risk on 10/17/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.3 percent in September. The rates of change for July and August were notably revised; the current estimate for July, a decrease of 0.1 percent, was 0.5 percentage point lower than previously reported, while the estimate for August, a decrease of 0.7 percent, was 0.2 percentage point higher than before. The estimates for manufacturing, mining, and utilities were each revised lower in July. The continued effects of Hurricane Harvey and, to a lesser degree, the effects of Hurricane Irma combined to hold down the growth in total production in September by 1/4 percentage point.[1] For the third quarter as a whole, industrial production fell 1.5 percent at an annual rate; excluding the effects of the hurricanes, the index would have risen at least 1/2 percent. Manufacturing output edged up 0.1 percent in September but fell 2.2 percent at an annual rate in the third quarter. The indexes for mining and utilities in September rose 0.4 percent and 1.5 percent, respectively. At 104.6 percent of its 2012 average, total industrial production in September was 1.6 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in September to 76.0 percent, a rate that is 3.9 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.0% is 3.9% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in September to 104.6. This is 20.1% above the recession low, and close to the pre-recession peak.

The hurricanes are still impacting this data.

Monday, October 16, 2017

Tuesday: Industrial Production, Homebuilder Confidence

by Calculated Risk on 10/16/2017 06:46:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Higher

Mortgage rates were sideways to slightly higher today, depending on the lender. Underlying bond markets suggested a bit more movement, and that will likely be reflected in tomorrow morning's rate sheets unless bonds improve overnight. [30YR FIXED - 3.875-4.0%]Tuesday:

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 76.2%.

• At 10:00 AM, The October NAHB homebuilder survey. The consensus is for a reading of 64, unchanged from 64 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

Housing Starts and the Unemployment Rate

by Calculated Risk on 10/16/2017 02:49:00 PM

By request, here is an update to a graph I haven't posted in several years ...

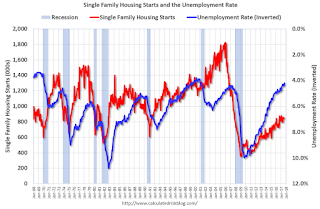

The graph below shows single family housing starts (red) and the unemployment rate (blue, inverted) through September 2017. Note: Of course there are many other factors impacting the unemployment rate, but housing is a key sector.

Usually when single family housing starts are increasing, then the unemployment rate is falling (with a lag).

You can see both the correlation and the lag. Housing starts fall (or increase) first, followed by the unemployment rate. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Here is what I wrote when I first posted this graph in 2009. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.That is exactly what happened.

Usually near the end of a recession, residential investment1 (RI) picks up as the Fed lowers interest rates. This leads to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the 2007 recession, with the huge overhang of existing housing units, this key sector didn't participate for a few years.

Currently I expect single family housing starts to continue to increase (still historically low), and for the unemployment rate to fall further.

1 RI is mostly new home sales and home improvement.

Phoenix Real Estate in September: Sales up slightly, Inventory down 10% YoY

by Calculated Risk on 10/16/2017 11:03:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in September were up 0.9% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 10.4% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the eleventh consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (3.1% through July or 5.4% annual rate).

| September Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Sept-08 | 6,179 | --- | 1,041 | 16.8% | 54,4271 | --- |

| Sept-09 | 7,907 | 28.0% | 2,776 | 35.1% | 38,340 | -29.6% |

| Sept-10 | 6,762 | -14.5% | 2,904 | 42.9% | 45,202 | 17.9% |

| Sept-11 | 7,892 | 16.7% | 3,470 | 44.0% | 26,950 | -40.4% |

| Sept-12 | 6,478 | -17.9% | 2,849 | 44.0% | 21,703 | -19.5% |

| Sept-13 | 6,313 | -2.5% | 2,106 | 33.4% | 23,405 | 7.8% |

| Sept-14 | 6,252 | -1.0% | 1,609 | 25.7% | 26,492 | 13.2% |

| Sept-15 | 6,980 | 11.6% | 1,573 | 22.5% | 23,396 | -11.7% |

| Sept-16 | 7,421 | 6.3% | 1,499 | 20.2% | 24,195 | 3.4% |

| Sept-17 | 7,485 | 0.9% | 1,592 | 21.3% | 21,680 | -10.4% |

| 1 September 2008 probably includes pending listings | ||||||

NY Fed: Manufacturing Activity "grew at a robust pace" in October

by Calculated Risk on 10/16/2017 08:44:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew at a robust pace in New York State, according to firms responding to the October 2017 Empire State Manufacturing Survey. The headline general business conditions index climbed six points to 30.2, its highest level in three years. The new orders index came in at 18.0 and the shipments index rose eleven points to 27.5—readings that pointed to ongoing solid gains in orders and shipments. ...This was well above the consensus forecast of a reading of 20.0.

...

The index for number of employees rose five points to 15.6, suggesting that employment expanded more strongly this month, while the average workweek index registered zero, indicating that the average workweek held steady. ...

Indexes assessing the six-month outlook suggested that firms continued to be optimistic about future conditions. The index for future business conditions climbed six points to 44.8, and the index for future new orders also came in at 44.8. Employment was expected to increase modestly.

emphasis added

Sunday, October 15, 2017

Sunday Night Futures

by Calculated Risk on 10/15/2017 08:00:00 PM

Weekend:

• Schedule for Week of Oct 15, 2017

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 20.0, down from 24.4.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 future are up 4 and DOW futures are up 30 (fair value).

Oil prices were up over the last week with WTI futures at $51.80 per barrel and Brent at $57.72 per barrel. A year ago, WTI was at $50, and Brent was at $49 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.45 per gallon. A year ago prices were at $2.25 per gallon - so gasoline prices are up 20 cents per gallon year-over-year.