by Calculated Risk on 2/28/2017 08:34:00 AM

Tuesday, February 28, 2017

Q4 GDP Unrevised at 1.9% Annual Rate

From the BEA: Gross Domestic Product: Fourth Quarter 2016 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 1.9 percent in the fourth quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.5 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 2.3% to 3.0%. (solid PCE). Residential investment was revised down from 10.2% to +9.6%. This was below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was also 1.9 percent. With the second estimate for the fourth quarter, the general picture of economic growth remains the same; the increase in personal consumption expenditures was larger and increases in state and local government spending and in nonresidential fixed investment were smaller than previously estimated ...

emphasis added

Monday, February 27, 2017

Tuesday: GDP, Case-Shiller House Prices, Chicago PMI

by Calculated Risk on 2/27/2017 09:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher

Mortgage rates moved slightly higher after a strong run to the lowest levels of the year as of last Friday. ... For now, rates are still much closer to 2017's lows. Most borrowers would be quoted the same rate as last Friday, but with slightly higher upfront costs today. The average lender continues to quote 4.125% on top tier scenarios, though there are a few lenders at 4.0% and 4.25%.Tuesday:

emphasis added

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2016 (second estimate). The consensus is that real GDP increased 2.1% annualized in Q4, up from the advance estimate of 1.9%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices. The consensus is for a 5.4% year-over-year increase in the Comp 20 index for December.

• At 9:45 AM, Chicago Purchasing Managers Index for February. The consensus is for a reading of 52.9, up from 50.3 in January.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February. This is the last of the regional Fed surveys for February.

Merrill: "The undocumented economy"

by Calculated Risk on 2/27/2017 04:45:00 PM

A few excerpts from a Merrill Lynch research note: The undocumented economy

Let’s consider three scenarios:

1.Improved border security and more aggressive deportations that lower the number of undocumented workers by 200,000 per year. This could be achieved by increasing annual deportations from about 400,000 to 500,000 and stopping 100,000 more people per year at the border.

2. Cut the number of undocumented workers in half over a four year period through tougher enforcement.

3. Effectively eliminate all undocumented workers over a four year period.

...

In the first scenario the economic impacts are likely to be very small. ... The story is very different under the second and third scenarios. Undocumented immigrants tend to specialize in certain kinds of jobs. Hence cutting the labor force in these areas could hurt the productivity of complementary workers causing indirect loses beyond the direct labor force reduction. ... With full deportation an outright recession seems plausible, as output would be disrupted and as the Fed may be unwilling to act because a labor shortage would mean a surge in wage and price inflation.

...

Undocumented immigrants are a relatively small part of the overall labor force [and] our baseline is relatively benign, but we see significant downside risks to that baseline.

emphasis added

Dallas Fed: "Growth in Texas Manufacturing Activity Continues" in February

by Calculated Risk on 2/27/2017 11:11:00 AM

From the Dallas Fed: Growth in Texas Manufacturing Activity Continues

Texas factory activity increased for the eighth consecutive month in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose five points to 16.7, suggesting output growth picked up pace this month. ...The Richmond Fed manufacturing survey for February will be released tomorrow. Based on the surveys released so far, it appears manufacturing was very strong in February.

...

The general business activity index returned to positive territory in October 2016 and has pushed further positive every month since, reaching 24.5 this month.

...

Labor market measures indicated employment gains and longer workweeks. The employment index posted a second positive reading in a row—something that hasn’t happened since the end of 2015—and edged up from 6.1 to 9.6. ...

emphasis added

NAR: Pending Home Sales Index decreased 2.8% in January, up 0.4% year-over-year

by Calculated Risk on 2/27/2017 10:04:00 AM

From the NAR: Pending Home Sales Weaken in January

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 2.8 percent to 106.4 in January from an upwardly revised 109.5 in December 2016. Although last month's index reading is 0.4 percent above last January, it is the lowest since then.This was well below expectations of a 1.1% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

...

The PHSI in the Northeast rose 2.3 percent to 98.7 in January, and is now 3.6 percent above a year ago. In the Midwest the index fell 5.0 percent to 99.5 in January, and is now 3.8 percent lower than January 2016.

Pending home sales in the South inched higher (0.4 percent) to an index of 122.5 in January and are now 2.0 percent above last January. The index in the West dropped 9.8 percent in January to 94.6, and is now 0.4 percent lower than a year ago.

emphasis added

Black Knight: House Price Index up 0.1% in December, Up 5.7% year-over-year

by Calculated Risk on 2/27/2017 08:01:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: December 2016 Transactions: U.S. Home Prices Up 0.1 Percent for the Month; Up 5.7 Percent Year-Over-Year

• U.S. home prices rose a total of 5.7 percent in 2016, having seen an average of 5.4 percent annual appreciation each month of the year, accelerating into the later monthsThe year-over-year increase in this index has been about the same (5% to 5.7% range) for the last year, although the index picked up a little at the end of 2016.

• December marks 56 consecutive months of annual national home price increases

• Home prices in four of the nation’s 20 largest states and seven of the 40 largest metros hit new peaks

Note that house prices are close to the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for December will be released tomorrow.

Sunday, February 26, 2017

Vehicle Sales Forecast: Sales Over 17 Million SAAR in February

by Calculated Risk on 2/26/2017 07:46:00 PM

The automakers will report February vehicle sales on Wednesday, March 1st.

Note: There were 24 selling days in February 2017, unchanged from 24 in February 2016.

From WardsAuto: Forecast: U.S. February Sales to Reach 16-Year High

A WardsAuto forecast calls for U.S. automakers to deliver 1.34 million light vehicles in February, a 16-year high for the month. A daily sales rate of 55,949 units over 24 days represents a 0.1% improvement from like-2016 (also 24 days).From Kelley Blue Book: February New-Car Sales To Fall 3 Percent Year-Over-Year; Sales Pace For Industry Is Healthy, Sustainable, According To Kelley Blue Book

The report puts the seasonally adjusted annual rate of sales for the month at 17.70 million units, compared with year-ago’s 17.60 million ...

emphasis added

- New-vehicle sales are expected to decrease 3 percent year-over-year to a total of 1.3 million units in February 2017, resulting in an estimated 17.1 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book...And from J.D. Power: Despite Record Incentives, Auto Sales Expected to Show Only Modest Gain

Total vehicle sales in February are expected to be similar to a year ago while incentives remain at record levels, according to a forecast developed jointly by J.D. Power and LMC Automotive [17.7 million SAAR].Looks like another strong month for vehicle sales, but incentives are at record levels and inventories are high.

Hotels: Hotel Occupancy Softens in February

by Calculated Risk on 2/26/2017 11:42:00 AM

After a solid start for 2017 - during the slow season - hotel occupancy has been weak over the last few weeks.

From HotelNewsNow.com: STR: US hotel results for week ending 18 February

The U.S. hotel industry reported mixed results in the three key performance metrics during the week of 12-18 February 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In a year-over-year comparison with the week of 14-20 February 2016:

• Occupancy: -3.2% to 62.2%

• Average daily rate (ADR): +3.1% to US$124.41

• Revenue per available room (RevPAR): -0.2% to US$77.36

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, this is the slow season of the year, and occupancy will pick up into the Spring.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, February 25, 2017

Schedule for Week of Feb 26, 2017

by Calculated Risk on 2/25/2017 09:31:00 AM

The key economic report this week is the second estimate of Q4 GDP.

Other key indicators include the February ISM manufacturing and non-manufacturing indexes, February auto sales, and the Case-Shiller house price index.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.8% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 1.1% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

8:30 AM: Gross Domestic Product, 4th quarter 2016 (second estimate). The consensus is that real GDP increased 2.1% annualized in Q4, up from advance estimate of 1.9%..

9:00 AM ET: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the November 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.4% year-over-year increase in the Comp 20 index for December.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 52.9, up from 54.6 in December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. This is the last of the regional Fed surveys for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 17.7 million SAAR in February, from 17.5 million in January (Seasonally Adjusted Annual Rate).

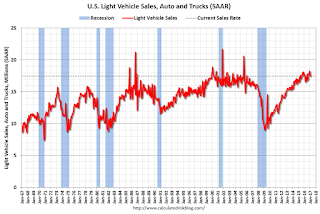

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 17.7 million SAAR in February, from 17.5 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 56.1, up from 54.7 in December.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 56.1, up from 54.7 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 56.0% in January. The employment index was at 56.1%, and the new orders index was at 60.4%.

10:00 AM: Construction Spending for January. The consensus is for a 0.2% increase in construction spending.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand the previous week.

10:00 AM: the ISM non-Manufacturing Index for February. The consensus is for index to increase to 57.2 from 57.1 in December.

2:00 PM: Speech by Fed Chair Janet Yellen, Economic Outlook, At the Executives Club of Chicago, Chicago, Ill.

Friday, February 24, 2017

February 2017: Unofficial Problem Bank list declines to 155 Institutions

by Calculated Risk on 2/24/2017 09:49:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 2017.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for February 2017. During the month, the list dropped from 163 to 155 institutions after nine removals and one addition. Aggregate assets fell by $1.25 billion to $41.8 billion. A year ago, the list held 229 institutions with assets of $66.0 billion.

Actions were terminated against Bank of Bartlett, Bartlett, TN ($359 million); Farmers & Merchants Bank, Eatonton, GA ($170 million); Solera National Bank, Lakewood, CO ($149 million Ticker: SLRK); Liberty Bell Bank, Marlton, NJ ($145 million Ticker: LBBB); Gulf Coast Community Bank, Pensacola, FL ($135 million); Colonial Co-operative Bank, Gardner, MA ($73 million); and American Patriot Bank, Greeneville, TN ($58 million).

Several banks merged to find their way off the problem bank list including Polonia Bank, Huntingdon Valley, PA ($276 million Ticker: PBCP) and MBank, Gresham, OR ($158 million Ticker: MBNC).

The addition this month was Ashton State Bank, Ashton, NE ($23 million).

We anticipate for the FDIC on Tuesday to release industry results for the fourth quarter and updated figures for the official problem bank list.