by Calculated Risk on 12/05/2016 04:11:00 PM

Monday, December 05, 2016

A few comments on the Seasonal Pattern for House Prices

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

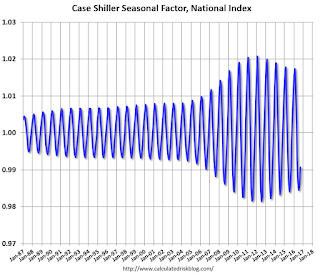

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

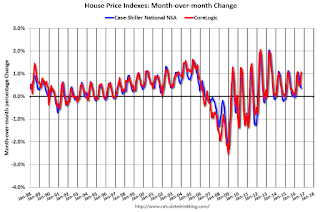

This graph shows the month-to-month change in the CoreLogic (through September 2016) and NSA Case-Shiller National index since 1987 (through September 2016). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

2017 Housing Forecasts

by Calculated Risk on 12/05/2016 12:59:00 PM

Towards the end of each year I collect some housing forecasts for the following year. It looks like analysts are optimistic on New Home sales for 2017.

First a review of the previous four years ...

Here is a summary of forecasts for 2016. In 2016, new home sales will probably be around 565 thousand, and total housing starts will be around 1.175 million. Fannie Mae and Merrill Lynch were very close on New Home sales, and MetroStudy was close on starts.

Here is a summary of forecasts for 2015. In 2015, new home sales were 501 thousand, and total housing starts were 1.112 million. Zillow, CoreLogic, and the MBA were right on with New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all correct on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2017:

From Fannie Mae: Housing Forecast: November 2016

From Freddie Mac: Interest Rates Headed Higher. What that Means for Housing

From NAHB: NAHB’s housing and economic forecast

From Wells Fargo: Monthly Economic Outlook

From NAR: U.S. Economic Outlook: November 2016

Note: For comparison, new home sales in 2016 will probably be around 565 thousand, and total housing starts around 1.175 million.

| Housing Forecasts for 2017 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Bloomberg | 1,250 | |||

| Blue Chip | 1,260 | |||

| CoreLogic | 4.7% | |||

| Fannie Mae | 671 | 883 | 1,308 | 4.8%2 |

| Freddie Mac | 1,260 | 4.7%2 | ||

| Goldman Sachs | 648 | 893 | 1,333 | 3.7% |

| HomeAdvisor5 | 614 | 893 | 1,236 | 3.5% |

| Merrill Lynch | 625 | 825 | 1,225 | 3.2% |

| MBA | 860 | 1,268 | ||

| NAHB | 647 | 873 | 1,258 | |

| NAR | 623 | 838 | 1,221 | 4.2%3 |

| Wells Fargo | 600 | 830 | 1,170 | 4.4% |

| Zillow | 3.6%4 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices 4Zillow Home Prices 5Brad Hunter, chief economist, formerly of MetroStudy |

||||

ISM Non-Manufacturing Index increased to 57.2% in November

by Calculated Risk on 12/05/2016 10:06:00 AM

The November ISM Non-manufacturing index was at 57.2%, up from 54.8% in October. The employment index increased in November to 58.1%, from 53.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:November 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 82nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 57.2 percent in November, 2.4 percentage points higher than the October reading of 54.8 percent. This represents continued growth in the non-manufacturing sector at a faster rate. This is the 12-month high, and the highest reading since the 58.3 registered in October of 2015. The Non-Manufacturing Business Activity Index increased to 61.7 percent, 4 percentage points higher than the October reading of 57.7 percent, reflecting growth for the 88th consecutive month, at a faster rate in November. The New Orders Index registered 57 percent, 0.7 percentage point lower than the reading of 57.7 percent in October. The Employment Index increased 5.1 percentage points in November to 58.2 percent from the October reading of 53.1 percent. The Prices Index decreased 0.3 percentage point from the October reading of 56.6 percent to 56.3 percent, indicating prices increased in November for the eighth consecutive month at a slightly slower rate. According to the NMI®, 14 non-manufacturing industries reported growth in November. The Non-Manufacturing sector rebounded after a slight cooling-off in October. The majority of respondents' comments are positive about business conditions and the direction of the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.5, and suggests faster expansion in November than in October. A strong report.

Black Knight October Mortgage Monitor

by Calculated Risk on 12/05/2016 07:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for October today. According to BKFS, 4.35% of mortgages were delinquent in October, down from 4.77% in October 2015. BKFS also reported that 0.99% of mortgages were in the foreclosure process, down from 1.43% a year ago.

This gives a total of 5.34% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Post-Election Rate Jumps Eliminate 4.3 Million from Refinanceable Population, Push Home Affordability to Post-Recession Low

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of October 2016. In the immediate aftermath of the U.S. presidential election, 30-year mortgage rates have spiked by 49 basis points (BPS) in just a few short weeks. This month, Black Knight examines the impact of these jumps on the population of borrowers who could both likely qualify for and have incentive to refinance as well as the wider matter of home affordability. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the effects have been dramatic, but must still be seen in the proper historical context.

“The results of the U.S. presidential election triggered a treasury bond selloff, resulting in a corresponding rise in both 10-year Treasury and 30-year mortgage interest rates,” said Graboske. “As mortgage rates jumped 49 BPS in the weeks following the election, we saw the population of refinanceable borrowers cut by more than half. From the 8.3 million borrowers who could both likely qualify for and had interest rate incentive to refinance immediately prior to the election, we’re now looking at a population of just 4 million total, matching a 24-month low set back in July 2015. While there are still two million borrowers who could save $200 or more per month by refinancing and a cumulative $1 billion per month in potential savings, this is less than half of the $2.1 billion per month that was available just four short weeks ago. These changes will likely have an impact on refinance origination volumes moving forward. And, since higher interest rates tend to reduce the refinance share of the market – specifically in higher credit segments – which typically outperform their purchase mortgage counterparts, they may potentially impact overall mortgage performance as well.

emphasis added

Click on graph for larger image.

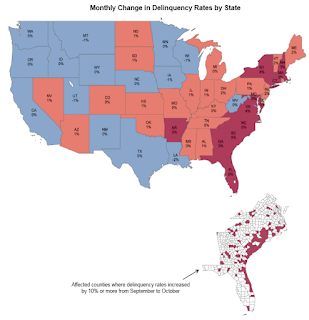

Click on graph for larger image.This map from Black Knight shows the monthly change in delinquency rate - and the impact of Hurricane Matthew on mortgage delinquencies.

From Black Knight:

• While most of the country saw minimal increases or even declines in delinquencies, those areas of the country impacted by Hurricane Matthew saw significant increases in delinquency rates in October

• South Carolina’s delinquency rate jumped nine percent, (from 5.1 to 5.6 percent) while Florida’s climbed six percent (from 4.5 to 4.8 percent)

• The hardest hit areas were along the coast, and correspondingly higher increases in delinquencies were observed in these areas as well

• In some of the hardest hit areas of South Carolina, delinquency rates rose by more than 20 percent from September to October

• Since the worst of the storm hit the southeast on October 7th and 8th, after the majority of borrowers would have made their mortgage payments, we could yet see further impact in November’s mortgage performance data

This graph from Black Knight shows the number of 90 day defaults. This is back to normal.

This graph from Black Knight shows the number of 90 day defaults. This is back to normal.From Black Knight:

• The inflow of new troubled loans has now returned to pre-recession levels; on average, over the past six months default volumes have been four percent below historic (2000-2006) normsThat last sentence is amazing.

• However, the share of mortgages becoming 90-days delinquent each month has actually averaged 13 percent below historic norms over the same period, due to the larger number of active mortgages today than in the early 2000s

• Despite making up only 25 percent of all active mortgages, pre-recession vintages (2007 and prior) still account for 60 percent of all new defaults, even though these mortgages now have nine or more years of seasoning

There is much more in the mortgage monitor.

Sunday, December 04, 2016

Sunday Night Futures

by Calculated Risk on 12/04/2016 07:17:00 PM

Weekend:

• Schedule for Week of Dec 4, 2016

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• Also at 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for the index to increase to 55.5 from 54.8 in October.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 8, and DOW futures are down 40 (fair value).

Oil prices were up sharply over the last week with WTI futures at $51.68 per barrel and Brent at $54.46 per barrel. A year ago, WTI was at $40, and Brent was at $41 - so oil prices are up 25% to 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon - a year ago prices were at $2.04 per gallon - so gasoline prices are up more than 10 cents per gallon year-over-year.

This graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY. Oil prices are volatile!

WTI oil prices are currently up 27% year-over-year.

Poor Gretchen on Fannie and Freddie

by Calculated Risk on 12/04/2016 12:40:00 PM

My former co-blogger Tanta wrote several posts pointing out questionable reporting in articles by "poor Gretchen" Morgenson of the NY Times. Tanta would have a field day with GM's article today: Trump Treasury May Mean Independence for Fannie and Freddie

With an apology to Tanta (who knew far more about the mortgage market than I ever will, and was a far better writer than me), here are a few comments on the article today.

Gretchen starts by quoting Steven Mnuchin, the nominee to run the Treasury Department for the next administration:

“We got to get Fannie and Freddie out of government ownership,” he told Fox Business. “It makes no sense that these are owned by the government and have been controlled by the government for as long as they have.”We got to get Steve in an English class, but lets focus on the substance.

Mr. Mnuchin is right.

Is Mnuchin right? "It makes no sense that these are owned by the government" is a declarative statement without any backing. Perhaps Gretchen and Steve could study a little history. Fannie Mae was started in 1938 as a government agency to provide liquidity in the mortgage market. Over time Fannie was changed into a public-private organization, and finally into a private, for-profit, corporation with an implied government backing.

This privatization has been described as "privatizing profits, and socializing losses". If something made no sense, it was a structure that gave the profits to private investors, with the risks borne by the taxpayers. It should be obvious to all that the original privatization was a mistake.

Instead of putting Fannie and Freddie into bankruptcy during the crisis - and wiping out the shareholders while putting a stranglehold on the housing market at exactly the wrong time - the government put Fannie and Freddie into conservatorship. This kept the housing market on life support. The taxpayers took all of the risk, and therefore the taxpayers deserve all of the profits. That should be the end of that story.

Note: For the funny naming history of Fannie and Freddie, see Tanta's: On Maes and Macs

Back to Gretchen:

So what might happen now? In his comments, Mr. Mnuchin nodded to a crucial issue regarding Fannie and Freddie: safety and soundness. “We’ll make sure that when they’re restructured, they’re absolutely safe and they don’t get taken over again,” he said, “But we got to get them out of government control.”Out of "government control"? Does me mean no government backing if they collapse again? Then what entity would provide liquidity during the next crunch? Or is Steve suggesting going back to privatizing profits (enriching the investors), and socializing the risks (all of of us taxpayers)?

What makes sense is for most of the mortgage market - most of the time - to be in the private sector, and for the government to provide liquidity during a credit crunch. We need government organizations operating all the time (hopefully as a small portion of the overall market), so that they can ramp up quickly during a crunch. But that doesn't appear to be what Steve is considering.

Saturday, December 03, 2016

Schedule for Week of Dec 4, 2016

by Calculated Risk on 12/03/2016 08:11:00 AM

This will be a light week for economic data.

The key reports are the ISM non-manufacturing index, Job Openings, and the October trade deficit.

The Q3 Quarterly Services and the Fed's Q3 Flow of Funds reports will be released this week.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for index to increase to 55.5 from 54.8 in October.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through September. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $42.0 billion in October from $36.4 billion in September.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is a 2.7% increase in orders.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in September to 5.486 million from 5.453 million in August.

The number of job openings (yellow) were up 2% year-over-year, and Quits were up 12% year-over-year.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $19.0 billion increase in credit.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 268 thousand the previous week.

10:00 AM: The Q3 Quarterly Services Report from the Census Bureau.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 94.1, up from 93.8 in November.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% decrease in inventories.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

Friday, December 02, 2016

Brad Hunter: The 2017 Housing Market Forecast

by Calculated Risk on 12/02/2016 06:46:00 PM

From Brad Hunter (formerly of MetroStudy) at HomeAdvisor: The 2017 Housing Market Forecast

The 2017 housing outlook is one of diverging trends. HomeAdvisor’s forecast calls for single-family housing to rise at a rate similar to the 2016 rate, but for multifamily construction (apartments and condos) to fall, as the recent apartment boom finally winds down. The single-family home increase is because of job growth and rising household formations, while the multifamily story has more to do with cyclicality. Single-family starts rising 12.2% in 2017, to just shy of 900,000, while multifamily construction falls by 10.7% to 343,000.CR Note: Hunter describes three scenarios for 2017: Base case, Overshoot and Slow Climb. I also think the multifamily has peaked.

I'll be posting several 2017 forecasts on Monday.

Zillow Forecast: Expect Case-Shiller Index to "continue to accelerate" in October

by Calculated Risk on 12/02/2016 03:55:00 PM

The Case-Shiller house price indexes for September were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: October Case-Shiller Forecast: Continuing to put the Recession in the Rearview

According to Zillow’s October Case-Shiller forecast, annual growth in the national index is expected to continue to accelerate, along with upticks in monthly growth in both smaller 10-city and 20-city indices. Sustained growth in the national index will continue to put pre-recession housing peaks in the rearview mirror, as September marked the first month in which national home prices exceeded those set prior to the recession.The year-over-year change for the 10-city and 20-city indexes will probably be about the same or slightly lower in the October report as in the September report. The change for the National index will probably be slightly higher.

The September Case-Shiller national index is expected to grow 5.7 percent year-over-year and 0.8 percent month-to-month (seasonally adjusted), even with the pace of monthly growth and up from 5.5 percent annual growth pace set in September. We expect the 10-city index to grow 4.2 percent year-over-year and 0.4 percent (SA) from September. The 20-City Index is expected to grow 5 percent between October 2015 and October 2016, and rise 0.5 percent (SA) from Septmber.

Zillow’s October Case-Shiller forecast is shown in the table below. These forecasts are based on today’s September Case-Shiller data release and the October 2016 Zillow Home Value Index. The October S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, December 27.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 12/02/2016 01:00:00 PM

By request, here is another update of an earlier post through the November 2016 employment report including all revisions. And, yes, I will post these graphs during the next Presidential term.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton.

The third best growth for the private sector is Obama's 2nd term.

Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,082 |

| GW Bush 1 | -811 |

| GW Bush 2 | 415 |

| Obama 1 | 1,921 |

| Obama 2 | 9,4881 |

| 146 months into 2nd term: 9,901 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term, and President Obama is in the final months of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,921,000 more private sector jobs at the end of Mr. Obama's first term. Forty six months into Mr. Obama's second term, there are now 11,409,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 334,000 jobs). This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -708 |

| Obama 2 | 3741 |

| 146 months into 2nd term, 390 pace | |

Looking forward, I expect the economy to continue to expand through the two months of Mr. Obama's presidency, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are over. Right now I'm expecting some further increase in public employment during the last months of Obama's 2nd term, but obviously nothing like what happened during Reagan's second term.

Below is a table of the top four presidential terms for total non-farm job creation.

Currently Obama's 2nd term is on pace to be the 3rd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fifth best for total job creation.

Note: Only 374 thousand public sector jobs have been added during the forty six months of Obama's 2nd term (following a record loss of 708 thousand public sector jobs during Obama's 1st term). This is about 25% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,082 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| 4 | Carter | 9,041 | 1,304 | 10,345 |

| 5 | Obama 21 | 9,488 | 374 | 9,862 |

| Pace2 | 9,901 | 390 | 10,291 | |

| 146 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top four presidential terms. Right now it looks like Obama's 2nd term will be the 3rd best for private employment (behind Clinton's two terms, and ahead of Reagan) and probably 5th for total employment.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 698 | 857 | ||

| #2 | 297 | 731 | ||

| #3 | -66 | 467 | ||

| #4 | -224 | 242 | ||