by Calculated Risk on 9/29/2016 08:34:00 AM

Thursday, September 29, 2016

Q2 GDP Revised Up to 1.4% Annual Rate

From the BEA: Gross Domestic Product: Second Quarter 2016 (Third Estimate)

Real gross domestic product increased at an annual rate of 1.4 percent in the second quarter of 2016 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 4.4% to 4.3%. (Solid PCE). Non-Residential investment was revised up from -0.9% to +1.0%. This was close to the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.1 percent. With the third estimate for the second quarter, the general picture of economic growth remains the same. The most notable change from the second to third estimate is that nonresidential fixed investment increased in the second quarter; in the previous estimate, nonresidential fixed investment decreased ...

emphasis added

Wednesday, September 28, 2016

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 9/28/2016 08:06:00 PM

The GDP release will be for Q2. Here are two looks at Q3 ...

Atlanta Fed GDP Now:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2016 is 2.8 percent on September 28, down from 2.9 percent on September 20.New York Fed Nowcasting:

The FRBNY Staff Nowcast stands at 2.3% and 1.2% for 2016:Q3 and 2016:Q4, respectively.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, up from 252 thousand the previous week.

• Also at 8:30 AM, Gross Domestic Product, 2nd quarter 2016 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q2, up from 1.1% in the second estimate.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

• At 5:10 PM, Speech by Fed Chair Janet Yellen, Conversation with conference participants, At the Banking and the Economy: A Forum for Minority Bankers, Federal Reserve Bank of Kansas City, Kansas City, Missouri

Freddie Mac: Mortgage Serious Delinquency rate declined in August, Lowest since July 2008

by Calculated Risk on 9/28/2016 04:40:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 1.03%, down from 1.08% in July. Freddie's rate is down from 1.45% in August 2015.

This is the lowest rate since July 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.42 percentage points over the last year, and at that rate of improvement, the serious delinquency rate could be below 1% in next month (September).

Note: Fannie Mae will report in the next few days.

OPEC Agrees to Cut Oil Output

by Calculated Risk on 9/28/2016 03:34:00 PM

From Bloomberg: OPEC Agrees to First Oil Output Cut in Eight Years

In two days of round-the-clock talks in Algiers, the group agreed to drop production to 32.5 million barrels a day, the delegate said, asking not to be named because the decision isn’t yet public. That’s nearly 750,000 barrels a day less than it pumped in August.

...

As OPEC agreed to limit its output, Russia smashed a post-Soviet oil-supply record, pumping 11.1 million barrels a day in September, up 400,000 from August, according to preliminary estimates. Russia participated in the Algiers talks, but it’s not party to the OPEC deal.

Click on graph for larger image

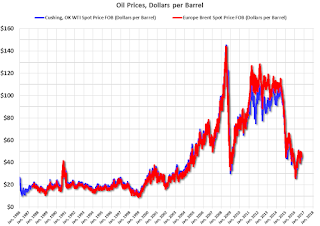

Click on graph for larger imageThis graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Brent and WTI oil prices are now up about 5% year-over-year.

The second graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

The second graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $46.83 per barrel today, and Brent is at $48.41.

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Who knows if this agreement will hold, but it seems likely that oil prices - and eventually gasoline prices - will be up year-over-year at the end of 2016 and no longer a drag on CPI.

Update on "Peak Renter"

by Calculated Risk on 9/28/2016 12:52:00 PM

From economist Josh Lehner at Oregon Office of Economic Analysis Peak Renter In Real Life

A year ago our office asked “Is 2015 Peak Renter?” We laid out a straightforward case examining the three main underlying drivers for the shift into rentership over the past decade: household finances, demographics, and preferences and tastes. We know the pendulum has swung all the way toward rentership. The question is not whether or not it will swing back toward ownership, it will. The question is when will this happen. Our office’s position was that it would happen probably sooner than the conventional wisdom suggested. The reason was household finances and demographics are now working in favor of ownership.CR Note: there is much more in the post. When Lehner sent me his post last year, I added some comments here - including the following graph.

...

Well, the 2015 ACS data was just released and we got an update on the question of ownership vs rentership. As Jed Kolko notes in his great summary of the ACS data, rentership ticked up 0.1 percentage points nationwide last year. So not yet peak renter across the entire U.S. and the HVC data differ from the ACS data as well. That said, the U.S. changes were minimal, suggesting the shift into rentership has slowed considerably; possibly an indication that peak renter is near.

Locally, however, peak renter is already here. Statewide the homeownership rate ticked up from 60.7% in 2014 to 61.1% in 2015. In the Portland metro region the increase was even bigger at 1.6 percentage points.

Click on graph for larger image.

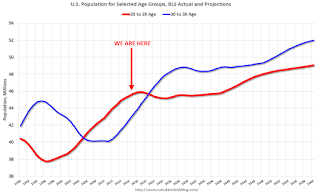

Click on graph for larger image.This graph shows the long term trend for two key age groups: 20 to 29, and 30 to 39.

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s).

Note: I used a similar graph six years ago to argue there would be a surge in rentals from both demographics, and also from people losing their homes to foreclosure.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

ATA Trucking Index increased Sharply in August

by Calculated Risk on 9/28/2016 09:46:00 AM

This was released last week by the ATA: ATA Truck Tonnage Index Jumped 5.7% in August

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 5.7% in August, following a 2.1% decline during July. In August, the index equaled 141.8 (2000=100), up from 134.2 in July. The all-time high was 144 in February.

Compared with August 2015, the SA index rose 5.9%, the largest year-over-year gain since May also 5.9%. In July, the year-over-year increase was 0.2%. Year-to-date, compared with the same period in 2015, tonnage was up 3.5%.

...

“Volatility continues to reign in 2016. This month’s tonnage reading highlights this fact and underscores the difficulty in determining any real or clear trend in truck tonnage,” said ATA Chief Economist Bob Costello. “What is clear to me is that normal seasonal patterns are not holding in 2016.”

...

“Despite a difficult to read August, I expect the truck freight environment to be softer than normal as well as continued choppiness until the inventory correction is complete. With moderate economic growth forecasted, truck freight will improve as progress is made with the inventory overhang,” he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 5.9% year-over-year.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 9/28/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 23, 2016.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index remained unchanged from the previous week and was 10 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.66 percent from 3.70 percent, with points decreasing to 0.33 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "10 percent higher than the same week one year ago".

Tuesday, September 27, 2016

Lawler: Renter Share of Single-Family Market Declined Slightly in 2015

by Calculated Risk on 9/27/2016 05:12:00 PM

From housing economist Tom Lawler:

Data from the 2015 American Community Survey suggest thatFor the first time since 2006, the number of single-family housing units occupied by renters declined slightly last year. The share of occupied single-family (detached and attached) housing units occupied by renters, which went up from 14.8% in 2006 to 18.9% in 2014, declined very slightly to 18.8% in 2015.

| Occupied Single Family Detached and Attached Homes, American Community Survey | |||

|---|---|---|---|

| 2015 | 2014 | Change | |

| Total | 80,881,173 | 80,426,594 | 454,579 |

| Owner | 65,703,475 | 65,231,767 | 471,708 |

| 15-34 year olds | 6,165,488 | 6,153,328 | 12,160 |

| 35-64 year olds | 39,953,123 | 40,044,935 | -91,812 |

| 65+ year olds | 19,584,864 | 19,033,504 | 551,360 |

| Renter | 15,177,698 | 15,194,827 | -17,129 |

| 15-34 year olds | 4,676,567 | 4,735,281 | -58,714 |

| 35-64 year olds | 8,800,400 | 8,819,476 | -19,076 |

| 65+ year olds | 1,700,731 | 1,640,070 | 60,661 |

| Renter Share | 18.8% | 18.9% | -0.1% |

Click on graph for larger image.

Click on graph for larger image.ACS estimates suggest that the number of owner-occupied single-family homes declined by about 260,000 from 2006 to 2014, while the number of renter-occupied single-family homes increased by almost 3.9 million.

On the owner-occupied single-family front, from 2010 to 2015 the share of owned homes occupied by households 65 years or older rose from 25.5% to 29.8%.

Some analysts believe that the combination of a high renter-share and a high “old-folks” share of the single-family market is at least partly responsible for the relatively low level of single-family homes for sale.

CR Note: My view is these are two of the key reasons existing home inventory is low: 1) As Lawler notes, a large number of single family home and condos were converted to rental units. Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. and 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers).

Chemical Activity Barometer indicated "Solid Growth in September"

by Calculated Risk on 9/27/2016 03:25:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Continues Solid Growth in September

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), expanded 0.4 percent in September following a 0.4 percent gain in August and a 0.7 percent gain in July and June. Accounting for adjustments, the CAB is up 3.7 percent over this time last year, an improvement over prior months. All data is measured on a three-month moving average (3MMA). On an unadjusted basis the CAB climbed 0.2 percent in September, following a 0.4 percent gain in August.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production over the next year.

Real Prices and Price-to-Rent Ratio in July

by Calculated Risk on 9/27/2016 12:21:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.1% year-over-year in July

The year-over-year increase in prices is mostly moving sideways now around 5%. In July, the index was up 5.1% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 2.2% below the bubble peak (seasonally adjusted). However, in real terms, the National index is still about 16.6% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to December 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to July 2005.

Real House Prices

CPI less Shelter has declined over the last two years pushing up real house prices.

In real terms, the National index is back to January 2004 levels, the Composite 20 index is back to October 2003, and the CoreLogic index back to November 2003.

In real terms, house prices are back to late 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to July 2003 levels, the Composite 20 index is back to April 2003 levels, and the CoreLogic index is back to June 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.