by Calculated Risk on 3/04/2013 09:53:00 AM

Monday, March 04, 2013

Update: Seasonal Pattern for House Prices

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced in recent years.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

However, house prices - not seasonally adjusted (NSA) - have been pretty strong over the last few months - at the start of the normally weak months.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (both Case-Shiller and CoreLogic through December). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

The CoreLogic index was positive in both the November and December reports (CoreLogic is a 3 month weighted average, with the most recent month weighted the most).

Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November and turned positive in the December report. This shows that the "off-season" for prices has been pretty strong this year.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

Note: I was one of several people to question this change in the seasonal factor - and this led to S&P Case-Shiller reporting the NSA numbers.

It appears the seasonal factor has stopped increasing, and I expect that over the next several years - as the percent of distressed sales decline - the seasonal factors will slowly move back towards the previous levels.

Fed's Yellen: Challenges Confronting Monetary Policy

by Calculated Risk on 3/04/2013 08:53:00 AM

From Fed Vice Chair Janet Yellen: Challenges Confronting Monetary Policy. A few excerpts on asset purchases and what a "Substantial Improvement in the Outlook for the Labor Market" means:

The first imperative will be to judge what constitutes a substantial improvement in the outlook for the labor market. Federal Reserve research concludes that the unemployment rate is probably the best single indicator of current labor market conditions. In addition, it is a good predictor of future labor market developments. Since 1978, periods during which the unemployment rate declined 1/2 percentage point or more over two quarters were followed by further declines over the subsequent two quarters about 75 percent of the time.CR Notes: Defining a "substantial improvement" is helpful in trying to determine when the Fed when end the asset purchase program. Obviously the program will continue for some time ...

That said, the unemployment rate also has its limitations. As I noted before, the unemployment rate may decline for reasons other than improved labor demand, such as when workers become discouraged and drop out of the labor force. In addition, while movements in the rate tend to be fairly persistent, recent history provides several cases in which the unemployment rate fell substantially and then stabilized at still-elevated levels. For example, between the fourth quarter of 2010 and the first quarter of 2011, the unemployment rate fell 1/2 percentage point but was then little changed over the next two quarters. Similarly, the unemployment rate fell 3/4 percentage point between the third quarter of 2011 and the first quarter of 2012, only to level off over the subsequent spring and summer.

To judge whether there has been a substantial improvement in the outlook for the labor market, I therefore expect to consider additional labor market indicators along with the overall outlook for economic growth. For example, the pace of payroll employment growth is highly correlated with a diverse set of labor market indicators, and a decline in unemployment is more likely to signal genuine improvement in the labor market when it is combined with a healthy pace of job gains.

The payroll employment data, however, also have shortcomings. In particular, they are subject to substantial revision. When the Labor Department released its annual benchmarking of the establishment survey data last month, it revised up its estimate of employment in December 2012 by 647,000.

In addition, I am likely to supplement the data on employment and unemployment with measures of gross job flows, such as job loss and hiring, which describe the underlying dynamics of the labor market. For instance, layoffs and discharges as a share of total employment have already returned to their pre-recession level, while the hiring rate remains depressed. Therefore, going forward, I would look for an increase in the rate of hiring. Similarly, a pickup in the quit rate, which also remains at a low level, would signal that workers perceive that their chances to be rehired are good--in other words, that labor demand has strengthened.

I also intend to consider my forecast of the overall pace of spending and growth in the economy. A decline in unemployment, when it is not accompanied by sufficiently strong growth, may not indicate a substantial improvement in the labor market outlook. Similarly, a convincing pickup in growth that is expected to be sustained could prompt a determination that the outlook for the labor market had substantially improved even absent any substantial decline at that point in the unemployment rate.

emphasis added

Sunday, March 03, 2013

Sunday Night Futures

by Calculated Risk on 3/03/2013 09:29:00 PM

I thought US Fiscal Policy was the biggest question mark for 2013, and that fiscal policy posed the biggest downside risk to the US economy (I still think fiscal policy is the biggest risk).

First there was the "fiscal cliff", and then the threat of default and not paying the bills (aka "debt ceiling"), then "sequestration", followed by the March 27th threat to shut down the government (really just a small portion of the government, but will be very disruptive). As I've noted several times, the deficit is declining fairly quickly, and the key risk is too much deficit reduction too quickly (this can't be repeated enough).

Hopefully something will be worked out to reverse the "sequestration" cuts, and maybe the government shutdown will be avoided ...

From the WaPo: Deal to avert government shutdown likely, officials say

Congress returns to work this week with no plan to reverse across-the-board spending cuts that took effect Friday, but with hope on both sides of the aisle of averting an end-of-the-month showdown that could result in a government shutdown.Weekend:

...

It would provide funding through the end of the fiscal year on Sept. 30 ...

• Summary for Week Ending March 1st

• Schedule for Week of March 3rd

The Asian markets are mixed tonight with the Nikkei up 0.8%, and Shanghai Composite down 1.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 5 and DOW futures are down 40 (fair value).

Oil prices have moved down a little recently with WTI futures at $90.61 per barrel and Brent at $110.55 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down a few cents over the last week after increasing more than 50 cents per gallon from the low last December.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Q4 2012 GDP Details: Commercial Real Estate investment very low, Single Family investment increases

by Calculated Risk on 3/03/2013 04:30:00 PM

Here is some investment data from the BEA (Note: The BEA released the underlying details for the Q4 second GDP report on Friday). The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased slightly, but from a very low level.

Investment in offices is down about 55% from the recent peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years - even though there has been some increase in the Architecture Billings Index lately.

Click on graph for larger image.

Click on graph for larger image.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 63% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 73%. With the hotel occupancy rate close to normal, it is possible that hotel investment will increase this year.

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures is now increasing after mostly moving sideways for almost three years (the increase in 2009-2010 was related to the housing tax credit).

Investment in home improvement was at a $159 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (about 1.0% of GDP), still above the level of investment in single family structures of $143 billion (SAAR) (or 0.9% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment later this year.

Brokers' commissions increased slightly in Q4 as a percent of GDP. And investment in multifamily structures increased in Q4. This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

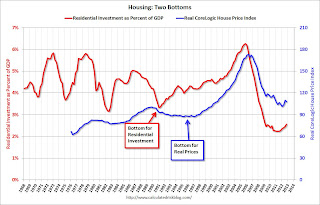

Housing: The Two Bottoms

by Calculated Risk on 3/03/2013 10:34:00 AM

Last year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it is, and here is another update to that graph.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through December.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through December.

Although the CoreLogic data only goes back to 1976, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 (real prices were mostly flat for several year). Something similar happened in the early 1980s - first activity bottomed, and then real prices - although the two bottoms were closer in the '80s.

Now it appears activity bottomed in 2009 through 2011 (depending on the measure) and house prices bottomed in early 2012.