by Calculated Risk on 7/12/2011 08:30:00 AM

Tuesday, July 12, 2011

Trade Deficit increased sharply in May to $50.2 billion

The Department of Commerce reports:

[T]otal May exports of $174.9 billion and imports of $225.1 billion resulted in a goods and services deficit of $50.2 billion, up from $43.6 billion in April, revised. May exports were $1.0 billion less than April exports of $175.8 billion. May imports were $5.6 billion more than April imports of $219.4 billion.The first graph shows the monthly U.S. exports and imports in dollars through May 2011.

Click on graph for larger image.

Click on graph for larger image.Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in May as both prices and the quantity of oil imported increased. Oil averaged $108.70 per barrel in May, up from $103.18 per barrel in April, and up from $76.95 in May 2010. There is a bit of a lag with prices, and import prices will probably be a little lower in June.

The trade deficit with China increased to $24.96 billion, so once again the deficit is mostly oil and China.

NFIB: Small Business Optimism Index "basically unchanged" in June

by Calculated Risk on 7/12/2011 07:30:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Stagnates

NFIB’s monthly Small-Business Optimism Index dropped one tenth of a point (0.1) in June, settling at 90.8, an unsurprising reading, basically unchanged from the previous month and solidly in recession territory. While some indicators rose slightly – including expected capital outlays – pessimism about future business conditions and expected real sales gains tugged the Index down, causing a small but disappointing drop in the Index for the fourth consecutive month.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase from May and an indication that the unemployment rate will ease back below 9 percent in the late summer or early fall.

...

Inflation has slowed slightly, due in part to a leveling of gas prices.

...

The sales outlook for small firms continues to look grim as expectations have declined for 4 months in a row and “poor sales” continues to be the #1 problem for owners in operating their business.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 90.8 in June from 90.9 in May.

This index is still very low - and had been trending up - but optimism has declined for four consecutive months now.

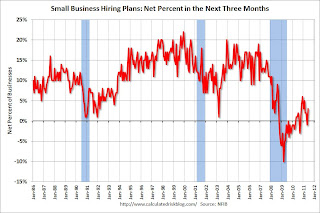

The second graph shows the net hiring plans for the next three months.

Hiring plans increased in June and this is the highest level since February.

Hiring plans increased in June and this is the highest level since February.According to NFIB: “Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase and an indication that the unemployment rate will ease back below 9 percent in the coming months. "

Weak sales is still the top business problem with 24 percent of the owners reporting that weak sales continued to be their top business problem in June.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.There was some good news this month in the survey - employment plans are increasing, expected capital outlays are also increasing, and "poor sales" as the biggest problem is decreasing. However the recovery continues to be sluggish for this index, probably somewhat due to the high concentration of real estate related companies.

Monday, July 11, 2011

Misc: New Policy Ideas for housing being discussed, Realtor group overstates house prices

by Calculated Risk on 7/11/2011 10:58:00 PM

• From Nick Timiraos at the WSJ: U.S. Tackles Housing Slump

The Obama administration is ramping up talks on how to revive the housing market ... Policy ideas include having taxpayer-owned mortgage giants Fannie Mae and Freddie Mac relax their rules for loans to investors, allowing those buyers to vacuum up excess housing inventory. In certain markets, Fannie and Freddie could hold some foreclosed homes off the market and rent them out ... Officials also could sweeten incentives for banks to reduce loan balances for borrowers who are underwater ...I'll have some thoughts on this later this week, but some of these proposals (like converting some owners to renters) make sense.

• From Mary Ellen Podmolik at the Chicago Tribune: Realty trade group overreported Chicago home prices (ht Eric, Austin, Peter)

The Illinois Association of Realtors dramatically overreported the median price of condominiums sold within the city of Chicago in May, with the price tumbling 23 percent year-over-year, not rising 10.3 percent as the trade group said.A key sentence was at the bottom of the story:

The state Realtors' group acknowledged the error after the Tribune, acting on a tip, questioned the accuracy of the data.

In February, questions arose about the accuracy of home sales data as reported monthly by the National Association of Realtors, and whether the trade group had been overestimating the volume of existing home sales since 2007.So we might get the revisions in August (Note: I broke this story about the revisions in January, not February).

Possibly as soon as August, the national group will issue revised- and revised downward - national home sales numbers going back at least three years.

Statement by the Eurogroup

by Calculated Risk on 7/11/2011 07:46:00 PM

I know everyone was waiting for this ... here is the statement by the Eurogroup

Ministers reaffirmed their absolute commitment to safeguard financial stability in the euro area. To this end, Ministers stand ready to adopt further measures that will improve the euro area’s systemic capacity to resist contagion risk, including enhancing the flexibility and the scope of the EFSF, lengthening the maturities of the loans and lowering the interest rates, including through a collateral arrangement where appropriate. Proposals to this effect will be presented to Ministers shortly.It sounds like they will expand the EFSF to buy back bonds of Greece, Ireland and Portugal. That might buy some time, but there is no mention of Italy - and if Italy goes, the EU has lost containment.

Ministers discussed the main parameters of a new multi-annual adjustment programme for Greece, which will build on strong commitments to fiscal consolidation, ambitious growth-enhancing structural reforms and a substantial privatisation of state assets. Ministers welcomed the reinforcement of monitoring mechanisms of the programme of Greece, the nomination of the board of the privatisation agency, which comprises two observers representing euro area Member States and the European Commission, and agreed to provide extended technical assistance to Greece. They called upon the Greek government to sustain its on-going efforts to meet these commitments in full and on time.

Ministers welcomed the decision by the IMF to disburse the latest tranche of financial assistance to Greece, as well as the proposals from the private sector to voluntarily contribute to the financing of a second programme, building on the work already underway. The ECB confirmed its position, reaffirmed by its Governing Council last Thursday, that a credit event or selective default should be avoided.

While the responsibility for resolving the crisis in Greece lies primarily with Greece, Ministers recognised the need for a broader and more forward-looking policy response to assist the government in its efforts to bolster debt sustainability and thereby safeguard financial stability in the euro area.

In this context, Ministers have tasked the Eurogroup Working Group to propose measures to reinforce the current policy response to the crisis in Greece. The Eurogroup Working Group will notably explore the modalities for financing a new multi-annual adjustment programme, steps to reduce the cost of debt-servicing and means to improve the sustainability of Greek public debt. This reinforced strategy should provide the basis for an agreement in the Eurogroup on the main elements and financing of a second adjustment programme for Greece shortly.

Ministers commit to continue negotiating with the European Parliament the

legislative proposals to reinforce economic governance in the European Union in order to agree on an ambitious reform as soon as possible. The reinforced governance should be fully operational without delay.

Distressed House Sales using Sacramento data

by Calculated Risk on 7/11/2011 05:51:00 PM

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

I'm not exactly sure what I'm looking for, but hopefully I'll know it when I see it! As some point, the number (and percent) of distressed sales will start to decline without foreclosure moratoria, homebuyer tax credits or other distortions. There is no sign of a decline yet (except seasonal).

The percent of distressed sales in Sacramento declined slightly in June compared to May because of a seasonal pickup in conventional sales. In June 2011, 65.2% of all resales (single family homes and condos) were distressed sales. This is down from 65.6% in May, and up from 62.4% in June 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer.

Notes: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both. The tax credits might have also boosted conventional sales in 2009 and early 2010.