by Calculated Risk on 3/26/2008 11:31:00 AM

Wednesday, March 26, 2008

More on New Home Sales

There is actually some good news in the Census Bureau's New Home sales report this morning. But first a few more ugly graphs (see February New Home sales for earlier graphs). Click on graph for larger image.

Click on graph for larger image.

This graph shows New Home Sales vs. recessions for the last 45 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001.

It appears the U.S. economy is now in recession - possibly starting in December - as shown on graph.

This is what we call Cliff Diving!

The second graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns in January and February 2008. This is the lowest sales for February since the recession of '91.

As the graph indicates, the spring selling season has started - and started poorly. Toll Brothers CEO said last month:

“The selling season, which we believe starts in mid-January, has been weak ..."And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at the highest level since 1981. Note that this doesn't include cancellations, but that was true for the earlier periods too.

The all time high for Months of Supply was 11.6 months in April 1980.

Once again, the current recession is "probable" and hasn't been declared by NBER.

So what is the good news?

There are actually two pieces of good news in the report. First, inventory levels (even accounting for cancellations) are clearly falling. This is a small first step in correcting the huge overhang in new home inventory.

Note: The inventory (and sales) reported by the Census Bureau doesn't account for cancellations, and the Census Bureau doesn't include many condos (especially high rise condos).

The second piece of good news is revisions. During periods of rapidly declining sales, the Census Bureau routinely overestimates sales in the initial report - and then revises down sales over the next few months. In this report, sales were revised up slightly for November (from 630K to 631K), December (605K to 611K) and January (588K to 601K). This is actually a positive sign that New Home sales might be nearing a bottom. However, a quick rebound in sales is unlikely with the huge overhang of both new and existing homes for sale.

Sunday, November 11, 2007

That Was Then And This Is Now

by Anonymous on 11/11/2007 05:26:00 PM

Angelo Mozilo, February 4, 2003, Washington, DC:

As we had envisioned in 1992, House America offers unique loan products that have been specifically designed to meet the needs of minority and low- to moderate- income borrowers. But it also does more. It has become not just a lending program, but a more comprehensive effort that devotes considerable intellectual and financial resources to increasing homeownership among minority and low- to moderate-income individuals and families.

It is an effort that includes a counseling center which provides free services by phone in a comfortable, no obligation environment where people can obtain information about the home-buying process. It is an effort that, in addition to providing loan products with flexible underwriting criteria such as home rehab loans, also specializes in being able to layer financing programs through participation in hundreds of down payment and closing cost assistance programs. House America also offers other tools to ensure that we are doing everything in our power to expand the opportunities for home-ownership. It is an effort absolutely committed to education and outreach, both in English and Spanish, both online and in local communities, both at local home-buyer fairs and at lending workshops, and with our many partners, like Fannie Mae, Freddie Mac, FHA, the Congressional Black Caucus, the National Council of La Raza, AFL-CIO, and faithbased groups across the Country, just to name a few.

I want to specifically and especially recognize Franklin Raines and his entire team at Fannie Mae for providing a great deal of the resources that have made it possible for us to achieve our House America objectives.

In 1993, Countrywide opened four dedicated House America retail branches, and now we have 23 staffed with local and diverse professionals in major metropolitan areas all across the Country.

It is an effort that has enabled Countrywide to become the number one lender to Hispanics for the last 6 years and the number one lender to African Americans for the past 3 years.1 It is an effort that is helping create, if you will allow me to paraphrase, a Field of American Dreams. “If you build it, and build it right, they will come.” Finally, House America is an effort that, as you can tell, makes all of us at Countrywide extremely proud. I could talk about it all night, but I won’t.

But I want to make the point that this outreach effort is imperative. Fortunately Countrywide isn’t alone – there are other mortgage lenders and financial institutions that are all making positive contributions. And the lesson we can take away from this is the following: for a long time, when it came to increasing low-income and minority homeownership, the message has always been “we should,” or “we must.” But the fact is, “we can,” and “we are.”

Now, we must take the energy and expertise and the ideas and the innovation that we’ve brought to increasing the overall homeownership rate, and apply them to creating reasonable parity among homeowners. It is time, once and for all, to narrow and ultimately eliminate the homeownership gap. I believe we can eliminate the gap and it is, in large part, why I got into this business. [Emphasis added]

Angelo Mozilo, October 29, 2007, Los Angeles:

In just the period from second quarter 2005 to second quarter 2007, California delinquency rates have climbed more than 180 percent. But State Treasurer Bill Lockyear said that while he anticipates some economic ripple effect across the state, "it's still too early to measure." Next year, California’s deficit is expected to reach $9 billion, he noted, and while the subprime effect will be "significant," he anticipates that the state will be shielded by its strong and diverse economy.

Countrywide's Chairman and CEO, Angelo Mozilo, took pains to explain what precipitated the subprime problem. First, he said, easy money began to drive up home prices at the start of the decade. When the Fed began to raise interest rates -- after some six or seven times, in fact -- people suddenly began to scramble to get into houses before the next rate hike. In addition, lenders were facing pressure from minority advocates to help people purchase homes. Lenders felt pressure to lessen their loan standards.

Thursday, October 25, 2007

More on September New Home Sales

by Calculated Risk on 10/25/2007 10:40:00 AM

For more graphs, please see my earlier post: September New Home Sales

Let's start with revisions. Last month I wrote:

The new homes sales number today [August] will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.Sure enough, sales for August were revised down to 735 thousand. I believe the Census Bureau is doing a good job, but the users of the data need to understand what is happening (during down trends, the Census Bureau overestimates sales).

This makes a mockery of headlines like this from the AP: New Home Sales Rebound in September. Sales did not "rebound", in fact the September report was horrible, and the sales number will almost certainly be revised down.

For an analysis on Census Bureau revisions, see the bottom of this post.

Click on graph for larger image.

Click on graph for larger image.This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession - possibly starting right now!

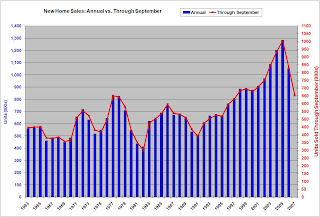

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through August.

Typically, for an average year, about 78% of all new home sales happen before the end of September. Therefore the scale on the right is set to 78% of the left scale.

It now looks like New Home sales will be in the low 800s - the lowest level since 1997 (805K in '97). My forecast was for 830 to 850 thousand units in 2007 and that might be a little too high.