by Calculated Risk on 4/25/2008 11:30:00 PM

Friday, April 25, 2008

Major Land Partnership in Default

From the WSJ: Calpers-Linked Land Partnership Gets Default Notice

A large California land partnership involving one of the largest U.S. pension funds has received a notice of default on a $1 billion loan after failing to meet certain terms of its lenders.Here come the defaults and builder bankruptcies.

LandSource Communities Development LLC, a partnership that involves the California Public Employees' Retirement System, received the default notice Tuesday, amid talks to restructure $1.24 billion of debt. The partnership ... owns 15,000 acres in Southern California ...

LandSource's trouble followed mounting stress at two large joint ventures in Las Vegas ... One partner in these ventures said Friday that it is unlikely that it will meet its obligations to the deals. The partner, home builder Kimball Hill Homes, announced Wednesday that it had filed for Chapter 11 bankruptcy protection.

UPDATE: Remember this photo from January 1, 2008? Anyone think housing bubble?

Click on photo for larger image.

Click on photo for larger image.This is a photo taken at the Sacramento Airport by Itamar

Friday, April 11, 2008

Fitch Warns on Home Builders

by Calculated Risk on 4/11/2008 02:30:00 PM

From MarketWatch: Fitch warns on darker outlook for home builders

Home builders are facing the twin specters of a slowing U.S. economy and a housing contraction that looks likely to extend through 2008, Fitch Ratings said Friday.Press Release from Fitch: U.S. Housing Contraction Has Legs, Teleconference 4/15 @ 11AM ET

...

"[A] modest recession, declining home prices, tighter mortgage standards even for conventional loans, poor buyer psychology and record levels of new and existing homes for sale will continue to define the current environment for housing."

[said Bob Curran, Fitch's lead home-building analyst]

Following are the details of the teleconference:Might be an interesting conference call.

--Date: Tuesday April 15, 2008

--Time: 11:00 a.m. ET

--Conference ID: 43464842

--U.S/Canada: +1-866-529-2924

Wednesday, April 09, 2008

Builder Tax Break in Jeopardy

by Calculated Risk on 4/09/2008 02:20:00 PM

Last month I reported on a home builder selling improved land for 15 cents on the dollar (of builder's total costs). What made the deal work was a tax provision that allowed the home builder to apply the losses to earlier profits (up to two years ago) and receive a nice tax refund.

Many home builders were already in trouble two years ago, and the Senate has proposed legislation to extend the loss carry-back period to four years, as opposed to the current two year period. This would mean the home builders could apply losses this year - like from a land sale - to the huge profits made up to four years ago, at the peak of the bubble, and get a large tax refund.

Now Dow Jones reports that that tax provision is in jeopardy: Builders Fearful As US House Shuns Beneficial Tax Provision

The possibility the U.S. House of Representatives' housing stimulus plan might not include a tax provision that would benefit home builders sent shudders across that industry Tuesday.

...

For the sector, the most significant part of the Senate package would allow companies to apply current losses to taxes paid four years ago, instead of the current two-year carry-back. Builders could apply losses against profits from the boom, and some could receive significant tax refunds.

...

John Burns, a California-based housing consultant, [said]: "This could be the difference between bankruptcy or not."

...

Added Fitch Ratings' Robert Curran: "This would help keep, potentially, some builders afloat."

Friday, February 15, 2008

NAHB: More Than Just A Touch Off

by Anonymous on 2/15/2008 07:39:00 AM

Washington Post sends a reporter to a home builders' trade show.

ORLANDO -- The cavernous convention center, the site of this week's International Builders Show, is lined row after row with slick display booths and polished sales reps peddling retro-style ovens, state-of-the-art foam insulation and a vegetable-oil-based product that plugs leaky ponds.Frankly bewildered, huh? Wait til they're stunned and surprised. It'll be perceptible.

But the crowd is a bit thinner than in the past, and the mood among the gathered home builders is noticeably different as their industry drags through the worst market in years.

"A few years ago, everyone was very happy and smiley," said Douglas Jones of Keystone Builders in Richmond. "Last year it was a touch off. This year it's a little more serious. It's perceptible."

With housing sales foundering, inventory way up and the future of the industry hazy, the show, with 1,900 exhibitors and nearly 100,000 attendees, is more angst-ridden as builders look for ways to stay afloat until there's a turnaround. Attendance is expected to be down about 5 percent.

"There's a deep sense of concern about the market right now," said David Seiders, chief economist for the National Association of Home Builders, after sitting on a panel of experts who delivered a sobering talk on the state of the industry.

"This time last year, it looked like the demand side of the market was stabilizing. Our forecasts were that, yeah, 2007 will be a down year but it won't be that bad," he said.

"Then the entire subprime debacle hit, other shocks to the financial system hit. A lot of builders are frankly bewildered as to what in the world has happened. I can't go 15 feet without being grabbed by somebody trying to talk about it."

Seiders now predicts a turnaround in the latter half of this year, but other less-optimistic economists see no improvement until 2009 or later.

Friday, February 01, 2008

Beazer Shuts Mortgage Company

by Anonymous on 2/01/2008 10:54:00 AM

BOSTON (MarketWatch) -- Beazer Homes USA Inc. before Friday's opening bell said it is shuttering its troubled mortgage-origination unit and exiting several underperforming markets as it tries to endure the housing downturn.So which is worse? Being the lender preferred by Beazer, or being the builder that prefers Countrywide? I have to think about that.

The Atlanta home builder said it would stop writing mortgages through a unit, cease building homes in five markets, and enter marketing partnerships with Countrywide Financial Corp. and St. Joe Co.

Beazer will discontinue mortgage-origination services through Beazer Mortgage Corp. And it will end its relationship with Homebuilders Financial Network LLC. Instead, it will market Countrywide, the Calabasas, Calif., mortgage company, to buyers of Beazer homes as the preferred mortgage provider. Beazer will take charges, which it can't yet calculate, as it ends the Beazer Mortgage operation.

After reviewing its markets to determine where best to put its resources, Beazer said the company will exit home-building operations in Charlotte, N.C., Cincinnati/Dayton and Columbus, Ohio, Columbia, S.C., and Lexington, Ky.

It said it will complete all homes that it's currently building in those markets and will determine how to dispose of its land holdings there. At June 30, 2007, Beazer had committed some 5% of its home-building assets in those markets. It'll take charges for closing these operations as well. And Beazer said it will enter the Northwest Florida market in cooperation with St. Joe, the Jacksonville, Fla., real-estate company. The companies already work together, with St. Joe selling home sites to Beazer.

Wednesday, December 19, 2007

Moody's Cuts D.R. Horton to Junk

by Calculated Risk on 12/19/2007 04:18:00 PM

From Bloomberg: D.R. Horton Credit Ratings Cut to Junk Status by Moody's (hat tip Matt)

D.R. Horton Inc., the fourth-largest U.S. homebuilder ... ratings were lowered to Ba1 on concern that a housing recovery won't begin before 2009 ...The public builder BKs are coming. I'm not saying Horton will go BK, but more of the public builders probably will (like Levitt & Sons). There is simply too much capacity in the industry, plus too much debt, too much inventory, and poor demographics for housing in general. The next few years will be very difficult for the homebuilders, and I suspect 2008 will make 2007 look like a good year.

Wednesday, December 05, 2007

Home Builders and Homeownership Rates

by Calculated Risk on 12/05/2007 04:00:00 PM

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year. Note: A special thanks to Jan Hatzius. Much of the ideas for this post are from his piece: "Housing (Still) Holds the Key to Fed Policy", Nov 27, 2007 Click on graph for larger image.

Click on graph for larger image.

The first graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The reasons for the change in homeownership rate will be discussed later in this post, but here are two key points: 1) The change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the rate (red arrow is trend) appears to be heading down.

The U.S. population has been growing close to 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these numbers, there would be close to 1.25 million new households formed per year in the U.S. (just estimates).

Since about 2/3s of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year. If an additional 500K per year moved to homeownership - as indicated by the increase in the homeownership rate from 1995 to 2005 - then the U.S. would have needed 1.3 million additional owner occupied homes per year.

Important note: these number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for to compare the numbers.

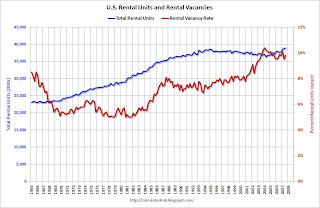

During that same period, since about 1/3 of all households rent, the U.S. would have needed about 400K+ new rental units per year, minus the 500K per year of renters moving to homeownership. So the U.S. needed fewer rental units per year from 1995 to 2005. Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

What this change in homeownership rate meant for the homebuilders was that they had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units, but the builders definitely benefited from the increase in homeownership rate.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.33% per year (Goldman's Hatzius estimated 0.5% per year). This would mean the net demand for owner occupied units would be 833K minus about 333K or 500K per year - about 40% of the net demand for owner occupied units for the period 1995 to 2005.

This means the builders have two problems over the next few years: 1) too much inventory, and 2) demand will be significantly lower over the next few years than the 1995-2005 period, and even when the homeownership rate stabilizes and the inventory is reduced, demand (excluding speculation) will only be about 2/3 of the 1995-2005 period.

Why did the homeownership rate increase?

A recent research paper - Matthew Chambers, Carlos Garriga, and Don E. Schlagenhauf (Sep 2007), "Accounting for Changes in the Homeownership Rate", Federal Reserve Bank of Atlanta - suggests that there were two main factors for the recent increase in homeownership rate: 1) mortgage innovation, and 2) demographic factors (a larger percentage of older people own homes, and America is aging).

The authors found that mortgage innovation accounted for between 56 and 70 percent of the recent increase in homeownership rate, and that demographic factors accounted for 16 to 31 percent. Not all innovation is going away (securitization and some smaller downpayment programs will stay), and the population is still aging, so the homeownership rate will probably only decline to 66% or 67% - not all the way to 64%.

This isn't the first time mortgage innovation contributed to a significant increase in the homeownership rate. The follow graph is from the referenced paper:

After World War II, the homeownership rate increased from 48 percent to roughly 64 percent over twenty years. This period was not only an important change in the trend, but determined a new level for the years to come. The expansion in homeownership during the postwar period has been part of the so-called "American Dream." ...Not all mortgage innovation is bad!

Prior to the Great Depression the typical mortgage contract had a maturity of less than ten years, a loan-to-value ratio of about 50 percent, and mortgage payment comprised of only interest payments during the life of the contract with a "balloon payment" at expiration. The FHA sponsored a new mortgage contract characterized by a longer duration, lower downpayment requirements (i.e., higher loan-to-value ratios), and self- amortizing with a mortgage payment comprised of both interest and principal.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.The 5% increase in the U.S. is actually less than many other countries.

Once again, looking forward this means the builders will face two problems over the next few years: too much supply and significantly lower demand (not even counting for speculation).

Friday, November 02, 2007

S&P cuts D.R. Horton, Pulte Debt to Junk

by Calculated Risk on 11/02/2007 01:02:00 PM

From Reuters: S&P cuts D.R. Horton, Pulte debt into junk territory

Standard & Poor's ... cuts its ratings on D.R. Horton Inc and Pulte Homes Inc into junk territory, citing the vulnerability of the home builders to the deteriorating housing market and macroeconomic conditions.No surprise.

...

The outlook for both companies is negative, indicating an additional cut is likely over the next two years.