by Calculated Risk on 10/30/2010 12:30:00 PM

Saturday, October 30, 2010

Investment Contribution to GDP: Leading and Lagging Sectors

By request, the following graph is an update to: The Investment Slump in Q2 2009

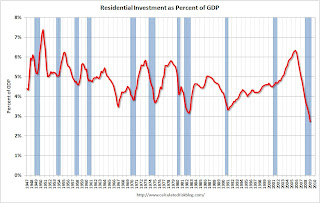

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential Investment (RI) made a negative contribution to GDP in Q3 2010, and the four quarter rolling average is negative again.

RI was negatively impacted by the slowdown in new home construction, and also because the number of existing home sold fell sharply (real estate commissions are included in RI).

Equipment and software investment has made a significant positive contribution to GDP for five straight quarters (it is coincident).

The contribution from nonresidential investment in structures was slightly positive in Q3. The details will be released next week, but I expect that oil and gas investment made a positive contribution, and hotels, malls and office investment were negative again. As usual nonresidential investment in structures is the last sector to recover.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Thursday, August 05, 2010

Residential Investment Components in Q2

by Calculated Risk on 8/05/2010 11:19:00 AM

More from the Q2 2010 GDP underlying detail tables ...

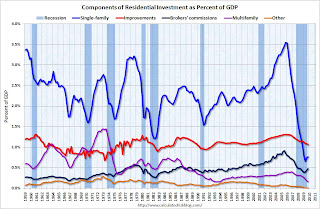

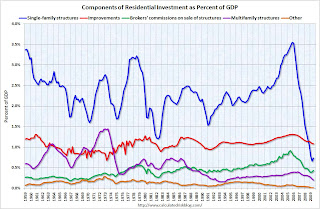

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

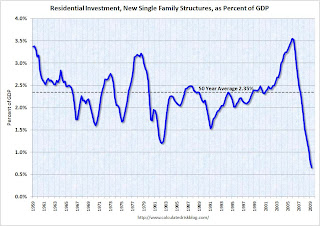

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $150.8 billion Seasonally Adjusted Annual Rate (SAAR) in Q2, significantly above the level of investment in single family structures of $119.7 billion (SAAR).

Investment in single family structures has been increasing since bottoming in Q2 2009, however - based on home builder comments and a collapse in new home sales - this will decline sharply in Q3.

Brokers' commissions will also decline sharply in Q3 as the number of existing home sales falls off a cliff in July and August (based on pending home sales).

And investment in multifamily structures - already at a series low as a percent of GDP (since 1959) - will decline further in Q3 since completions have been significantly above starts for some time.

According to the BEA, RI contributed 0.59 percentage points to real annualized Q2 GDP growth, and a RI will probably subtract about the same amount from Q3 (part of the 2nd half slowdown).

Tuesday, May 04, 2010

Residential Investment Components Q1 2010

by Calculated Risk on 5/04/2010 02:57:00 PM

More from the Q1 2010 GDP underlying detail tables ...

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q1 2010. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $152.9 billion Seasonally Adjusted Annual Rate (SAAR) in Q1, significantly above the level of investment in single family structures of $115.2 billion (SAAR).

Home improvement spending, as a percent of GDP, is close to the long term median - although still declining. Brokers' commissions declined after the initial expiration of the tax credit - but will probably be boosted in Q2 by the extension of the homebuyer tax credit - and then will decline again in Q3.

Investment in single family structures is above the record low set in Q2 2009, and far below the normal level. And investment in multifamily structures is still collapsing. These two categories will not increase significantly until the number of excess housing units is reduced.

Saturday, May 01, 2010

Investment Contributions to GDP: Leading and Lagging Sectors

by Calculated Risk on 5/01/2010 03:57:00 PM

By request, the following graph is an update to: The Investment Slump in Q2 2009

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential Investment (RI) made a small positive contribution to GDP in the second half of 2009, but was a drag in Q1 2010. The rolling four quarter change is moving up, but as expected there has been no strong boost to GDP from RI.

Equipment and software investment has made a positive contribution to GDP for three straight quarters (it is coincident).

Nonresidential investment in structures continues to be a drag on the economy, and as usual the economy is recovering long before nonresidential investment in structures recovers.

The key leading sector - residential investment - is lagging the recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Monday, February 01, 2010

Residential Investment Components in Q4

by Calculated Risk on 2/01/2010 04:44:00 PM

More from the Q4 GDP underlying detail tables ...

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q4 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $153.3 billion Seasonally Adjusted Annual Rate (SAAR) in Q4, significantly above the level of investment in single family structures of $110.9 billion (SAAR).

Home improvement spending, as a percent of GDP, is close to the long term median. Brokers' commissions are above the median after being boosted by the homebuyer tax credit.

Of course investment in single family structures is still fairly close to the record low set in Q2 2009, and far below the normal level. Also far below normal is investment in multifamily structures. These two categories will not increase significantly until the number of excess housing units is reduced (I'll have more on the number of excess housing units tomorrow after the Census Bureau releases the Q4 Housing Vacancies and Homeownership report).

Monday, November 02, 2009

Residential Investment Components in Q3

by Calculated Risk on 11/02/2009 09:40:00 PM

More from the Q3 GDP underlying detail tables ...

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q3 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $154.7 billion Seasonally Adjusted Annual Rate (SAAR) in Q3, significantly above the level of investment in single family structures of $105.2 billion (SAAR).

Home improvement spending, as a percent of GDP, is close to the long term average. And Brokers' commissions are slightly above average (2009 was a solid year for agents).

Of course investment in single family structures is near the record low, and far below the normal level. Also far below normal is investment in multifamily structures. These two categories will not increase significantly until the number of excess housing units is reduced (I'll have more on the number of excess housing in the next few days).

Saturday, October 03, 2009

The Impact of the Declining Homeownership Rate

by Calculated Risk on 10/03/2009 05:00:00 PM

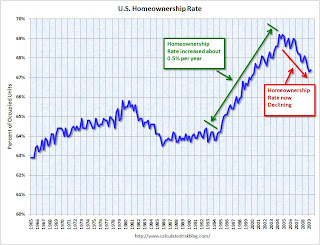

This is an update to a 2007 post: Home Builders and Homeownership Rates1

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The reasons for the change in homeownership rate are discussed in the 2007 post ( a combination of demographics and changes in mortgage "innovation"), but here are two key points: 1) During the boom, the change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the homeownership rate (red arrow is trend) is now declining.

The U.S. population has been growing at close to 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these rates, there would be close to 1.25 million new households formed per year in the U.S. (The are just estimates, and fewer households are formed during a recession - a key problem right now).

Since about 2/3s of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year. If an additional 500K per year moved to homeownership - as indicated by the increase in the homeownership rate from 1995 to 2005 - then the U.S. would have needed 1.3 million additional owner occupied homes per year.

Important note: these number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for to compare the numbers.

During that same period, since about 1/3 of all households rent, the U.S. would have needed about 400K+ new rental units per year, minus the 500K per year of renters moving to homeownership. So the U.S. needed fewer rental units per year from 1995 to 2005. The second graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The second graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

Since 2004 there has been a surge in rental units. Most of this increase is not new apartment buildings, rather a combination of investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes or 2nd homes instead of selling. This increase in rental units is more than offsetting the decline in the homeowership rate, and the rental vacancy rate was at a record 10.6% in Q2. (and will probably be over 11% soon because of the "first-time" homebuyer tax credit).

This increase in the homeownership rate, from 1995 through 2005, meant the homebuilders had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units, but the builders definitely benefited from the increase in homeownership rate.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.5% per year. This means the net demand for owner occupied units would be 833K minus about 500K per year or about 333K per year - about 25% of the net demand for owner occupied units for the period 1995 to 2005. (Not including replacing demolished units and 2nd home buying).

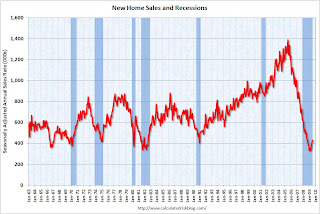

Although we can't compare this number directly to new home sales (because of 2nd home buying, replacement of demolished units, and other factors) this does suggest new home sales will probably remain at a low level until the homeownership rate stops declining. The third graph shows New Home Sales for the last 45 years. the Census Bureau reported: "Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000."

The third graph shows New Home Sales for the last 45 years. the Census Bureau reported: "Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000."

Once the homeownership rate stops declining - probably at about the same time the excess existing home units are mostly absorbed - new home sales will probably increase to a steady state rate based on population growth. However this level will be substantially below the average for the period from 1995 to 2005 when the homebuilders benefited from the increasing homeownership rate.

The "first-time" homebuyer tax credit (and new homebuyer tax credit in California) probably boosted new home sales a little this year, so the homeownership rate might increase in the 2nd half of 2009. However that increase will probably be temporary, and the homeownership rate will probably start declining again.

Key points:

1 A special thanks to Jan Hatzius. Several of the ideas for this post are from his piece: "Housing (Still) Holds the Key to Fed Policy", Nov 27, 2007

Monday, August 17, 2009

Lowe's: 'Consumers Remain Cautious', Cuts Investment Plans

by Calculated Risk on 8/17/2009 08:17:00 AM

Press Release from Lowe's:

Lowe's Companies, Inc. ... the world's second largest home improvement retailer, today reported net earnings of $759 million for the quarter ended July 31, 2009, a 19.1 percent decline from the same period a year ago.According to the BEA data, home improvement has held up better than other areas of residential investment:

...

"Wavering consumer confidence, unseasonable weather in core markets, and restrained customer spending compared to last year's fiscal stimulus-aided results led to lower than expected sales in the second quarter," commented Robert A. Niblock, Lowe's chairman and CEO. "Cautious consumers remain reluctant to take on discretionary projects until signs of economic improvement are more evident."

...

In response to the challenging economic environment, which has resulted in declining demand for home improvement products, the company has re-evaluated its future store expansion plans. For 2010, expansion in North America will be below previously anticipated levels, and new store openings will likely be in the range of 35 to 45. Given this, the company has evaluated the pipeline of potential future store sites and made the decision to no longer pursue several projects.

emphasis added

Click on graph for updated image in new window.

Click on graph for updated image in new window.This graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.08% of GDP, well off the high of 1.31% in Q4 2005 - but just back to the average of the last 50 years of 1.07%.

This would seem to suggest there remains downside risk to home improvement spending. Home Depot and Lowes are the largest home improvement retailers, and their results are something to watch.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.

Thursday, August 06, 2009

Residential Investment Components in Q2

by Calculated Risk on 8/06/2009 03:50:00 PM

More from the supplemental GDP tables released yesterday ...

Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $153.3 billion Seasonally Adjusted Annual Rate (SAAR) in Q2, significantly above investment in single family structures of $92.8 billion (SAAR).

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 0.66% of GDP, significantly below the average of the last 50 years of 2.35% - and almost half of the previous record low in 1982 of 1.20%.

And on home improvement: The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.08% of GDP, well off the high of 1.31% in Q4 2005 - but just back to the average of the last 50 years of 1.07%.

This would seem to suggest there remains downside risk to home improvement spending. Home Depot and Lowes announce results in the middle of August, and this might be something to watch.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.

Friday, July 31, 2009

The Investment Slump in Q2

by Calculated Risk on 7/31/2009 08:53:00 AM

The investment slump continued in Q2 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (RI) has been declining for 14 consecutive quarters, and the decline in Q2 was still very large - a 29.3% annual rate in Q2.

This puts RI as a percent of GDP at 2.4%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are declining.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are declining.

Business investment in equipment and software was off 9.0% (annualized) and has declined for 6 consecutive quarters. Investment in non-residential structures was only off 8.9% (annualized) and will probably fall sharply over the next year or so.

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last three and a half years. The good news is the drag on GDP will probably end soon. The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

Residential investment (red) has been a huge drag on the economy for the last three and a half years. The good news is the drag on GDP will probably end soon. The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - declined in Q2. If there is a surprise it is how well nonresidential investment in structures held up in Q2 (although we could see this in the construction spending data). This investment will decline sharply soon as many major projects are completed, and few new projects are started.

In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - and I expect it to turn slightly positive in the second half of 2009.

Saturday, July 18, 2009

Housing Starts: A Little Bit of Good News

by Calculated Risk on 7/18/2009 05:29:00 PM

For the last few years, whenever housing starts increased, I wrote that was bad news because there was already too much inventory.

Now, even though there is still too much existing home inventory, and too much new home inventory in some areas, it appears that new home sales have stabilized. Since single family housing starts (built for sale) have been below new home sales for six consecutive quarters (through Q1), this suggests single family housing starts should also bottom soon. There is a good chance that has already happened.

Why is that good if there is still too much housing inventory overall?

This increase in starts means that the drag from Residential Investment will slow or stop, and also that residential construction employment is close to the bottom. Residential investment has been a drag on the economy for 14 straight quarters, and just removing that drag will seem like a positive.

And residential construction has lost jobs for several years, and even though construction employment will probably not increase significantly, not losing jobs will also seem like a positive.

This removes drags from the economy - and that is the little bit of good news.

To be clear, this is not great news for the homebuilders. It will take some time to work off all the excess inventory, so new home sales and single family housing starts will probably stay low for some time. And it is possible that new home sales and housing starts could still fall further.

Are new home sales actually below single family starts (built for sale)?

Monthly housing starts (single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale", from the Census Bureau's "Quarterly Starts and Completions by Purpose and Design" to New Home sales on a quarterly basis.

The quarterly report shows that there were 52,000 single family starts, built for sale, in Q1 2009 and that is less than the 87,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this is not perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. However cancellation rates for most homebuilders have fallen sharply recently. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last six quarters, starts have been below sales – and new home inventories have been falling.

What is Residential Investment?

Residential investment is a major investment category reported by the Bureau of Economic Analysis (BEA) as part of the GDP report.

Residential investment, according to the BEA, includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures and home improvement.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures and home improvement.

Investment in home improvement was at a $162.3 billion Seasonally Adjusted Annual Rate (SAAR) in Q1, significantly above investment in single family structures of $113.7 billion (SAAR).

Let's take a closer look at investment in single family structures (usually the largest category): As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

In Q1, investment in single family structures was at 0.8% of GDP, significantly below the average of the last 50 years of 2.35% - and also below the previous record low in 1982 of 1.20%.

Based on the housing starts report, investment in single family structures will probably increase in Q2 for the first time since Q1 2006. This doesn't guarantee that residential investment increased in Q2, because home improvement and the other categories might offset the gains in single family structure investment, but most of the drag on GDP should be gone.

Friday, May 15, 2009

Residential Investment Components

by Calculated Risk on 5/15/2009 07:11:00 PM

Home Depot (Tuesday) and Lowes (Monday) announce results next week, and this might be something to watch!

Residential investment, according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

In Q4 - for the first time - investment in home improvements exceeded investment in new single family structures. This continued into Q1 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $162.3 billion Seasonally Adjusted Annual Rate (SAAR) in Q1, significantly above investment in single family structures of $113.7 billion (SAAR).

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 0.8% of GDP, significantly below the average of the last 50 years of 2.35% - and also below the previous record low in 1982 of 1.20%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.15% of GDP, off the high of 1.30% in Q4 2005 - but still above the average of the last 50 years of 1.07%.

This would seem to suggest there remains significant downside risk to home improvement spending.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.

Wednesday, April 29, 2009

The Investment Slump

by Calculated Risk on 4/29/2009 09:13:00 AM

The huge investment slump was the key story in Q1. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (RI) has been declining for 13 consecutive quarters, and Q1 2009 was the worst quarter (in percentage terms) of the entire bust. Residential investment declined at a 38% annual rate in Q1.

This puts RI as a percent of GDP at 2.7%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

Business investment in equipment and software was off 33.8% (annualized), and investment in non-residential structures was off 44.2% (annualized).

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - fell off a cliff. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - it is the best predictor of future economic activity.

Wednesday, March 25, 2009

New Home Sales: Is this the bottom?

by Calculated Risk on 3/25/2009 02:31:00 PM

Earlier today I posted some graphs of new home sales, inventory and months of supply.

A few key points:

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the February "rebound".

You have to look closely - this is an eyesight test - and you will see the increase in sales (if you expand the graph).

Not only was this the worst February in the Census Bureau records, but this was the 2nd worst month ever on a seasonally adjusted annual rate basis (only January was worse).

This graph shows existing home sales and new home sales through February.

This graph shows existing home sales and new home sales through February. For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

To close the gap, existing home sales need to fall or new home sales increase - or a combination of both. This will probably take several years ...

The following table, from Business Cycle: Temporal Order, shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

There are a number of reasons why housing and personal consumption won't rebound quickly, but they will probably bottom soon. And that means the recession is moving to the lagging areas of the economy. But we know the first signs to watch: Residential Investment (RI) and PCE.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Wednesday, March 18, 2009

More on Housing Bottoms

by Calculated Risk on 3/18/2009 03:23:00 PM

Yesterday I noted that housing starts might be nearing a bottom. This post led to a number of emails from readers stating that they believe prices will fall further. I agree.

There will almost certainly be two distinct bottoms for housing: the first will be single-family housing starts, new home sales, and residential investment, and the second will be for house prices.

These bottoms could happen years apart!

As I noted yesterday, it is way too early to try to call the bottom in prices. House prices will almost certainly fall for some time. My original prediction (a few years ago) was that real house prices would fall for 5 to 7 years, and we could start looking for a bottom in the 2010 to 2012 time frame for the bubble areas. That still seems reasonable to me. However some lower priced areas might be much closer to the bottom.

For the first bottom, we have several possible measure - the following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.  The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

Although the Case-Shiller data only goes back to 1987, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 - more than 5 years later!

Something similar will most likely happen again. Indicators like new home sales, housing starts and residential investment will bottom long before house prices.

Economists and analysts care about these housing indicators (starts, sales, RI) because they impact GDP and employment. However most people (homeowners, potential homebuyers) think 'house prices' when we talk about a housing bottom - so we have to be aware that there will be two different housing bottoms. And a bottom in starts doesn't imply a bottom in prices.

Sunday, March 15, 2009

Hamilton: "What will recovery look like?"

by Calculated Risk on 3/15/2009 06:10:00 PM

Professor Hamilton provides a number of graphs on the temporal order of a recovery: What will recovery look like?

This adds to my post: Business Cycle: Temporal Order

Here is the table I provided of a simplified temporal order for emerging from a recession. The table shows when each area typically starts to recovery relative to the end of the recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

And this graph from Professor Hamilton shows the average pattern for all the recessions since 1947.

And here is what the current recession looks like. The record slump in RI has changed the scale of the graph, but the order appears the same.

For recovery, we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

Unfortunately there are reasons that RI (excess supply) and PCE (too much debt) won't rebound quickly, but they are still the areas to watch.

And here is an excerpt from a research note by Jan Hatzius, Chief Economist at Goldman Sachs, sent out this afternoon:

"Although we still think real GDP will fall by about 7% annualized in Q1 and the labor market numbers remain awful, the good news is that the weakness is shifting from more leading to more lagging sectors."(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Friday, February 27, 2009

Investment Contributions to GDP

by Calculated Risk on 2/27/2009 02:00:00 PM

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag is getting smaller, and the drag on GDP will be significantly less in 2009, than in 2007 and 2008.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

The REALLY bad news is nonresidential investment (blue) is about to fall off a cliff. Nonresidential investment subtracted -0.24% (SAAR) from GDP in Q4, and will decline sharply in 2009 based on the Fed's Senior Loan Officer Survey, the Architecture Billings Index, and many many other reports and stories. In previous downturns the economy recovered long before nonresidential investment - and that will probably be true again this time.

As always, residential investment is the investment area to follow - it is the best predictor of future economic activity.

Monday, February 02, 2009

Residential Investment Components

by Calculated Risk on 2/02/2009 11:09:00 AM

This is a first ... investment in home improvements exceeded investment in new single family structures for the first time ever in Q4 2008 (it was close in Q3).

Residential investment, according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $170.8 billion Seasonally Adjusted Annual Rate (SAAR) in Q4, above investment in single family structures of $150.2 billion (SAAR) for the first time ever.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 1.05% of GDP, significantly below the average of the last 50 years of 2.35% - and also below the previous record low in 1982 of 1.20%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.20% of GDP, off the high of 1.30% in Q4 2005 - but still well above the average of the last 50 years of 1.07%.

This would seem to suggest there remains significant downside risk to home improvement spending over the next couple of years.

Friday, January 30, 2009

Investment as a Percent of GDP

by Calculated Risk on 1/30/2009 09:09:00 AM

Here are a couple of graphs on the investment slump. Residential real residential fixed investment decreased at an a 23.6% annualized rate in Q4. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows residential investment (RI) as a percent of GDP since 1947. Residential investment has fallen to 3.07% of GDP. This is the lowest residential investment, as a percent of GDP, since WW II.

I'll post more on the components of RI in a few days when the supplemental data is released. The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.

Investment in software and equipment declined at a 27.8% annualized rate in Q4. Cliff diving! This investment is at the lowest rate since the '70s.

However investment in non-residential structures only declined at a 1.8% annualized rate. As a percent of GDP, non-residential structure investment actually increased slightly in Q4. This story will change in 2009, and non-residential structure investment will be a significant drag on GDP.

I'll have much more on non-residential structures in a few days ...

This investment slump is a huge part of the recession story. Residential led the economy into recession (as is typical) and now non-residential investment is falling off a cliff - or, as in the case of non-residential structures, will fall off a cliff in 2009.

Sunday, November 16, 2008

Slowing Exports and Residential Investment

by Calculated Risk on 11/16/2008 02:46:00 PM

From Dr. Setser: Ut-oh …. exports are starting to fall fast.

[T]he non-petrol goods deficit is now moving in the wrong direction. It increased from $29.3b in June to $35.6b in August. Non-petrol exports fell by $9.9b over the last two months, while non-petrol imports fell by “only” $3.7 billion.Although Brad Setser is concerned about the global impact of slowing U.S. exports, I think there is another interesting relationship: net exports vs. residential investment. Let me add a couple of graphs ...

...

And remember this is the September data. Since then the global outlook has deteriorated — and the dollar has strengthened substantially. That isn’t going to help US exports.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows real residential investment (from the BEA) and real net exports. These are historically countercyclical; as residential investment increases the trade deficit tends to increase, and as residential investment falls, the trade deficit declines.

The second graph shows this as a contribution to GDP (rolling 4 quarters to smooth the data).

The second graph shows this as a contribution to GDP (rolling 4 quarters to smooth the data).This shows that residential investment and net exports are countercyclical and tend to offset each other somewhat as far the impact on GDP. This is important because slowing exports could mean that there is nothing to offset a further decline in residential investment.

The good news is the trade deficit will decline sharply over the next few months (because of the decline in oil prices), and residential investment might bottom sometime in the next few quarters.

The bad news is the trade deficit might start increasing again - after the oil price adjustment - because of the stronger dollar and weak global economies. And residential investment might bottom, but any recovery will probably be anemic because of the huge overhang of surplus inventory. So it is unlikely that residential investment will offset any possible rise in the trade deficit.

Just something to add to Setser's post ...