by Calculated Risk on 11/19/2010 03:47:00 PM

Friday, November 19, 2010

Disposition of Canceled HAMP Trial Modifications

Treasury released the October HAMP statistics last night.

There is some interesting data on the disposition of canceled HAMP trial modifications. The general view was that a majority of these borrowers would lose their homes in foreclosure or through a short sale. That hasn't happened yet.

The statistics, from the 8 largest servicers (about 80% of HAMP), show that most of these borrowers are in alternative modification programs or have cured the default (current of loan paid off).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the disposition of canceled HAMP trial modifications (in percentages). This represents 552 thousand canceled trial modifications as of September.

Only 3.9% of borrowers have lost their homes in foreclosure, and another 8.5% have lost their homes through a short sale or deed-in-lieu of foreclosure.

About 13% of borrowers are in the foreclosure process, and another 1.9% in bankruptcy.

So what has happened to the borrowers in all of those canceled trials? The largest percentage of borrowers are in alternative modification programs (lender programs). The next largest group is in "action pending". Some have paid off their loans (probably sold their homes), and another 7.7% have managed to become current.

So the number of foreclosures was lower than many expected, although many of the borrowers in the alternative modification programs will probably redefault (and the action pending group might also results in a number of foreclosures). Hopefully HAMP will keep updating this table.

Wednesday, September 22, 2010

HAMP data for August

by Calculated Risk on 9/22/2010 05:18:00 PM

From Treasury: HAMP Servicer Performance Report Through August 2010

And here is the HUD Housing Scorecard.

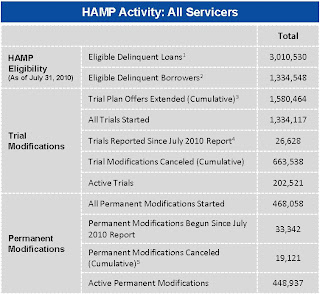

About 468 thousand modifications are now "permanent" - up from 422 thousand last month - and 663 thousand trial modifications have been cancelled.

The pace of new trial modifications has slowed sharply from over 150,000 in September 2009 to under 18,000 in August. The program has slowed way down.

According to HAMP, there are 202,521 "active trials", down from 255,934 last month.

The shows that the HAMP servicers have made progress on getting borrowers out of "modification limbo" - although the trial program was originally designed to be for 3 months - so maybe the measurement should be 4 months (instead of 6 months).

Debt-to-income ratios

If we look at the HAMP program stats (see page 3), the median front end DTI (debt to income) before modification was 44.9% - the same as last month. And the back end DTI1 was an astounding 79.9%.

This means that for the median borrower, about 80% of the borrower's income went to servicing debt. And the median is 63.5% after the modification.

These borrowers still have too much debt, even after the modification - and that suggests an eventual high redefault rate. There have been 18,773 redefaults already. It would be nice to see percent defaults by months from when the "permanent modification" started.

1 Back end DTI from HAMP:

Ratio of total monthly debt payments (including mortgage principal and interest, taxes, insurance, homeowners association and/or condo fees, plus payments on installment debts, junior liens, alimony, car lease payments and investment property payments) to monthly gross income.

Friday, August 20, 2010

HAMP data for July

by Calculated Risk on 8/20/2010 11:43:00 AM

From Treasury: HAMP Servicer Performance Report Through July 2010

And here is the HUD Housing Scorecard.

About 422 thousand modifications are now "permanent" - up from 389 thousand last month - and 617 thousand trial modifications have been cancelled - up sharply from 521 thousand last month.

According to HAMP, there are 255,934 "active trials", down from 364,077 last month. There is still a large number of borrowers in limbo since only 165 thousand trials were started over the last 5 months. I expect another large number of cancellations in August.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to under 17,00 in July. The program is winding down ...

Debt-to-income ratios

If we look at the HAMP program stats (see page 3), the median front end DTI (debt to income) before modification was 44.8% - the same as last month. And the back end DTI was an astounding 79.7 (about the same as last month).

Think about that for a second: for the median borrower, about 80% of the borrower's income went to servicing debt. And the median is 63.5% after the modification.

These borrowers are still up to their eyeballs in debt after the modification.

Summary:

Wednesday, July 28, 2010

Treasury: HAMP Re-default Rate incorrect

by Calculated Risk on 7/28/2010 10:55:00 AM

Several analysts noted the reported re-default rate appeared too low ... it was.

Shahien Nasiripour at the HuffPo has the story: HAMP Report Revised After Analysts Question New Metric

The Obama administration has revised its latest monthly report on its signature foreclosure-prevention plan, deleting a heavily-criticized performance metric used to measure whether assisted homeowners are re-defaulting on their taxpayer-financed mortgages.As Nasiripour notes, most analysts think a majority of HAMP modifications will eventually re-default. Nasiripour mentions a Fitch analyst's forecast that 75 percent will re-default; Barclays estimates 60 percent.

...

"Subsequent to releasing the report, Treasury received inquiries regarding the calculation methodology used in this table," spokesman Mark Paustenbach said Tuesday. "These inquiries were related to the treatment of modifications that are cancelled from HAMP and ultimately become ineligible for TARP incentives after 90 days delinquency.

"In an effort to review and better explain the methodology, we learned from our program administrator, Fannie Mae, that not all cancelled loans were included in the underlying information provided to Treasury," Paustenbach continued. "The error caused inconsistent reporting of permanent modifications during the snapshots reported. These omissions have impacted our previous analysis... with respect to the performance of HAMP permanent modifications."

...

In place of the now-deleted table, in a revised report posted Monday to their FinancialStability.gov Web site, Treasury said:

"Since the Making Home Affordable report was posted on July 20th, Fannie Mae, which administers the program, has reported to Treasury an issue in its implementation of the delinquency statistic methodology used to report performance of permanent modifications. Fannie Mae is now revising the data, and Treasury has retained a third-party consultant to provide additional review and validation. Upon completion of that independent review, a revised table will be provided.".

Last month, the reported median back end DTI1 was 63.7% AFTER modification. That just screams "re-default".

From HAMP: 1 Ratio of total monthly debt payments (including principal and interest on the first mortgage, taxes, insurance, homeowners association and/or condo fees, plus payments on installment debts, junior liens, alimony, car lease payments and investment property payments) to monthly gross income.

Tuesday, July 20, 2010

HAMP data: Only 15,000 trial modifications started in June

by Calculated Risk on 7/20/2010 01:07:00 PM

From Treasury: HAMP Servicer Performance Report Through June 2010

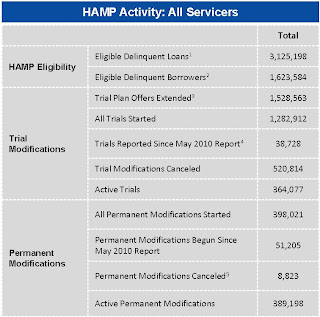

About 389 thousand modifications are now "permanent" - up from 347 thousand last month - and 521 thousand trial modifications have been cancelled - up sharply from 430 thousand last month.

According to HAMP, there are 364,077 "active trials", down from 467,672 last month. There is still a large number of borrowers in limbo since only 235 thousand trials were started over the last 5 months. I expect another large number of cancellations in July.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 15,000 in June (down from 30,000 in April 2010). This is the slowest pace since the program started, probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers. The program is winding down ...

Debt-to-income ratios

If we look at the HAMP program stats (see page 3), the median front end DTI (debt to income) before modification was 44.8% - the same as last month. And the back end DTI was an astounding 79.9 (up slightly from last month).

Think about that for a second: for the median borrower, about 80% of the borrower's income went to servicing debt. And the median is 63.7% after the modification.

And that is the median - and just imagine the characteristics of the borrowers who can't be converted!

Summary:

Note: On page 3, HAMP added the delinquency rates for "permanent" modifications. As an example, 5.9% of borrowers are 60+ days delinquent six months after their modifications became "permanent". Over 8,800 "permanent" modifications have been cancelled, and only 195 have been paid off (probably sold property). The others probably are in foreclosure (or other distress sale).

Monday, June 21, 2010

HAMP data shows over 150 Thousand Trials Cancelled in May

by Calculated Risk on 6/21/2010 01:35:00 PM

From Treasury: HAMP Servicer Performance Report Through May 2010

About 347 thousand modifications are now "permanent" - up from 299 thousand last month - and 430 thousand trial modifications have been cancelled - up sharply from 277 thousand last month.

According to HAMP, there are 467,672 "active trials", down from 637,353 last month. However if we add the trials started since December (5 months!), there should only be 300,000 thousand borrowers in trial programs. That means there is still a huge number of borrowers in limbo, but with all the cancellations, the number is declining.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 30,000 in May (down from 47,160 in April 2010). This is the slowest pace since the program started, probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers. The program continues to slow down ...

Debt-to-income ratios worsen

If we look at the HAMP program stats (see page 5), the median front end DTI (debt to income) before modification was 44.8% - about the same as last month. And the back end DTI was an astounding 79.8 (down slightly from 80.2% last month).

Think about that for a second: for the median borrower, about 80% of the borrower's income went to servicing debt. And it is almost 64% after the modification.

And that is the median - and just imagine the characteristics of the borrowers who can't be converted!

Summary:

Sunday, May 23, 2010

On Loan Mods and Credit Scores

by Calculated Risk on 5/23/2010 08:58:00 AM

From Carolyn Said at the San Francisco Chronicle: Loan modifications often damage credit scores

Struggling homeowners who get a loan modification to reduce their mortgage payments are often unaware that it can seriously ding their credit score.And on short sales:

...

"A lot of people don't understand that by making the payments due on their temporary loan mod they're reported as delinquent immediately," said Margot Saunders of the National Consumer Law Center in Washington. "It's a huge misunderstanding."

...

"A lot of lenders are reporting these modifications as paying under a partial payment plan. FICO regards that status as a serious delinquency," said Craig Watts, a spokesman for FICO ...

Watts said it is a "widespread myth" that short sales and deeds in lieu of foreclosure have less impact on credit scores than do foreclosures.There is much more in the article ...

"Generally speaking, when you can't pay your mortgage, in the eyes of the FICO score what matters is that you were not able to fill your obligation as you originally agreed and that failure is highly predictive of future risk," he said.

Wednesday, April 14, 2010

HAMP March Data

by Calculated Risk on 4/14/2010 05:45:00 PM

From Treasury: Administration Releases March Loan Modification Report

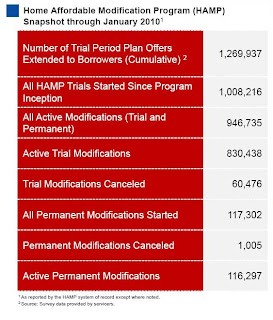

|

About 228,000 modifications are now "permanent", and 155,000 trial modification cancelled. There is still a huge number of borrowers in limbo. If we add the 228,000 permanent mods, plus 155,000 cancelled, and the 108,000 pending permanent mods that is only 491,000 borrowers - there were 825,000 borrowers in the program as of last November. So there are another 334,000 borrowers in modification limbo.

Here is the report. See here for a list of reports.

|

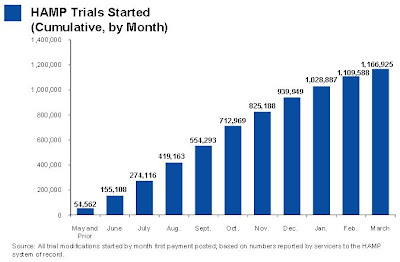

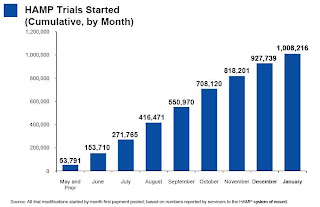

The second graph shows the cumulative HAMP trial programs started.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to around 57,000 in March 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Debt-to-income ratios worsen

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) before modification was 44.8% - down slightly from 45% last month. And the back end DTI was an astounding 77.5% (up from 76.4% last month).

Just imagine the characteristics of the borrowers who can't be converted!

No wonder the re-default rate is high ... from David Streitfeld at the NY Times: Defaults Rise in Loan Modification Program

The number of homeowners who secured cheaper mortgages through the government’s modification program only to default again nearly doubled in March, continuing a worrisome trend that threatens to undermine the entire program.In summary: 1) the program is slowing, 2) the borrowers DTI characteristics are poor - and getting worse, and 3) the re-default rate is rising. Oh, and 4) there are a large number of borrowers in modification limbo.

Treasury Department data released Wednesday showed that 2,879 loans that were permanently modified have defaulted since the program’s inception in the fall, up from 1,499 in February and 1,005 in January.

Tuesday, March 23, 2010

HAMP applicants tanned and juiced

by Calculated Risk on 3/23/2010 01:23:00 PM

CR Note: The following is from long time reader Shnaps. Shnaps has been working in the mortgage industry in various capacities "since people were extending the antennas on their mobile phones". Shnaps currently serves in a key role related to HAMP at one of the largest non-prime mortgage servicers in the Nation.

Shnaps writes:

One aspect of the Making Home Affordable loan modification program known as ‘HAMP’ is almost always taken for granted in its wide reporting – that the borrowers in fact need ‘help’. Moreover, it is generally taken for granted that those seeking modification under HAMP simply cannot afford their monthly mortgage payment. It is assumed that they have made great sacrifices, assumed they have already cut back drastically on discretionary expenses, assumed that they have already gone over their monthly budgets with a fine-toothed comb to eliminate all but the most necessary expenditures in an effort to keep their home. So prepare to be shocked – shocked! – as I share with you that I have seen first-hand that this assumption is oftentimes greatly, seriously flawed.

Let me begin with a word to the wise for HAMP applicants: unless you believe Snooki is now in charge of approving HAMP applications, it might be a good idea to cut back a bit on some of the creature comforts to which you have become accustomed at least a month before submitting your HAMP modification application.

Allow me to explain. The guidelines for servicers participating in HAMP stipulate that the borrower must submit a “hardship affidavit”. This, ostensibly, is to serve as their sworn testimony that they have been driven into default due to some particular hardship they encountered, and despite making every possible sacrifice, they can no longer “maintain payment on the mortgage and cover basic living expenses at the same time". (see HAMP Directive)

To demonstrate this, applicants are required to submit recent paystubs and bank statements. The statements are to help further corroborate the income they report (lest they forget to include all of their paystubs) and also to demonstrate that their monthly expenses are as described on their application. Which is to say that they have already ‘cut back to the bone’ and STILL are unable to make ends meet.

So how do these look in practice? The very first ‘HAMPlication’ that your correspondent pulled up recently showed a wanton disregard for minimizing spending. On the contrary, it looked like “cutting back” for this applicant does not involve such Draconian cuts as eliminating:

• visits to the tanning salon

• the nail spa

• some kind of gourmet produce market (have you seen the price of arugula?)

• various liquor stores

• A DirecTV bill that must involve some serious premium programming or pay-per-view events (or both?).

• And over $1,700 in retail purchases, including: Best Buy, Baby Gap, Brookstone, Old Navy, Bed, Bath & Beyond, Home Depot, Macy’s, Pac Sun, Urban Behavior, Sears, Staples, and Footlocker.

And that was just in one month! They were seeking to reduce a $1,880 mortgage payment that had just gotten to be a real cramp to their ability to keep a roof over their heads.

I’d like to say this is the exception, but it’s much closer to the norm. Many people who request HAMP modifications submit bank statements that demonstrate little if any “belt-tightening” going on.

Somehow, we now expect the same people who asked for ‘liar’s loans’ to be truthful on when it comes to ‘hardship affidavits’?

Tuesday, March 16, 2010

HAMP Debt-to-income Ratios of "Permanent" Mods

by Calculated Risk on 3/16/2010 11:10:00 AM

Last night I mentioned the astounding DTI (Debt-to-income) of HAMP modification borrowers who were converted to a permanent modification: 2010: REOs or Short Sales?  Click on chart for larger image in new window.

Click on chart for larger image in new window.

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) before modification was 45%, and the back end DTI was an astounding 76.4%!

Just imagine the characteristics of the borrowers who can't be converted!

Here is a table putting the numbers in dollars:

| Median Characteristics of HAMP Permanent Modification | ||

|---|---|---|

| Before Modification | After Modification | |

| Monthly Income | $2,702.77 | $2,702.77 |

| Front End (PITI & HOA) | $1,216.25 | $837.86 |

| Back End (total) | $2,064.92 | $1,616.26 |

| After Debt Income | $637.85 | $1,086.52 |

Front end DTI includes Principal, Interest, Taxes and Insurance (PITI) plus any homeowners association fees.

The back end DTI includes PITI and HOA, plus installment debt, alimony, 2nd liens, and other fixed payments.

That left the median borrower before modification with only $637.85 not including payroll taxes ($206.76), income taxes, utilities, food, and other monthly expenses. No wonder the borrowers were delinquent.

Now these median borrowers have $1,086.52 to pay all those expenses after the to 59.8% DTI bank end ratio. Remember this is gross, and is before the $206,76 in payroll taxes and an income taxes). Although this is an improvement, I expect many of these borrowers to redefault.

Wednesday, February 24, 2010

97,000 Homeowners in "Loan Mod Limbo"

by Calculated Risk on 2/24/2010 05:03:00 PM

Paul Kiel at ProPublica reports: Chase and Other Servicers Leave Many in Loan Mod Limbo; Treasury Threatens Penalties

About 97,000 homeowners in the government’s mortgage modification program have been stuck in a trial period for over six months. Most of them, about 60,000, have their mortgages with a single mortgage servicer, JPMorgan Chase.Paul Kiel has much more.

Trial periods are designed to last only three months, after which mortgage servicers are supposed to either give homeowners a permanent modification or drop them from the program. According to a ProPublica analysis, about 475,000 homeowners have been in a trial modification for longer than three months.

A couple of key points on HAMP I've mentioned before:

The January guidance from Treasury addressed both of the above points.

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests that there will be fewer trial modifications per month in the future (this is already happening, see graph below) and a surge of trial cancellations in February.

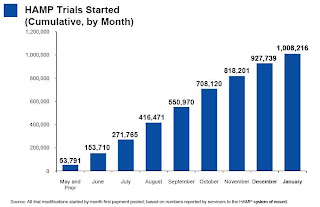

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Monday, February 22, 2010

WSJ: Treasury Considering Appeal Process for HAMP

by Calculated Risk on 2/22/2010 05:07:00 PM

From James Hagerty at the WSJ: U.S. Weighs Changes to Mortgage-Relief Program

The U.S. Treasury is considering new ... proposals ... to give borrowers 30 days to respond after being denied a modification of their loan terms under the ... HAMP. During that period, which would allow borrowers to appeal against the decision, the servicer couldn't put the home up for sale at a foreclosure auction.Probably the main impact of HAMP has been to keep the supply of distressed properties down by delaying the inevitable. In most cases, this would just be another delay ...

...

A Treasury spokeswoman said the proposals are among "many ideas under consideration in the administration's ongoing housing stabilization efforts." She added: "This proposal has not been approved and there are no immediate planned announcements on the issue."

Servicers also would be required to provide a "written certification" that a borrower isn't eligible for HAMP before a foreclosure sale can be held.

...

These measures would likely further slow down the foreclosure process.

Saturday, February 20, 2010

Study: Mods just Delay Foreclosures, 6.1 Million to Lose Homes

by Calculated Risk on 2/20/2010 07:46:00 AM

Jeff Collins, at the O.C. Register, has a Q&A with Wayne Yamano, vice president at John Burns Real Estate Consulting: Loan mods won’t halt foreclosures, study shows

Register: Your study says that five million of the 7.7 million delinquent homes will go through foreclosure or a “foreclosure-related procedure.” How is this likely to occur?Burns Consulting doesn't think there will be flood of homes hitting the market - they expect these homes will be lost over a few years - so in their view there will not be "another leg down in pricing".

Wayne: Most shadow inventory will get out onto the market as an REO or short sale. In any event, it results in the homeowner losing their home, and that home being added to the supply of homes available for sale.

Register: Do the remaining 2.7 million borrowers get their loan payments caught up?

Wayne: Of the 7.7 million delinquent homeowners, we actually think that only about 1.6 million will be able avoid losing their homes, and that the remaining 6.1 million will lose their homes. We say that there is 5 million units of shadow inventory because we estimate that about 1.1 million delinquent homeowners already have their homes listed for sale, and we would not classify those homes as “shadow.”

Register: When will this wave of foreclosures hit, and how will this shadow inventory affect home prices?

Wayne: We don’t believe that the shadow inventory will be dumped onto the market all at once. Although we don’t believe modification efforts will truly save a lot of homeowners from losing their homes, we do believe that these programs are effective in delaying foreclosures and pushing out the additional supply to later years.

Wednesday, February 17, 2010

HAMP: 116,000 Permanent Mods, Over 1,000 Permanent Mods Cancelled

by Calculated Risk on 2/17/2010 04:11:00 PM

From Treasury: Administration Releases January Loan Modification Report

Click on graph for larger image  in new window.

in new window.

Just over 116,000 modifications are now permanent.

Here is the link at Treasury. See here for a list of reports.

If there were 416,471 cumulative HAMP trial modifications in August - how come there were only 116,297 permanent mods and 60,476 disqualified modifications by the end of January? The numbers don't add up.

What happened to the other 240,000 modifications? I guess they we will find out in the February report when the servicers start removing delinquent borrowers from the trial modification program. The second graph shows the cumulative HAMP trial programs started.

The second graph shows the cumulative HAMP trial programs started.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in Septmenber to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Edit: Also - 1,005 permanent modifications have already failed. At first that seemed high considering those borrowers made all the trial modification payments ... but I suppose that is about the expected re-default rate.

Tuesday, February 16, 2010

CNBC's Olick: Treasury Concerned about Next Wave of Foreclosures

by Calculated Risk on 2/16/2010 04:35:00 PM

From Diana Olick at CNBC: What Mortgage Modifications Say About the Housing Market

Treasury officials today said they are still concerned about a coming wave of foreclosures, many from pay option ARMs and many from the prime jumbo basket, particularly hard hit by unemployment.Olick also notes that the HAMP report for January has been delayed by weather until tomorrow. And she reports that only 2/3 of HAMP borrowers are current on their payments.

A couple of comments:

The main reason 1/3 of HAMP borrowers are delinquent is because some servicers didn't adequately pre-qualify borrowers before putting them in the program. The Treasury recently changed the guidelines for placing borrowers in to a trial program, and these more stringent pre-qualification requirements must be implemented by June. Most servicers have already started using the new requirements, and the number of new trial modifications will probably slow dramatically.

As James Haggerty at the WSJ noted this morning:

Loan servicers ... seem to have "nearly exhausted the supply of plausible candidates for loan modifications" and will find that many loans are "unredeemable," [a] S&P study says.Note: the HAMP report tomorrow will be for January. Although the number of permanent modifications probably increased significantly, the actual number will still be very low compared to the number of HAMP trial modifications. Also - it is the report for February that will be VERY interesting because the servicers have been instructed to remove many of the delinquent borrowers from the program after Jan 31, 2010.

Thursday, January 28, 2010

Treasury Releases new Guidance for HAMP

by Calculated Risk on 1/28/2010 02:11:00 PM

There are two key components:

1) New Requirements that Documentation be Provided Before Trial Modification Begins.

2) and guidance on Converting Borrowers in the Temporary Review Period to Permanent Modifications

From Treasury: Administration Updates Documentation Collection Process and Releases Guidance to Expedite Permanent Modifications. And the Special Directive.

1) On beginning trial modifications: The original plan allowed servicer discretion on when to place borrowers in HAMP trial modification programs. Some servicers required documentation and a first payment before putting the borrower in a trial program, others just accepted a verbal agreement over the phone. The new rules include:

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The Treasury was initially trumpeting the number of trial modifications, but that was a poor metric of success since some servicers were just putting anyone who answered the phone in a trial modification.

2) The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests a surge of trial cancellations in February.

Tuesday, January 26, 2010

BofA signs up for HAMP Second Lien Program

by Calculated Risk on 1/26/2010 06:32:00 PM

From BofA: Bank of America Becomes First Mortgage Servicer to Sign Contract for Home Affordable Second-Lien Modification Program

Bank of America announced that it is the first mortgage servicer to sign an agreement formally committing to participation in the pending second-lien component of the federal government's Home Affordable Modification Program (HAMP)And more from HousingWire: BofA Signs up as First Servicer for HAMP Second Lien Program

...

Bank of America has systems in place to begin implementing the Second Lien Modification Program (2MP) with the release of final program policies and guidelines by federal regulatory agencies, which is expected soon. 2MP will require modifications that reduce the monthly payments on qualifying home equity loans and lines of credit under certain conditions, including completion of a HAMP modification on the first mortgage on the property.

This program was announced in April 2009, and is still in process. Here are the guidelines for the HAMP 2nd lien program. I don't have high hopes for this program.

Friday, January 22, 2010

HAMP Changes Coming

by Calculated Risk on 1/22/2010 12:27:00 AM

But what changes isn't exactly clear ...

From Peter Goodman at the NY Times: Treasury Weighs Fixes to a Program to Fend Off Foreclosures

The Treasury is likely to alter the program by making pay stubs an acceptable means of verifying income, rather than requiring tax documents ...Unless I'm missing something, the only change to be announced next week, mentioned in the article, is allowing borrowers to use pay stubs to verify income, as opposed to providing tax documents. That doesn't make much sense since it is pretty easy to provide tax documents, and underwriting in arrears is one of the keys to the program (the failure to document income was one of the problems with nontraditional mortgages). This sounds like another delaying tactic.

The changes by the Treasury Department are expected to include greater assistance for homeowners no longer able to make mortgage payments because their paychecks have shrunk ... The Treasury was still debating the method ... looking at either direct cash assistance or a grace period in which borrowers could postpone payments. That component may not be announced next week, but would follow soon after.

...

The changes to be introduced next week are unlikely to address what has emerged as a potent factor propelling a wave of foreclosures: the roughly 15 million borrowers who are said to be underwater ...

Friday, January 15, 2010

Treasury: No Further HAMP Extensions

by Calculated Risk on 1/15/2010 11:59:00 PM

UPDATE: The trials modification period was originally 3 months, and then was extended to 5 months, and then extended to the end of January. This means that for the borrowers in the trial modification program, there will be no further extensions. For borrowers just entering the trial phase, they will have the normal three month period.

From the WSJ: Paperwork Woes Plague Mortgage Plan

The administration last month gave borrowers who were current on their payments after at least three months an extension until Jan. 31 to provide needed paperwork. But the administration doesn't plan to extend that deadline, Assistant Treasury Secretary Michael Barr said Friday.No extension, but "further guidance".

"We are going to have further guidance for [mortgage] servicers at the end of the month," he said.

Unless something changes, distressed sales (foreclosures and short sales) should start to increase in February. BofA's estimates the number ...

"of homes being taken back by Bank of America [will] range from 11,000 to 14,000 a month in the early part of this year to 29,000 to 35,000 by November and December, said John Ciresi, vice president and portfolio manager for Bank of America in Towson, Md.Here comes the next wave of distressed sales, and based on the BofA estimates, the wave will build all year.

...

The system became "clogged" by a voluntary moratorium on foreclosures while banks met the requirements of President Obama's Making Home Affordable mortgage plan program and by state legislation requiring mediation before banks can start the foreclosure process, Ciresi said ...

Bank of America is getting 40,000 new offers a month on short sales, or homes offered for less than the mortgage balance, Ciresi said."

Here was an earlier post today: HAMP: 66,465 Permanent Mods

Here is the Press Release from Treasury: Administration Releases December Loan Modification Report, Update on Conversion Drive and the December HAMP report.

HAMP: 66,465 Permanent Mods

by Calculated Risk on 1/15/2010 12:21:00 PM

From Treasury: Administration Releases December Loan Modification Repot, Update on Conversion Drive Click on graph for larger image in new window.

Click on graph for larger image in new window.

Just over 66,000 modifications are now permanent, and this shows about a 43% failure rate (loans permanent divided by loans permanent + loans no longer active)

Here is the link at Treasury. See here for a list of reports.

If there were 270,000 cumulative HAMP trial modifications in July - how come there were only 66,465 permanent mods and 48,924 disqualified modifications by the end of December? The numbers don't add up.

What happened to the other 150,000+ modifications? I guess they have all been extended until the end of January.

And of the 787,231 active trial modifications, are all the borrowers current? My understanding was the HAMP data would show how many trial modifications had started, and the redefault rate by month. That key data is still missing.

Note: Nice misspelling in the press release title. I like "repot" for modifications!