by Calculated Risk on 8/17/2009 08:17:00 AM

Monday, August 17, 2009

Lowe's: 'Consumers Remain Cautious', Cuts Investment Plans

Press Release from Lowe's:

Lowe's Companies, Inc. ... the world's second largest home improvement retailer, today reported net earnings of $759 million for the quarter ended July 31, 2009, a 19.1 percent decline from the same period a year ago.According to the BEA data, home improvement has held up better than other areas of residential investment:

...

"Wavering consumer confidence, unseasonable weather in core markets, and restrained customer spending compared to last year's fiscal stimulus-aided results led to lower than expected sales in the second quarter," commented Robert A. Niblock, Lowe's chairman and CEO. "Cautious consumers remain reluctant to take on discretionary projects until signs of economic improvement are more evident."

...

In response to the challenging economic environment, which has resulted in declining demand for home improvement products, the company has re-evaluated its future store expansion plans. For 2010, expansion in North America will be below previously anticipated levels, and new store openings will likely be in the range of 35 to 45. Given this, the company has evaluated the pipeline of potential future store sites and made the decision to no longer pursue several projects.

emphasis added

Click on graph for updated image in new window.

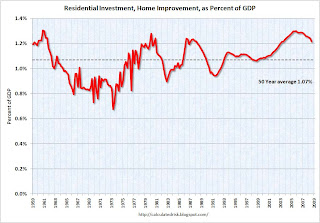

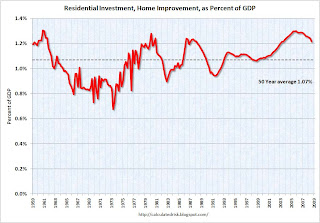

Click on graph for updated image in new window.This graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.08% of GDP, well off the high of 1.31% in Q4 2005 - but just back to the average of the last 50 years of 1.07%.

This would seem to suggest there remains downside risk to home improvement spending. Home Depot and Lowes are the largest home improvement retailers, and their results are something to watch.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.

Monday, May 18, 2009

Lowe's: "Pressures on consumers remain intense"

by Calculated Risk on 5/18/2009 08:41:00 AM

Press Release: Lowe's Reports First Quarter Sales and Earnings Results

"The economic pressures on consumers remain intense, and bigger ticket projects continue to be postponed as wary home improvement consumers watch the economic climate and housing market dynamics very closely," [Robert A. Niblock, Lowe's chairman and CEO said] "But, as spring arrived, we saw relative strength in smaller, outdoor projects."From the WSJ: Lowe's Earnings Slide 22%, Narrows Revenue Outlook

[Lowe's] now sees [fiscal-year] revenue ranging from down 2% to up 1%, from February's view of down 2% to up 2%. It still sees same-store sales down 4% to 8%.A 4% to 8% decline in same store sales is a very difficult environment and indicates that home improvement remains very weak.

Tuesday, February 24, 2009

Home Depot Sales Fell 17% in Q4

by Calculated Risk on 2/24/2009 08:45:00 AM

From the WSJ: Home Depot Posts Loss, Expects Earnings Below Views

Home Depot's sales fell by more than 17% in the fourth quarter and by nearly 8% on the year. The company expects them to fall another 9% in its 2009 fiscal year ...Hoocoodanode?

"We expect the home improvement market in 2009 will remain just as challenging as 2008," Chief Executive Frank Blake said in a release.

Friday, February 20, 2009

Lowe's: Same Store Sales to Decline 6% to 10%

by Calculated Risk on 2/20/2009 09:07:00 AM

From the WSJ: Lowe's Profit Drops Sharply, Evaluates Expenses

Lowe's Cos.' fiscal fourth-quarter net income dropped 60% on falling sales and margins as the world's second-largest home-improvement retailer projected earnings below analysts' expectations.According to the BEA data, home improvement has held up better than other areas of residential investment:

...

Lowe's expects first-quarter ... same-store sales falling 6% to 10%.

Chief Executive Robert Niblock said Friday economic pressures continued to sap consumer confidence and spending, resulting in weak same-store sales.

Click on graph for updated image in new window.

Click on graph for updated image in new window.This graph shows home improvement investment as a percent of GDP.

Home improvement was at 1.20% of GDP in Q4 2008, off the high of 1.30% in Q4 2005 - but still well above the average of the last 50 years of 1.07%.

This would seem to suggest there remains significant downside risk to home improvement spending over the next couple of years (although some analysts disagree with the BEA numbers).

Monday, February 02, 2009

Residential Investment Components

by Calculated Risk on 2/02/2009 11:09:00 AM

This is a first ... investment in home improvements exceeded investment in new single family structures for the first time ever in Q4 2008 (it was close in Q3).

Residential investment, according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $170.8 billion Seasonally Adjusted Annual Rate (SAAR) in Q4, above investment in single family structures of $150.2 billion (SAAR) for the first time ever.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 1.05% of GDP, significantly below the average of the last 50 years of 2.35% - and also below the previous record low in 1982 of 1.20%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.20% of GDP, off the high of 1.30% in Q4 2005 - but still well above the average of the last 50 years of 1.07%.

This would seem to suggest there remains significant downside risk to home improvement spending over the next couple of years.

Tuesday, November 18, 2008

Home Depot Forecasts Annual Sales off 8%

by Calculated Risk on 11/18/2008 08:51:00 AM

From the Home Depot Press Release today:

Given the continued softness in the housing and home improvement markets as well as negative macro economic conditions, the Company now believes that fiscal 2008 sales could be down as much as 8 percent for the year.Back in August, Home Depot forecast 2008 sales off 5%:

[T]he Company believes fiscal 2008 sales will decline by approximately five percent ...This forecast revision - just 3 months later - suggests a double digit sales decline in the 2nd half of '08 (to make up the difference in forecasts).

Ouch.

Monday, November 17, 2008

Lowe's: "decline in sales trends" in November

by Calculated Risk on 11/17/2008 08:39:00 AM

"We expect continued, broad-based external pressures on our industry, as rising unemployment, falling home prices, tight credit and volatile equity markets continue to erode consumer confidence and impact sales," [Robert A. Niblock, Lowe's chairman and CEO said]. "While falling energy prices and initial signs of stabilization in housing turnover should aid the consumer, we saw a decline in sales trends in the last week of October that continued into November as the overall economic outlook deteriorated. In light of the difficult environment, we remain cautious in the near term and focused on providing great service to customers, increasing market share, controlling expenses, and appropriately managing capital expenditures to drive long-term returns for shareholders."

emphasis added

Friday, November 14, 2008

Quote of the Day: Home Improvement

by Calculated Risk on 11/14/2008 08:57:00 PM

"Armageddon is here."Note: this was private and I can't reveal the source or company (I have no position in the company)

a private comment from a Senior Buyer at a home improvement retailer, Nov 13, 2008

From a previous post, here are a couple of graphs on two key components of Residential Investment (RI):

Click on graph for larger image in new window.

Click on graph for larger image in new window.As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

Currently investment in single family structures is at 1.22% of GDP, significantly below the average of the last 50 years of 2.35% - and just above the record low in 1982 of 1.20%.

But what about home improvement?

The second graph shows home improvement investment as a percent of GDP.

The second graph shows home improvement investment as a percent of GDP.Home improvement is at 1.21% of GDP, off the high of 1.3% in Q4 2005 - but still well above the average of the last 50 years of 1.07%. Maybe lenders are boosting home improvement spending fixing up all those damaged REOs!

This would seem to suggest there is significant downside risk to home improvement spending over the next couple of years.

Lowe's is scheduled to announce results on Monday and Home Depot on Tuesday.

Friday, October 31, 2008

Residential Investment and Home Improvement

by Calculated Risk on 10/31/2008 11:49:00 AM

We frequently discuss "residential investment" (RI) without mentioning the components of RI according to the Bureau of Economic Analysis (BEA). Residential investment includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement ($175.2 billion SAAR) is almost at the same level as investment in single family structures ($176.0 billion SAAR) in Q3 2008.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

Currently investment in single family structures is at 1.22% of GDP, significantly below the average of the last 50 years of 2.35% - and just above the record low in 1982 of 1.20%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.21% of GDP, off the high of 1.3% in Q4 2005 - but still well above the average of the last 50 years of 1.07%. Maybe lenders are boosting home improvement spending fixing up all those damaged REOs!

This would seem to suggest there is significant downside risk to home improvement spending over the next couple of years.

Tuesday, August 19, 2008

Home Depot: Same Store Sales Off 7.9%

by Calculated Risk on 8/19/2008 08:18:00 AM

From Home Depot: The Home Depot Announces Second Quarter Results

Sales for the second quarter totaled $21.0 billion, a 5.4 percent decrease from the second quarter of fiscal 2007, reflecting negative comparable store sales of 7.9 percent, offset in part by sales from new stores.And the beat goes on ...

...

"We continue to see pressure on our market and the consumer, generally," said Frank Blake, chairman & CEO. ...

Given the continued softness in the housing and home improvement markets as well as the commitment to invest in its key retail priorities, the Company believes fiscal 2008 sales will decline by approximately five percent ... This is consistent with its previous guidance.

Monday, August 18, 2008

Lowe's: Same Store Sales decline 5.3%

by Calculated Risk on 8/18/2008 09:16:00 AM

From MarketWatch: Housing malaise eats into Lowe's net

Lowe's said while big-ticket item purchases continued to be hurt by the housing downturn, it saw relative strength in seasonal sales as homeowners restored lawns and outdoor landscaping after last year's drought in much of the country. The company said it also benefited from the stimulus checks from the U.S. government.Last quarter, Lowe's same store sales declined 8.4%. The stimulus checks probably helped some this quarter, but I expect the 2nd half of '08 will be difficult for home improvement retailers. Home Depot reports tomorrow.

...

Sales rose 2.4% to $14.5 billion as the company opened in more locations. Same-store sales, or sales at stores open at least a year, dropped 5.3%.

Tuesday, August 05, 2008

Home Improvement Investment

by Calculated Risk on 8/05/2008 10:37:00 AM

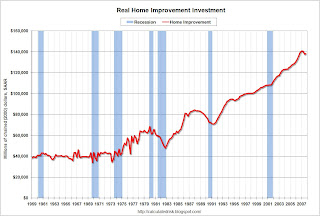

The Bureau of Economic Analysis released the underlying detail tables to the Q2 GDP report this morning. These estimates suggest that home improvement investment is still holding up pretty well. Click on graph for larger image in new window.

Click on graph for larger image in new window.

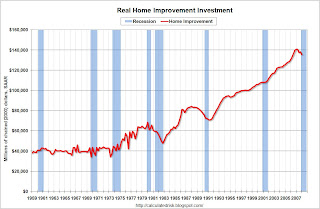

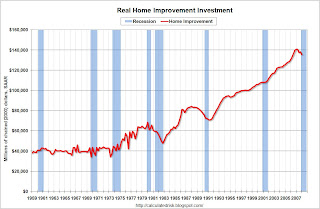

The first graph shows home improvement investment in real 2000 dollars.

Unlike during the housing slumps of the early '80s and early '90s, home improvement has not declined significantly during this housing bust.

This suggests there could be more downside for home improvement, especially with homeowners less able to borrow against their homes. The second graph shows investment in single family structures and home improvement as a percent of GDP.

The second graph shows investment in single family structures and home improvement as a percent of GDP.

Historically, the booms and busts in single family structure investment have been more pronounced than for home improvement. Note the different scales for single family structures and home improvement.

Still, home improvement investment is well above the normal range, as a percent of GDP, and investment could easily fall to 1.0% or less of GDP.

Sunday, June 15, 2008

Home Improvement Break Down

by Calculated Risk on 6/15/2008 07:02:00 PM

There was a blurb in the WSJ last week about hedge-fund manager Edward Lampert: Lampert Puts Money On Housing Rebound.

Although Lampert invested in several housing related stocks, the vast majority of his housing related investment is in home improvement (specifically Home Depot).

Let's take another look at home improvement (Important Note: this is not investment advice). Home Depot recently held an investor conference on June 5th, and here is the presentation material from CEO Frank Blake (hat tip Dave). In general I think Mr. Blake was very realistic about the tough economic environment for home improvement.

The first slide from Mr. Blake is very familiar to readers of CR: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows residential investment (RI) as a percent of GDP for the last 60 years. Blake has added the average of 4.8% on the graph, and clearly RI is well below the average.

Note: I usually present the last 50 years, and the average is closer to 4.6%.

This might convince some people that the end is near in the slump in RI. But let's break it down by two key components of RI: new single family structures and home improvement.

**************************

The next graph shows residential investment in new single family structures as a percent of GDP. As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

Currently investment in single family structures is below 1.6% of GDP, significantly below the average of the last 40 years of 2.4% - although still above the low in 1982 of 1.2%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.3% of GDP, off the high of 1.4% in Q1 2007 - but still well above the average of the last 40 years of 1.07%.

This would seem to suggest there is significant downside risk to home improvement spending over the next few years.

And finally, Mr. Blake presented this graph on subprime and Alt-A mortgage origination. This shows the stunning surge in subprime and Alt-A lending starting in 2004 and running well into 2007.

This shows the stunning surge in subprime and Alt-A lending starting in 2004 and running well into 2007.

The graph is captioned: "The worst part of the mortgage market is behind us", but it probably should have been captioned "Worst part of mortgage origination is behind us".

The fallout from these poorly underwritten loans happens when these houses fall into foreclosure, and delinquency and foreclosure rates are still rising - and rising sharply for Alt-A and even prime loans. The worst of the origination is definitely behind us, but the worst of the impact on the economy from this poor underwriting is probably still to come.

Tuesday, May 20, 2008

Home Depot: "Home-improvement conditions worsened"

by Calculated Risk on 5/20/2008 09:04:00 AM

From the WSJ: Home Depot's Net Falls 66% As Homeowners Cut Projects

Home Depot Inc. reported a 66% drop in fiscal first-quarter net income, thanks in part to restructuring charges, as it continues to suffer amid economic conditions that have been discouraging homeowners from spending on home-improvement projects.This is not a surprise. And it could get much worse.

...

"The housing and home-improvement markets remained difficult in the first quarter. In fact, conditions worsened in many areas of the country," Chairman and Chief Executive Frank Blake said.

Monday, May 19, 2008

Lowe's same-store sales expected to fall 6% to 7%

by Calculated Risk on 5/19/2008 09:53:00 AM

From the WSJ: Lowe's Posts 18% Fall in Net, Lowers Earnings Outlook

Lowe's Cos. reported an 18% drop in fiscal first-quarter net income and lowered its outlook for the year ...Based on previous housing downturns, there is much more pain to come for the home improvement bust. For a couple of historical charts on home improvement spending, see More on Home Improvement Investment.

Looking forward, the ... company lowered its guidance ... with same-store sales expected to fall 6% to 7%.

Chairman and Chief Executive Robert A. Niblock said consumer confidence slipped during the latest quarter and discretionary home purchases were called back, reflecting "the generally poor economic outlook" due to housing pressures, rising food and fuel prices and "a more negative employment picture."

Wednesday, May 07, 2008

More on Home Improvement Investment

by Calculated Risk on 5/07/2008 06:27:00 PM

Last week I presented a chart of home improvement investment in real terms. I argued that home improvement spending could fall 15% to 20% in real terms based on previous home improvement slumps.

Here is the chart: Click on graph for larger image.

Click on graph for larger image.

The BEA reports that real spending on home improvement fell 2% in Q1 2008 (from Q4 2007), and has fallen about 4% in real terms from the peak. This is probably just the beginning of the home improvement slump; if this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Note: This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue with the current recession "probable". (source: BEA) Here is a 2nd graph in nominal terms comparing residential investment in single family structures (left scale), with investment in home improvement (right scale).

Here is a 2nd graph in nominal terms comparing residential investment in single family structures (left scale), with investment in home improvement (right scale).

This graph shows how sharp the decline in single family structure investment has been - and how little impact (so far) the housing bust has had on home improvement spending. I don't expect the improvement investment slump to be anywhere near as severe as the single family structure collapse, but this does show there is potentially a significant downside.

Thursday, May 01, 2008

Home Improvement Investment

by Calculated Risk on 5/01/2008 01:53:00 PM

The BEA released the supplemental tables to the GDP report this morning. One of the interesting details is real spending on home improvement.

Almost exactly one year ago, I wrote that home improvement investment was holding up pretty well (see What Home Improvement Investment Slump?) - and I didn't expect that to continue. Click on graph for larger image.

Click on graph for larger image.

The BEA reports that real spending on home improvement fell 2% in Q1 2008 (from Q4 2007), and has fallen about 4% in real terms from the peak. This is probably just the beginning of the home improvement slump; if this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Note: This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue with the current recession "probable". (source: BEA)

Home Depot Reduces Capital Spending Plans

by Calculated Risk on 5/01/2008 09:43:00 AM

Press Release: The Home Depot Updates Square Footage Growth Plans

The Company has determined that it will no longer pursue the opening of approximately 50 U.S. stores that have been in its new store pipeline ...Of course Home Depot is being hit hard by the slump in home improvement spending, but this is another company significantly reducing capital spending.

Aggregate new store capital spending will be reduced by approximately $1 billion over the next three years ...

The Company reiterated that its total capital spending for the current fiscal year is projected to be approximately $2.3 billion, down from $3.6 billion last year.

The Company also announced that [it] will close 15 underperforming U.S. stores that do not meet the Company's targeted returns.

Thursday, April 17, 2008

Study: Home-Remodeling Spending To Fall 4.8% through 2008

by Calculated Risk on 4/17/2008 05:07:00 PM

From Dow Jones: Home-Remodeling Spending To Fall 4.8% Through '08 - Study

Home-improvement spending is unlikely to improve until 2009, and the second half of 2008 is shaping up to be weaker than the first, according to Harvard University's Joint Center for Housing Studies.I think this might be optimistic. First, falling house prices and the inability for homeowners to borrow against their homes (mortgage equity withdrawal) are probably "inhibiting remodeling spending" more than the weakening economy and consumer confidence.

Falling consumer confidence and a weakening economy are inhibiting remodeling spending, which is expected to fall by an annual rate of 4.8% through the end of 2008, the center said Thursday. That is steeper than the 2.6% annualized decline the center projected through the third quarter when it last updated its Leading Indicator of Remodeling Activity in January.

Second, we have recently seen warnings from Home Depot and Lowe's that suggest same store sales are falling off a cliff (about 8% year-over-year).

And third, the Joint Center for Housing Studies forecast is mild compared to declines in home improvement spending during previous housing busts.

Click on graph for larger image.

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue (source: BEA)

As of Q4 2007, real spending on home improvement had held up pretty well (only off 2% in real terms from the peak). If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Yes, the Joint Center for Housing Studies forecast is in nominal terms, but it appears they believe this slump in home improvement will be milder than the downturns during the previous two housing busts (early '80s and early '90s).

Monday, February 25, 2008

Lowe's Same Store Sales Sequentially Worse

by Calculated Risk on 2/25/2008 10:49:00 AM

This morning, Lowe's reported same-store sales declined 7.6% for the quarter.

But sequentially sales are even worse.

From the Lowe's conference call:

Same Store sales fell 4% in November (YoY)

Same store sales fell 9% in December

Same store sales fell 11% in January

CEO Niblock said he was "a bit surprised" by the weakness.