by Calculated Risk on 6/14/2010 03:54:00 PM

Monday, June 14, 2010

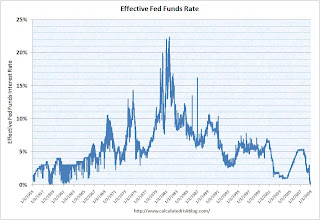

When will the Fed raise rates?

Over the last year a number of analysts have predicted the Fed would raise the Fed Funds rate "soon". They have all been wrong.

The Fed's mission is to conduct "monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates". Historically the Fed has not raised the Fed Funds rate until unemployment drops significantly. Based on the the Fed's own forecasts of the unemployment rate and inflation, the Fed will probably not raise the Fed Funds rate until late 2011 at the earliest.

San Francisco Fed senior vice president and associate director of research Glenn Rudebusch writes: The Fed's Exit Strategy for Monetary Policy

Rudebusch's economic letter suggests that the Fed might not raise rates until 2012 ...

The graph from Rudebusch's shows a modified Taylor rule. According to Rudebusch's estimate, the Fed Funds rate should be around minus 5% right now if we ignore unconventional policy (obviously there is a lower bound):

The resulting simple policy guideline recommends lowering the funds rate by 1.3 percentage points if inflation falls by 1 percentage point and by almost 2 percentage points if the unemployment rate rises by 1 percentage point.

...

Figure 1 also provides a simple perspective on when the Fed should raise the funds rate. The dashed line combines the benchmark rule of thumb with the Federal Open Market Committee’s median economic forecasts (FOMC 2010), which predict slowly falling unemployment and continued low inflation. The dashed line shows that to deliver future monetary stimulus consistent with the past—and ignoring the zero lower bound—the funds rate would be negative until late 2012. In practice, this suggests little need to raise the funds rate target above its zero lower bound anytime soon.

Rudebusch them modifies the rule taking into account unconventional policy.

Rudebusch them modifies the rule taking into account unconventional policy. Even though the funds rate was pushed to its zero lower bound by the end of 2008, considerable scope remained to lower long-term interest rates. To do this, the Fed started buying longer-term Treasury and federal agency debt securities ...Perhaps the unemployment rate will decline faster than expected - or inflation will increase - but right now I wouldn't expect an increase in the Fed Funds rate for a long long time ...

The additional stimulus from the Fed’s unconventional monetary policy implies that the appropriate level of short-term interest rates would be higher than shown in Figure 1. ... If the Fed’s purchases reduced long rates by ½ to ¾ of a percentage point, the resulting stimulus would be very roughly equal to a 1½ to 3 percentage point cut in the funds rate. Assuming unconventional policy stimulus is maintained, then the recommended target funds rate from the simple policy rule could be adjusted up by approximately 2¼ percentage points, as shown in Figure 3, and the recommended period of a near-zero funds rate would end at the beginning of 2012.

Wednesday, April 28, 2010

FOMC Statement: Economic activity has continued to strengthen

by Calculated Risk on 4/28/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in March suggests that economic activity has continued to strengthen and that the labor market is beginning to improve. Growth in household spending has picked up recently but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly; however, investment in nonresidential structures is declining and employers remain reluctant to add to payrolls. Housing starts have edged up but remain at a depressed level. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.The key language about rates stayed the same: "The Committee ... continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

In light of improved functioning of financial markets, the Federal Reserve has closed all but one of the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities; it closed on March 31 for loans backed by all other types of collateral.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly.

The comments on the economy were slightly more positive.

On housing, here is the language over the last several statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

March, 2010: housing starts have been flat at a depressed level

April, 2010: Housing starts have edged up but remain at a depressed level

At least this time the Fed didn't confuse an increase in housing activity with accomplishment!

Tuesday, March 16, 2010

FOMC Statement: Economic Activity "Continued to strengthen"

by Calculated Risk on 3/16/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in January suggests that economic activity has continued to strengthen and that the labor market is stabilizing. Household spending is expanding at a moderate rate but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly. However, investment in nonresidential structures is declining, housing starts have been flat at a depressed level, and employers remain reluctant to add to payrolls. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.The key language about rates stayed the same: "The Committee ... continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve has been purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt; those purchases are nearing completion, and the remaining transactions will be executed by the end of this month. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

In light of improved functioning of financial markets, the Federal Reserve has been closing the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities and on March 31 for loans backed by all other types of collateral.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to the buildup of financial imbalances and increase risks to longer-run macroeconomic and financial stability.

Another key point was that the FOMC reiterated the ending dates for the MBS purchases. The Fed is giving advance warning that these purchases will expire as previously announced.

There is some concern about what will happen when the Fed stops buying agency MBS. The important thing to remember is that there will be buyers; it is just a matter of price. My guess is that mortgage rates will rise about 35 bps relative to the Ten Year treasury over several months after the Fed stops buying MBS. The Fed's Brian Sack and others have argued for 10 bps or less.

Another important point in the Fed statement was the recognition that the housing sector is not as strong as it appeared at the end of last year. Here is the language on housing over the last few statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

March, 2010: housing starts have been flat at a depressed level

This was the first one day Fed meeting since September 16, 2008 - and that probably says something too.

Wednesday, February 10, 2010

Bernanke: Federal Reserve's exit strategy

by Calculated Risk on 2/10/2010 10:01:00 AM

Fed Chairman Ben Bernanke's prepared statement: Federal Reserve's exit strategy. In this testimony, Bernanke outlines the steps to unwind monetary stimulus. An excerpt:

I currently do not anticipate that the Federal Reserve will sell any of its security holdings in the near term, at least until after policy tightening has gotten under way and the economy is clearly in a sustainable recovery. However, to help reduce the size of our balance sheet and the quantity of reserves, we are allowing agency debt and MBS to run off as they mature or are prepaid. The Federal Reserve is currently rolling over all maturing Treasury securities, but in the future it may choose not to do so in all cases. In the long run, the Federal Reserve anticipates that its balance sheet will shrink toward more historically normal levels and that most or all of its security holdings will be Treasury securities. Although passively redeeming agency debt and MBS as they mature or are prepaid will move us in that direction, the Federal Reserve may also choose to sell securities in the future when the economic recovery is sufficiently advanced and the FOMC has determined that the associated financial tightening is warranted. Any such sales would be at a gradual pace, would be clearly communicated to market participants, and would entail appropriate consideration of economic conditions.A few points:

As a result of the very large volume of reserves in the banking system, the level of activity and liquidity in the federal funds market has declined considerably, raising the possibility that the federal funds rate could for a time become a less reliable indicator than usual of conditions in short-term money markets. Accordingly, the Federal Reserve is considering the utility, during the transition to a more normal policy configuration, of communicating the stance of policy in terms of another operating target, such as an alternative short-term interest rate. In particular, it is possible that the Federal Reserve could for a time use the interest rate paid on reserves, in combination with targets for reserve quantities, as a guide to its policy stance, while simultaneously monitoring a range of market rates. No decision has been made on this issue; we will be guided in part by the evolution of the federal funds market as policy accommodation is withdrawn. The Federal Reserve anticipates that it will eventually return to an operating framework with much lower reserve balances than at present and with the federal funds rate as the operating target for policy.

Wednesday, December 16, 2009

FOMC Statement: No Change

by Calculated Risk on 12/16/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in November suggests that economic activity has continued to pick up and that the deterioration in the labor market is abating. The housing sector has shown some signs of improvement over recent months. Household spending appears to be expanding at a moderate rate, though it remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment, though at a slower pace, and remain reluctant to add to payrolls; they continue to make progress in bringing inventory stocks into better alignment with sales. Financial market conditions have become more supportive of economic growth. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability.Update:

With substantial resource slack likely to continue to dampen cost pressures and with longer-term inflation expectations stable, the Committee expects that inflation will remain subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter of 2010. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets.

In light of ongoing improvements in the functioning of financial markets, the Committee and the Board of Governors anticipate that most of the Federal Reserve’s special liquidity facilities will expire on February 1, 2010, consistent with the Federal Reserve’s announcement of June 25, 2009. These facilities include the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility. The Federal Reserve will also be working with its central bank counterparties to close its temporary liquidity swap arrangements by February 1. The Federal Reserve expects that amounts provided under the Term Auction Facility will continue to be scaled back in early 2010. The anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30, 2010, for loans backed by new-issue commercial mortgage-backed securities and March 31, 2010, for loans backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

Tuesday, December 08, 2009

Morgan Stanley: Fed to Raise Rates in 2nd Half of 2010

by Calculated Risk on 12/08/2009 01:47:00 PM

In a research note titled: "The Fed Will Exit in 2010", Morgan Stanley's Richard Berner and David Greenlaw forecast that the Fed will raise the Fed Funds rate in the 2nd half of 2010 to 1.5%.

They are forecasting GDP to increase 2.8% in both 2010 and 2011, and for unemployment to peak in Q1 2010 at 10.3%, and decline to 9.5% in 2011.

The GDP and unemployment rate forecasts are consistent with each other (see my post: Employment and Real GDP), but the real question is why do they expect the Fed to raise rates in the 2nd half of 2010 with a sluggish recovery?

The reason is they expect inflation expectations to pickup, and the Fed to react by raising rates (to 1.5% by the end of 2010, and 2.0% by the end of 2011). That would be unusually since the Fed historically waits until sometime well after the unemployment rate peaks.

The following graph is from I post I wrote in September: Fed Funds and Unemployment Rate Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Here is more from Paul Krugman: When should the Fed raise rates? (even more wonkish)

Goldman Sachs recently forecast that the Fed will be on hold through 2011:

The key features of our 2011 outlook: (1) a strengthening in growth from 2.1% on average in 2010 to 2.4% in 2011, with real GDP rising at an above-potential 3½% pace in late 2011; (2) a peaking in unemployment in mid-2011 at about 10¾%; (3) extremely low inflation – close to zero on a core basis during 2011; and (4) a continuation of the Fed’s (near) zero interest rate policy (ZIRP) throughout 2011.Although there are other considerations - such as inflation expectations, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011 or even later.

Tuesday, November 17, 2009

Fed's Lacker: Fed Can't be "paralyzed by patches of lingering weakness"

by Calculated Risk on 11/17/2009 10:46:00 AM

From Richmond Fed President Jeffrey Lacker The Economic Outlook:

Earlier this year some economists were highlighting the risk that the low level of economic activity could push the rate of inflation down, perhaps even below zero. I think the risk of a substantial further reduction in inflation has diminished substantially since then. The historical record suggests that the early years of a recovery is when the risk is greatest that confidence in the stability of inflation erodes and we see an upward drift in inflation and inflation expectations. This risk could be particularly pertinent to the current recovery, given the massive and unprecedented expansion in bank reserves that has occurred, and the widespread market commentary expressing uncertainty over whether the Federal Reserve is willing and able to promptly reverse that expansion.Lacker is one of the inflation hawks on the FOMC.

As a technical matter, I do not see any problem – we do have the tools to remove as much monetary stimulus as necessary to keep inflation low and stable. The harder problem is the same one that we face after every recession, which is choosing when and how rapidly to remove monetary stimulus. There is no doubt that we must be aware of the danger of aborting a weak, uneven recovery if we tighten too soon. But if we hope to keep inflation in check, we cannot be paralyzed by patches of lingering weakness, which could persist well into the recovery. In assessing when we will need to begin taking monetary stimulus out, I will be looking for the time at which economic growth is strong enough and well-enough established, even if it is not yet especially vigorous.

First, I think we could see further declines in inflation in 2010; even the possibility of core PCI deflation. I don't think the risk of further declines has "diminished substantially".

Second, I think Q3 GDP will be revised down based on subsequent data (like the trade report), and GDP growth will be lower than Lacker expects in early 2010. I think Lacker is overly optimistic on the economy.

Also - historically the Fed hasn't raised rates until well after unemployment peaks, and I doubt they will raise rates until late in 2010 at the earliest (and probably later). Here is a graph from a previous post in September (the unemployment rate is now 10.2%):

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Monday, October 12, 2009

Fed's Bullard: Falling Unemployment Rate "Prerequisite" for Rate Increase

by Calculated Risk on 10/12/2009 10:07:00 PM

Usually this would be a "duh", but with some of the Fed talk recently, this is worth noting ...

From Bloomberg: Bullard Says Lower Unemployment Condition to Tighten

...“You want some jobs growth and unemployment coming down. That is a prerequisite” for an increase in interest rates, Bullard said. “It doesn’t mean you need unemployment all the way down to more normal levels.”As Paul Krugman noted this weekend, we are a long way from when the Fed will raise rates.

...

Bullard, referring to a prior jobless rate of 10.8 percent, said “I don’t think we will quite hit the peak we hit in 1982, but things have surprised us before.”

...

“I’m the north pole of inflation hawks,” Bullard said. “But we are trying to describe optimal policy, some optimal outcomes in an environment where inflation is below target -- we have an implicit target of 1.5 to 2 percent -- and you have the specter of a Japanese-style outcome, which I have worried about and some other members of the FOMC have worried about.”

...

“It is a little disappointing that private-sector economists are thinking so much about when we are going to move our fed funds rate up,” he said. “We are at zero. We are going to be there awhile. The focus should be more on” the Fed’s asset purchase program.

Sunday, October 11, 2009

More on When the Fed might Raise Rates

by Calculated Risk on 10/11/2009 04:45:00 PM

From Paul Krugman: When should the Fed raise rates? (even more wonkish)

Let me start with a rounded version of the Rudebusch version of the Taylor rule:This is all back-of-the-envelope stuff - and maybe NAIRU or core inflation will be a little higher (although I think core inflation might be lower next year because of declining owners' equivalent rent).

Fed funds target = 2 + 1.5 x inflation - 2 x excess unemployment

where inflation is measured by the change in the core PCE deflator over the past four quarters (currently 1.6), and excess unemployment is the different between the CBO estimate of the NAIRU (currently 4.8) and the actual unemployment rate (currently 9.8).

Right now, this rule says that the Fed funds rate should be -5.6%. So we’re hard up against the zero bound.

Suppose that core inflation stays at 1.6% (although in fact it’s almost sure to go lower.) Then we can back out the unemployment rate at which the target would cross zero, suggesting that tightening should begin: it’s an excess unemployment rate of 2.2, implying an actual rate of 7 percent. That’s a long way from here. ...

If we use Krugman's analysis, and the recent CBO projections for the average annual unemployment rate (10.2% in 2010, 9.1% in 2011, and 7.2% in 2012), the Fed would not raise rates until some time in 2012.

Last month I wrote:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)Maybe 2011. Or maybe 2012. But talk of a rate hike in early 2010 seems crazy ...

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

Thursday, October 08, 2009

NY Times: Divergent Fed Views

by Calculated Risk on 10/08/2009 09:05:00 PM

From the Edmund Andrews at the NY Times: Rift Emerges in Fed Over When to Tighten Money

Fissures are developing among policy makers at the Federal Reserve as they debate how and when to start raising the benchmark interest rate from its current level just above zero.And on the other side:

...

One hint of the discord came Tuesday, in a speech by Thomas M. Hoenig, president of the Federal Reserve Bank of Kansas City.

Though he stopped short of calling for immediate rate increases, Mr. Hoenig made it clear that he was getting impatient.

“My experience tells me that we will need to remove our very accommodative policy sooner rather than later,” he told an audience of business executives. ...

And he is not alone.

Richard Fisher, president of the Federal Reserve Bank of Dallas, sent a similar message in a speech on Sept. 29. “That wind-down process needs to begin as soon as there are convincing signs that economic growth is gaining traction,” he told a business group.

Other Fed officials [have] similar views ...

“The turnaround is certainly welcome, but it shouldn’t be overstated,” Daniel K. Tarullo, a Fed governor ...As I noted last month, it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks.

“Some observers are concerned that this expansion will ultimately prove to be inflationary,” William C. Dudley, president of the New York Fed told an audience at the Fordham University’s Corporate Law Center. “This concern is not well founded.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

And from Chairman Bernanke tonight:

When the economic outlook has improved sufficiently, we will be prepared to tighten the stance of monetary policy and eventually return our balance sheet to a more normal configuration.Some people are taking that as tough talk, see: Dollar Rises After Bernanke Says Fed Ready to ‘Tighten’ Policy, but I disagree - I think "improved sufficiently" means Bernanke will wait for a meaningful decline in the unemployment rate.

Monday, September 21, 2009

Fed Funds and Unemployment Rate

by Calculated Risk on 9/21/2009 07:04:00 PM

The Real Time Economics blog at the WSJ discusses expectations for the Fed two day meeting that starts tomorrow: Expect Patience From the Fed (note: the statement will be released on Wednesday).

No one expects a rate hike, and the main focus will be on the economic outlook and whether MBS purchases will slow. Last month, the FOMC statement noted "economic activity is leveling out", and the statement this month might be slightly more positive.

The Fed also announced last month: "To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions ..."

And this month the committee might announce a "smooth transition" for the purchases of agency mortgage-backed securities - and extend the deadline a few months into 2010.

As far as "patience", the Fed's mission is to conduct "monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates". So unless inflation picks up significantly (unlikely in the near term with so much slack in the system), it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

Saturday, August 22, 2009

Fed's Bullard: Rates to Stay Low Longer than Market Expects

by Calculated Risk on 8/22/2009 01:37:00 PM

From Felix Salmon at Reuters: Fed official: rates to be kept low past upturn (ht Anthony)

Financial markets have not fully understood that the U.S. Federal Reserve's pledge to keep interest rates exceptionally low for an extended period means they will stay low beyond when officials normally would raise them, a top Fed official said on Friday.Bullard is repeating the FOMC statement:

"I don't think markets have really digested what that means," St Louis Fed President James Bullard said in an interview.

The Fed's strategy is aimed at promoting a future rise in inflation, which should provide an immediate boost in activity in anticipation of a future boom, but that hasn't happened, Bullard said.

The Committee ... continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.Bullard thinks the markets haven't "digested what that means" - rates will be low for a long time - maybe through much or all of 2010.

Here is an interview with Bullard on a few other subjects, expects slow growth, discusses unwinding current policy.

Wednesday, August 12, 2009

FOMC Statement

by Calculated Risk on 8/12/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in June suggests that economic activity is leveling out. Conditions in financial markets have improved further in recent weeks. Household spending has continued to show signs of stabilizing but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment and staffing but are making progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

The prices of energy and other commodities have risen of late. However, substantial resource slack is likely to dampen cost pressures, and the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve is in the process of buying $300 billion of Treasury securities. To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions and anticipates that the full amount will be purchased by the end of October. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

emphasis added

Saturday, July 25, 2009

The Taylor Rule Debate

by Calculated Risk on 7/25/2009 09:11:00 AM

From Bloomberg: Taylor Says Fed Gets Rule Right, Goldman Doesn’t

Economists from Goldman Sachs Group Inc., Macroeconomic Advisers LLC, Deutsche Bank Securities Inc. and even the San Francisco Federal Reserve Bank argue the Taylor Rule, a pointer for finding the correct level for interest rates, suggests the Fed should be doing a lot more to stimulate the economy.And from Goldman's Hatzius (June 2nd, no link):

Taylor said his measure shows just the opposite: that Fed policy is appropriate, that central bankers are right to be considering how to withdraw their unprecedented monetary stimulus and that critics who say otherwise are misinterpreting his rule. The formula is designed to show the best rate for spurring growth without stoking inflation.

“They say they’re using the Taylor Rule, but they’re not,” Taylor, an economist at Stanford University in Stanford, California, said in an interview. “My rule does suggest a long time before we raise rates. But it also does suggest an earlier rate increase than you would think.”

[S]everal highly respected voices have weighed in on this debate, with arguments that imply a smaller need for Fed balance sheet expansion than suggested by our calculations. The first challenge came from Professor John Taylor—father of the eponymous rule—at an Atlanta Fed conference (see “Systemic Risk and the Role of Government,” May 12, 2009). Taylor argued that his rule implies a fed funds rate of +0.5%. He specifically attacked a reported Fed staff estimate of an “optimal” Taylor rate of -5% as having "... both the sign and the decimal point wrong.”Back in May, using then current data, Professor Taylor argued his rule implied a fed funds rate of plus 0.5 percent. Now Dr. Taylor argues current data suggest a rate of negative 0.955 percent.

What’s going on? The answer can be seen in a note published by Glenn Rudebusch of the San Francisco Fed [in May]; it justifies the Fed’s -5% figure and reads like a direct reaction to Taylor’s criticism, even though it does not reference his speech (see “The Fed’s Monetary Policy Response to the Current Crisis,” FRBSF Economic Letter 2009-17, May 22, 2009). The difference is fully explained by two choices. First, Taylor uses his “original” rule with an assumed (but not econometrically estimated) coefficient of 0.5 on both the output gap and the inflation gap, while the Fed uses an estimated rule with a bigger coefficient on the output gap. Second, Taylor uses current values for both gaps, while the Fed’s estimate of a -5% rate refers to a projection for the end of 2009, assuming a further rise in the output gap and a decline in core inflation.

Rudebusch uses a much larger coefficient for the output gap, and his method - with 9.5% unemployment - would suggest a -5.0% Fed Funds Rate currently. Since his method is also forward looking and assumes a higher unemployment rate later this year (very likely) Rudebusch approach suggests an even lower Fed Funds rate.

For the Fed Funds rate, with a zero bound, this debate doesn't matter right now - but it will matter in the future. But the debate does matter now for the Fed's other policies, as noted in the Bloomberg article:

Since the Fed can’t lower rates to less than zero, the Taylor rule means the central bank has to pump money into the economy through other methods, such as purchases of Treasuries, mortgage securities and agency bonds.Taylor argues the Fed doesn't need to use these other methods - at least not much - Rudebusch would argue these other methods are needed.

Note: Here is a spreadsheet for Rudebusch's Taylor rule method.

Wednesday, June 24, 2009

FOMC Statement

by Calculated Risk on 6/24/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in April suggests that the pace of economic contraction is slowing. Conditions in financial markets have generally improved in recent months. Household spending has shown further signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit. Businesses are cutting back on fixed investment and staffing but appear to be making progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.Update: Deflation concern last month:

The prices of energy and other commodities have risen of late. However, substantial resource slack is likely to dampen cost pressures, and the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve will buy up to $300 billion of Treasury securities by autumn. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.This time:

The prices of energy and other commodities have risen of late. However, substantial resource slack is likely to dampen cost pressures, and the Committee expects that inflation will remain subdued for some time.

Tuesday, June 23, 2009

Fed Meeting Tuesday and Wednesday

by Calculated Risk on 6/23/2009 12:05:00 AM

The Fed is meeting over the next two days, and although there is no chance of a change in the federal funds rate, it is possible the Fed will announce additional purchases of Treasury securities or agency MBS (I think this is unlikely) or change the Fed statement to reflect the view that the federal funds rate will stay at essentially zero for some time (this is very possible).

The most recent statement read:

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.The "exceptionally low levels" phrase might have confused some people into thinking that a modest rate hike was coming soon, so it is possible that the Fed will change that phrase to indicate "the current low levels ... for an extended period."

No one expects a rate change this week, but a few investors expect a rate increase by August. This graph from the Cleveland Fed shows public expectations of the Fed Funds rate after the August meeting. Maybe the Fed will try to change those expectations.

A short preview from Bloomberg ...

Wednesday, April 29, 2009

FOMC Statement: As Previous Announced, Will Buy $1.75 Trillion in MBS, Agency Debt and Treasuries

by Calculated Risk on 4/29/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in March indicates that the economy has continued to contract, though the pace of contraction appears to be somewhat slower. Household spending has shown signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit. Weak sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories, fixed investment, and staffing. Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time. Nonetheless, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve will buy up to $300 billion of Treasury securities by autumn. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is facilitating the extension of credit to households and businesses and supporting the functioning of financial markets through a range of liquidity programs. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of financial and economic developments.

Wednesday, January 28, 2009

FOMC: Prepared to Purchase Longer-Term Treasuries

by Calculated Risk on 1/28/2009 02:15:00 PM

The Federal Open Market Committee decided today to keep its target range for the federal funds rate at 0 to 1/4 percent. The Committee continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.

Information received since the Committee met in December suggests that the economy has weakened further. Industrial production, housing starts, and employment have continued to decline steeply, as consumers and businesses have cut back spending. Furthermore, global demand appears to be slowing significantly. Conditions in some financial markets have improved, in part reflecting government efforts to provide liquidity and strengthen financial institutions; nevertheless, credit conditions for households and firms remain extremely tight. The Committee anticipates that a gradual recovery in economic activity will begin later this year, but the downside risks to that outlook are significant.

In light of the declines in the prices of energy and other commodities in recent months and the prospects for considerable economic slack, the Committee expects that inflation pressures will remain subdued in coming quarters. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. The focus of the Committee's policy is to support the functioning of financial markets and stimulate the economy through open market operations and other measures that are likely to keep the size of the Federal Reserve's balance sheet at a high level. The Federal Reserve continues to purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand the quantity of such purchases and the duration of the purchase program as conditions warrant. The Committee also is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets. The Federal Reserve will be implementing the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Committee will continue to monitor carefully the size and composition of the Federal Reserve's balance sheet in light of evolving financial market developments and to assess whether expansions of or modifications to lending facilities would serve to further support credit markets and economic activity and help to preserve price stability.

Tuesday, December 16, 2008

Fed Funds Rate Target from ZERO to 0.25%

by Calculated Risk on 12/16/2008 02:15:00 PM

This is quite a statement ... Fed will hold rates low for an extended period.

Fed Statement:

The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent.

Since the Committee's last meeting, labor market conditions have deteriorated, and the available data indicate that consumer spending, business investment, and industrial production have declined. Financial markets remain quite strained and credit conditions tight. Overall, the outlook for economic activity has weakened further.

Meanwhile, inflationary pressures have diminished appreciably. In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate further in coming quarters.

The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.

The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level. As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Christine M. Cumming; Elizabeth A. Duke; Richard W. Fisher; Donald L. Kohn; Randall S. Kroszner; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 75-basis-point decrease in the discount rate to 1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Cleveland, Richmond, Atlanta, Minneapolis, and San Francisco. The Board also established interest rates on required and excess reserve balances of 1/4 percent.

Sunday, December 14, 2008

What if they had a Fed Meeting ...

by Calculated Risk on 12/14/2008 06:44:00 PM

... and no one cared?

The Fed starts a two day meeting tomorrow, and no one really cares about the Fed Funds rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Sure, the Fed will probably cut the Fed Funds rate by 50bps (maybe even 75 bps based on the probabilities from the Cleveland Fed)

But the effective Fed Funds rate is already close to zero (0.14% as of last Thursday). The 2nd graph shows the Federal funds effective rate since 1955. The last time the rate was this low was 50 years ago.

The last time the rate was this low was 50 years ago.

But people do care about the Fed statement. Will the Fed discuss non-traditional methods and quantitative easing?

Rex Nutting at MarketWatch has more: This is what a really bad recession looks like

In a speech he gave more than six years ago, Chairman Ben Bernanke laid out all the nontraditional methods he'll be using this year and next to fight the credit squeeze and escape from the liquidity trap.Here are two of Bernanke's speeches on the topic:

The two-day meeting, Bernanke will try to get the rest of the committee formally on board with his strategy, which will be more and more focused on what's called quantitative easing.

"We look for the accompanying statement to highlight that the main nexus of policy in the coming months will be quantitative easing operations, and we expect these operations to be aimed at lowering borrowing costs for households and businesses," wrote Dean Maki, economist for Barclays Capital Management.

What exactly is "quantitative easing"? Simply put, it's an attempt by the Fed to flood the financial system with so much cash that some of it will have to be lent out. The Fed would do that by "purchasing long-term Treasuries and agency debt and possibly financing a wider range of asset-backed securities," said economists for BMO Capital Markets.

Deflation: Making Sure "It" Doesn't Happen Here, Nov 21, 2002

Conducting Monetary Policy at Very Low Short-Term Interest Rates, January 3, 2004