by Calculated Risk on 10/30/2008 04:47:00 PM

Thursday, October 30, 2008

Fed Holds $145.7 Billion in Commercial Paper as of Oct 29

The Fed released the weekly balance sheet report today. The Fed reported that the Commercial Paper Funding Facility LLC holds $145.7 billion in 16 to 90 day commercial paper.

From Bloomberg: Fed Buys $145.7 Billion of Commercial Paper in Start of Program

The Federal Reserve bought commercial paper valued at $145.7 billion in the first days of the program aimed at backstopping the market, indicating the central bank is generating most of this week's record gains in short-term corporate borrowing.

The central bank extended $144.8 billion of loans as of yesterday to a unit that paid $143.9 billion for the debt, the Fed's weekly balance-sheet report said today.

Tuesday, October 07, 2008

Credit Crisis: LIBOR Rate Increases

by Calculated Risk on 10/07/2008 08:29:00 AM

From Bloomberg: Libor for Overnight Dollar Loans Jumps as Credit Freeze Deepens

The London interbank offered rate, or Libor, that banks charge each other for such loans rose 157 basis points to 3.94 percent today, the British Bankers' Association said. The corresponding rate for euros climbed 22 basis points to 4.27 percent, the highest in four days. The Tokyo interbank rate stayed at the highest level this year and the Libor-OIS spread, a gauge of cash scarcity among banks, widened to a record.However the TED spread, difference between the LIBOR interest rate and the three month T-bill, has declined slightly to 3.69.

Also, Dow Jones is reporting that the commercial paper (CP) market "dislocation worsens" as CP rates continue to rise.

Wednesday, June 25, 2008

Credit Crisis: The 4th Wave?

by Calculated Risk on 6/25/2008 11:46:00 PM

The TED spread is starting to rise again and is back above 1.0 for the first time since the beginning of May. Here is the TED Spread from Bloomberg. The spread is still far below the previous three waves, but well above the normal level (below 0.5).

And from the WSJ: European Bank-Lending Anxiety Returns

Tensions in Europe's short-term lending markets are on the rise again, repeating a pattern that central bankers had hoped to end by pumping in hundreds of billions of dollars in recent months.And from the Fed Commercial Paper report, the A2/P2 less AA spread has risen to 82 bps. Note: This is the spread between high and low quality 30 day nonfinancial commercial paper.

The pressure partly reflects an end-of-quarter effect, as banks hoard cash to make sure their finances look healthy when they report second-quarter results.

But it also demonstrates that fears of further write-downs and possible failures aren't going away.

Perhaps it's a little premature to worry about a 4th wave, but these are worrisome signs.

Thursday, April 17, 2008

Credit Crisis: Third Wave

by Calculated Risk on 4/17/2008 12:29:00 PM

Professor Krugman writes: It’s my TED! Mine!

OK, OK ... Today I'll just stick with the A2/P2 spread from the Fed's commercial paper report. Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. This doesn't include the Asset Backed CP - that is another category. (see commercial paper table).

The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now that concern is still pretty high.

Thursday, January 17, 2008

Cliff Diving

by Calculated Risk on 1/17/2008 05:07:00 PM

Plenty of sites are covering the stock market, so I'll bring you the cliff diving for the ABX and CMBX indices, Commercial paper spread, and MBIA surplus notes.

From Reuters: MBIA's surplus notes plunge to 80 cents on dollar. So much for that 14% yield!

| Click on graph for larger image. This chart is the ABX-HE-AAA- 07-2 close today. Many of the ABX series are back to their record lows set in October and November. |

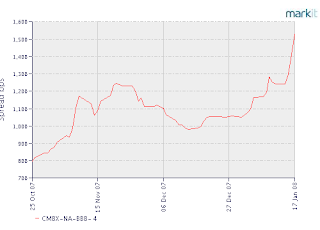

| All but one of the CMBX indices set new records today. Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down. The second graph is the CMBX-NA-BBB-4 close today. |

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies for commercial real estate is probably impacting the CMBX.

And finally, from the Federal Reserve: Commercial Paper Rates and Outstanding

The A2P2 spread is up to 85 bps (just one day, not the 5 day average). The spread is almost as high as in August, but still well below the peak at the end of the year.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that "fear" is very high. It is actually very rare for CP defaults, but they do happen (see table 5 in the above Fed link).

Thursday, January 03, 2008

Discount Rate Spread Narrows, Asset Backed CP Increases

by Calculated Risk on 1/03/2008 10:58:00 AM

From the Fed weekly report on commercial paper this morning, here is the discount rate spread: Click on graph for larger image.

Click on graph for larger image.

According to the Fed, the discount rate spread narrowed to 58 bps. This graph was released this morning.

Also, asset backed commercial paper (CP) increased $26.3 billion to $773.8 billion. This is the first increase since August.

This is preliminary evidence that the liquidity crisis is easing. But the solvency crisis remains. From the WSJ Economics Blog a couple of day ago: Liquidity Threat Eases; Solvency Threat Still Looms:

As 2007 winds down, the much-feared year-end liquidity crisis appears to have been averted thanks to aggressive action by central banks. ... [A]s 2008 begins, it's solvency, not liquidity, that threatens the economy and the financial system. And at the root of the solvency threat is a likely decline in housing prices that will further undermine credit quality. Making banks more confident of their own ability to raise funds is not going to resolve a generalized shrinkage of lending driven by declining collateral values. ...

Thursday, December 27, 2007

Discount Rate Spread: Credit Crisis Continues

by Calculated Risk on 12/27/2007 01:02:00 PM

From the Fed weekly report on commercial paper this morning, here is the discount rate spread: Click on graph for larger image.

Click on graph for larger image.

According to the Fed, the discount rate spread is 145 bps. This graph was released this morning.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. This doesn't include the Asset Backed CP.

The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that the fear of default is very high. Higher than in August. And higher than after 9/11.

Friday, December 21, 2007

Discount Rate Spread Still Increasing

by Calculated Risk on 12/21/2007 11:26:00 AM

From the Fed weekly report on commercial paper this morning, here is the discount rate spread: Click on graph for larger image.

Click on graph for larger image.

According to the Fed, the discount rate spread is still increasing. This is the graph released this morning.

Meanwhile, the Fed is still pouring liquidity into the market with another $20 billion TAF auction yesterday. And the Fed has announced:

The Federal Reserve intends to conduct biweekly Term Auction Facility (TAF) auctions for as long as necessary to address elevated pressures in short-term funding markets. The Board of Governors will announce the sizes of the January 14 and January 28 TAF auctions at noon on January 4.Here is the discount rate spread graph from last week:

Clearly this indicator of the credit crisis has worsened.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. This doesn't include the Asset Backed CP - that is another category and is even at a higher rate (see commercial paper table).

The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that "fear" is very high. It is actually very rare for CP defaults, but they do happen (see table 5 in the above Fed link).

Friday, November 30, 2007

Montana Fund Withdrawals

by Calculated Risk on 11/30/2007 01:40:00 PM

From MarketWatch: Florida's investment woes spark subprime fears in other states

Florida halted withdrawals from a $15 billion local-government fund on Thursday after concerns over losses related to subprime mortgages prompted investors to pull roughly $10 billion out of the fund in recent weeks.In addition to potential "bank runs" on these funds, another key concern is if other funds stop investing in asset backed CP - making the credit crunch worse.

Other states are experiencing similar problems on a smaller scale.

The Montana Board of Investments, which manages the state's money, has seen $247 million withdrawn by local governments in the past three days from a $2.5 billion money-market-like fund called the Short Term Investment Pool.

"We've had some local government withdrawals in the past few days because of reports about Florida's problems," Carroll South, executive director at the Montana Board of Investments, said in an interview on Thursday.

Rating agency Standard & Poor's warned last month that it could downgrade a $4.8 billion investment pool run by King County, Wash., because of potential subprime exposures.

Thursday, November 15, 2007

Corporations Taking Hits to Marketable Securities

by Calculated Risk on 11/15/2007 12:44:00 PM

Here is an interesting development, from an 8-K filed today by ADC Telecommunications (hat tip BR)

We hold a variety of highly rated interest bearing auction rate securities that most often represent interests in pools of either interest bearing loans or dividend yielding preferred shares. These auction rate securities provide liquidity via an auction process that resets the applicable interest rate at predetermined calendar intervals, usually every 7, 28, 35 or 90 days. This mechanism allows existing investors either to rollover their holdings, whereby they would continue to own their respective interest in the auction rate security, or to gain immediate liquidity by selling such interests at par. For several months, certain of these auctions have not had sufficient bidders to allow investors to complete a sale, indicating that immediate liquidity at par is unavailable.This is probably not significant for ADC, but these investments were pitched to many other corporations were the losses might be more significant. As BR noted:

At the end of our third quarter for fiscal 2007, we identified approximately $149.0 million of auction rate securities for which there were insufficient bidders at the scheduled rollover dates and another approximately $21.3 million which we believed were at risk of having this occur. As of November 15, 2007 we hold investments subject to auction processes with insufficient bidders with a par value of $169.8 million. These investments represent all of our investments held in auction rate securities.

We are continuing to monitor and analyze our auction rate securities investments. Recently one of these investments with a par value of approximately $17 million was downgraded from a Aaa rating to a A2 rating by Moodys Investor Services. We are not aware of any other of our auction rate securities investments that have been downgraded to date. In light of developing circumstances, we are analyzing the extent to which the estimated market value of this investment may no longer approximate its par value. We have not finalized this analysis. Further, it is possible we will determine other of these investments no longer approximate their par value. If we determine one or more investments no longer approximates its par value, it is possible we will have to record (a) an unrealized loss in the other comprehensive income section of shareowners' investment in our balance sheet as of October 31, 2007, and/or (b) an other-than-temporary impairment charge. An unrealized loss would be recorded in other comprehensive income to the extent we determined the loss on an investment was only temporary in nature and determined that we have the ability to continue to hold the investment until a recovery in market values occurs. In such an event, an unrealized loss would not reduce our net income for the quarter and year ended October 31, 2007, because the loss would not be viewed as permanent. An other-than-temporary impairment charge would be recorded against net income to the extent we determine the loss in fair value of any of these investments is other than temporary.

Several contacts of mine tell me that the money center banks pitched this ... to money funds and corporations over the past 2 years as a little spice on the stew but still AAA. They bought it like candy.

Friday, October 26, 2007

AHM v. LEH: The Revenge of Mark to Model

by Anonymous on 10/26/2007 11:47:00 AM

This is killing me:

PHILADELPHIA (Dow Jones/AP) - Bankrupt lender American Home Mortgage Investment Corp. has sued Lehman Bros., accusing the investment bank of essentially stealing from the company as it struggled to stay on its feet.That's an interesting theory of levering up your "assets": if the market says "no bid," you apparently get "no mark" and therefore "no call" and hence "no bankruptcy."

The lawsuit, filed Wednesday in the U.S. Bankruptcy Court in Wilmington, Del., accuses Lehman Bros. of hitting American Home with improper margin calls in July and demanding money the company says it did not owe.

When the Melville, N.Y.-based lender couldn't meet Lehman's second margin call, for $7 million, Lehman foreclosed on $84 million worth of subordinated notes issued in American Home's structured-finance operation. . . .

American Home is relying in part on the frozen market for mortgage-industry paper to make its case against Lehman Bros. Without actual trades to show the value of the notes had declined, American Home argues that Lehman Bros. should have obtained an independent valuation before issuing the margin call.

The thing is, in a nutshell, that AHM was using these borrowings to fund new mortgage origination operations. A "frozen market for mortgage-industry paper" means no money to make new loans with (proceeds from sales of commercial paper backed by the warehouse of held-for-sale loans) until you can sell the loans you've already made. But you can't sell the loans you've already made, unless you want to take a nasty hit on them, because nobody's buying decent whole loans in a "frozen market," and there is excellent reason to think AHM's warehouse held a boatload of not exactly decent loans. We know this because AHM was forced to visit the confessional about its massive number of buybacks of loans that didn't make the first three payments sucessfully.

So Lehman wanted out of its exposure to AHM's held for sale pipeline, as far as I can tell, because unlike your usual "pipeline," this one was a pipe to nowhere (kind of like the bridge to nowhere). It sounds like AHM is now saying that Lehman made up some ugly mark to model valuation instead of getting "independent" verification of the fact that there were no bids--or horrible ones--for the AHM loans. I guess the fact that AHM couldn't get 'em sold in the first place, which is the whole point of having a "held for sale pipeline," is insufficient evidence that the stuff was worthless.

I look forward to hearing about Lehman's response to this.

(Many thanks to the indefatiguable Clyde)

Tuesday, October 16, 2007

Institutional Risk Analytics on MLEC

by Anonymous on 10/16/2007 09:22:00 AM

Looks like we're going to need a bigger microwave.

Orchestrating the pooling of hundreds of billions worth of illiquid assets into a single conduit strikes us as a bad move. In analytics, we call such proposals a "difference without distinction." Instead of seeking to restore the abnormal and manic market conditions that prevailed in the world of structured finance prior to Q2 2007, we think Secretary Paulson and his Street-wise colleagues should be trying to reach a more stable formulation.(For you beginners, "C" is the ticker symbol for Citicorp, not 983,571,056 feet per second.)

The subsidiary banks of C, for example, have about $112 billion in Tier One Risk Based Capital supporting 10x that in "on balance sheet" assets, assets which typically throw off 3x the charge offs of C's large bank peers. A modest haircut of C's total conduit exposure of $400 billion could leave that capital decimated, forcing C into the hands of the New York Fed and FDIC. Of note, looks like the ratio of Economic Capital to Tier One RBC for C at 3.75:1 calculated by the IRA Bank Monitor was not so severe as some Citibankers previously have suggested.

The fact that much of the debt issued by C-controlled SIV's was maturing in November seems to have prompted the Treasury to act, yet another example of "limited government" under President George W. Bush. Apparently there are some people at the Treasury who think that aggregating large bank conduit risk into a single subprime burrito will somehow draw foreign and domestic investors back to the structured asset trough. This notion would be laughable were the situation not so perilous.

Hat tip to Clyde!

Monday, October 15, 2007

Musical SIVs

by Anonymous on 10/15/2007 08:44:00 AM

Yves at naked capitalism has a post up this morning on the Citicorp-Related Asset Conduit Kerfuffle (MLEC), which I recommend.

There's also this charming bit from this morning's New York Times:

The problems raised alarms immediately in Washington, because commercial paper is a critical financial pillar for the economy, helping to provide money for home loans, credit cards and airplane leases. At the Treasury, Robert Steel, deputy under secretary for domestic finance, and Anthony Ryan, assistant secretary for financial markets, called top executives from about 30 banks to a meeting in Washington after realizing that the banks were not talking to one another about the crisis, people familiar with the talks said.As a long-time observer of the banking industry, allow me to observe that one of our major problems has always been that we don't talk to anybody except each other. Trust a reporter to publish talking points about "pillars of the economy" and the Treasury just doin' a little healthy fostering of interbank communication skills.

From where I sit, it seems like a lot of investors no longer want to be the bagholder of the "pillars" of this economy, thanks. And Citicorp doesn't want to honor the guarantees it made to those SIVs in the first place, either. So instead of letting Citi take the consequences of having provided financial backstops to these things, the Treasury department thinks its a good idea to just "square" them (hey! it worked so well with CDOs!).

Sunday, September 30, 2007

WSJ: UBS Is Expected to Report Loss

by Calculated Risk on 9/30/2007 04:46:00 PM

From the WSJ: UBS Is Expected to Report Large Loss From Fixed-Income Unit

...UBS ... is projecting a third-quarter loss of ... ($510 million to $600 million) based on a writedown of 3 billion to 4 billion Swiss francs for fixed-income assets ...The confessional is now open.

...

Its losses resulted from applying sharply lower market values to asset-backed bonds ... Many banks had serious troubles with securities-tied to mortgages when liquidity dried up in the last quarter.

Friday, September 14, 2007

Commercial Paper

by Calculated Risk on 9/14/2007 01:52:00 PM

From BusinessWeek: A New Risk to the Credit Markets

The shaky U.S. credit markets will face a critical test over the next few weeks, as companies try to find buyers for hundreds of billions of dollars in short-term debt that is set to expire. Corporate borrowers are expected to struggle in refinancing their debts, and the repercussions may go far beyond the companies in question. ...For reference, here is the Fed page tracking commercial paper and a couple of charts from the Fed.

The tightest squeeze may come in what's known as the asset-backed commercial paper market. ... About $417 billion worth of asset-backed commercial paper is scheduled to come due during the weeks of Sept. 10 and Sept. 17, or about half of the $959 billion market, according to Sherif Hamid, an investment-grade credit strategist at Lehman Brothers.