by Calculated Risk on 9/17/2010 08:30:00 AM

Friday, September 17, 2010

Consumer Price Index increases 0.3%, core rate unchanged in August

From the BLS report on the Consumer Price Index this morning:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ... Over the last 12 months, the all items index increased 1.1 percent before seasonal adjustment.The general disinflationary trend continues - core CPI is up less than 1% over the last year - and with all the slack in the system (especially the 9.6% unemployment rate), the various measures of inflation will probably stay low or even fall further.

...

The index for all items less food and energy was unchanged in August ... Over the last 12 months, the index for all items less food and energy rose 0.9 percent ...

The index for owners' equivalent rent was unchanged and the lodging away from home index fell 1.3 percent....

Note: I'll post a graph later after the Cleveland Fed releases the 16% trimmed CPI (another measure of inflation).

Saturday, August 14, 2010

Inflation Graph

by Calculated Risk on 8/14/2010 10:54:00 PM

Since I didn't post an inflation graph when CPI was released, here is one for a Saturday night: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows three measure of inflation, Core CPI, Median CPI (from the Cleveland Fed), and 16% trimmed CPI (also from Cleveland Fed).

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year. Core CPI, median CPI, and the 16% trimmed mean CPI were all up 0.1% in July.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Friday, July 23, 2010

Deflation Watch

by Calculated Risk on 7/23/2010 09:57:00 AM

Tech Ticker quotes Euro Pacific Capital's Peter Schiff:

"I don't know where anyone thinks prices are falling," Schiff says, citing rising prices for food, healthcare and energy. "I don't know where most people do their shopping but I don't see falling prices. To me, prices are rising."And from Reuters:

Safeway executives said the strength of that push on pricing caught them by surprise.Maybe Schiff should shop at Safeway.

"Deflation continues in price per item and is not expected to significantly improve until the fourth quarter," said Chief Executive Steve Burd, who oversees supermarkets including Safeway, Vons and Dominick's.

Burd acknowledged that retail deflation was much greater than expected in the second quarter and drove a decline in identical-store sales.

More seriously there is little deflation so far, but general deflation would be a bad bad thing.

Friday, July 16, 2010

Consumer Price Index declines 0.1% in June

by Calculated Risk on 7/16/2010 08:30:00 AM

From the BLS report on the Consumer Price Index this morning:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the index increased 1.1 percent before seasonal adjustment.Even with the slight monthly increase, Owners' equivalent rent (OER) is down year-over-year.

...

The index for all items less food and energy rose 0.2 percent in June after increasing 0.1 percent in May. ... The 12-month change in the index for all items less food and energy remained at 0.9 percent for the third month in a row.

...

The index for owners' equivalent rent also rose 0.1 percent, its first increase since August 2009 ...

The general disinflationary trend continues - CPI is unchanged over the last 8 months - and with all the slack in the system (especially the 9.5% unemployment rate), CPI will probably stay low or even fall further.

Friday, February 19, 2010

Core Inflation Declines for the first time since 1982

by Calculated Risk on 2/19/2010 08:30:00 AM

From the BLS report on the Consumer Price Index this morning:

On On a seasonally adjusted basis, the January Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent ...Owners' equivalent rent (OER) declined 0.1% in January, and is declining at about a 1% annualized rate. OER has declined for five consecutive months (a record) and is important because it is the largest component of CPI.

The index for all items less food and energy fell 0.1 percent in January. This decline was largely the result of decreases in the indexes for shelter, new vehicles, and airline fares.

Based on reports of falling rents - and a near record high apartment vacancy rate, OER will probably decline for some time, keeping core CPI low and possibly negative this year. Also - falling rents will push up the price-to-rent ratio, and put additional pressure on house prices.

Friday, January 15, 2010

CPI, Rents and Real Earnings

by Calculated Risk on 1/15/2010 08:33:00 AM

From the BLS report on the Consumer Price Index this morning:

On a seasonally adjusted basis, the December Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent ... the indexes for rent and owners' equivalent rent were unchanged ...Owners' equivalent rent (OER) declined slightly in December, and has decreased at about a 1% annualized rate since peaking four months ago. OER is important because it is the largest component of CPI.

The index for all items less food and energy rose 0.1 percent in December after being unchanged in November.

Based on reports of falling rents - and a record high apartment vacancy rate, OER will probably decline fall for some time, keeping core CPI low and possibly negative next year. Also - falling rents will push up the price-to-rent ratio, and put additional pressure on house prices.

The BLS also reported on declining real earnings in 2009:

Real average hourly earnings did not change from November to December ... Real average hourly earnings fell 1.3 percent, seasonally adjusted, from December 2008 to December 2009. A 0.3 percent decline in average weekly hours combined with the decrease in real average hourly earnings resulted in a 1.6 percent decrease in real average weekly earnings during this period.

Wednesday, December 16, 2009

CPI and Falling Rents

by Calculated Risk on 12/16/2009 11:11:00 AM

From the BLS report on the Consumer Price Index this morning:

The index for all items less food and energy was unchanged in November after rising 0.2 percent in October. The heavily weighted index for shelter, unchanged in October, declined 0.2 percent in November. Within the shelter group, the indexes for rent and owners' equivalent rent both declined 0.1 percent and the lodging away from home index fell 1.5 percent.Owners' equivalent rent (OER) decreased at a 1.5% annualized rate in November, and has decreased at a 1.1% annualized rate over the last three months. OER is the largest component of CPI, and helped keep core CPI unchanged in November. Median CPI from the Cleveland Fed was also unchanged.

Based on reports of falling rents - and a record high vacancy rate, OER will probably continue to fall for some time, keeping core CPI low and possibly negative next year.

Also - falling rents will push up the price-to-rent ratio, and put additional pressure on house prices.

Wednesday, September 16, 2009

CPI Increases 0.4% in August, BLS Rent Measures Increase Slightly

by Calculated Risk on 9/16/2009 08:33:00 AM

From the BLS: Consumer Price Index Summary

On a seasonally adjusted basis, the Consumer Price Index for all Urban Consumers (CPI-U) rose 0.4 percent in August, the Bureau ofThe BLS measure for rent increased slightly (rounded to flat). And owners' equivalent rent (OER), the largest component of CPI, increased slightly even though rents have been falling in most areas.

Labor Statistics reported today. The index has decreased 1.5 percent over the last 12 months on a not seasonally adjusted basis.

...

The index for all items less food and energy also rose 0.1 percent in August, the second consecutive such increase.

...

the shelter index ... rose 0.1 percent in August after a 0.2 percent decline in July. The rent index was unchanged and the index for owners' equivalent rent increased 0.1 percent.

CPI has declined 1.5% compared to one year ago.

Wednesday, June 17, 2009

Owners' Equivalent Rent

by Calculated Risk on 6/17/2009 10:23:00 AM

Owners' equivalent rent (OER) is a major component of CPI (23.8% of CPI, see Cleveland Fed), and even though rents are falling in most areas, OER is still increasing (up 2.1% Year-over-year and up 1.8% annualized in May).

For a discussion from the BLS of rent measures see: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and Rent of primary residence (Rent)

The expenditure weight in the CPI market basket for Owners’ equivalent rent of primary residence (OER) is based on the following question that the Consumer Expenditure Survey asks of consumers who own their primary residence:UPDATE: I misread the BLS document.“If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?”

The survey question above is for weighting. The price relative for OER is calculated by sampling non rent-controlled renters every six months. These average rents are divided by the sample six months earlier - and converted to a monthly change (by taking to the 1/6th power).

From the BLS document above: "The first step is standardizing the collected (market) rents, putting them on a monthly basis, and adjusting them for a number of circumstances that should not affect the CPI."

I apologize for any confusion.

END UPDATE.

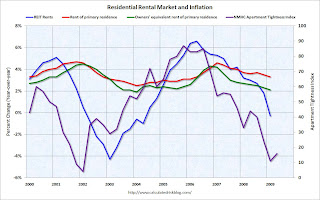

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman Sachs), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

CPI Increases Slightly, Off 1.3% in Past Year

by Calculated Risk on 6/17/2009 08:34:00 AM

From Rex Nutting at MarketWatch: Consumer prices inch 0.1% higher in May

U.S. consumer prices increased a seasonally adjusted 0.1% in May as higher gasoline prices were largely offset by falling food prices, the Labor Department reported Wednesday.

It was the first increase in the consumer price index in three months.

The core CPI ... also rose a seasonally adjusted 0.1% in May.

The CPI has fallen 1.3% in the past year, the sharpest decline in prices since April 1950.

Wednesday, May 20, 2009

Residential Rental Market and Inflation

by Calculated Risk on 5/20/2009 08:15:00 PM

Goldman Sachs tracks the rents at a large number of apartment REITs - and rents are now falling (excerpted from research report with permission):

REITs tend to adjust more rapidly to changing market conditions than the typical landlord, so changes in their behavior are useful signals of turns in the market ... Public REITs typically report the rent increases they have achieved on a year-over-year, comparable-unit basis with each quarterly filing. ... [the tracked] REITS managed 300,000 units that were comparable to the year-before period in the first quarter of 2009 ... In the first quarter of 2009, the major REITs collectively reported an outright decline in rents for the first time since 2004.Goldman notes that declining rents for REITS typically lead declines in the CPI measures of rent: Owners' equivalent rent of primary residence (OER) and Rent of primary residence.

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

This is important for house prices too. With falling rents, house prices need to fall further to bring the house price-to-rent ratio back to historical levels.

Wednesday, July 16, 2008

Falling Oil Prices and CPI

by Calculated Risk on 7/16/2008 10:57:00 AM

From MarketWatch: Crude falls over $6 as inventories show surprise increase

U.S. crude inventories gained surprisingly in the week ending July 11, up 3 million barrels to 296.9 million, the U.S. Energy Information Administration reported on Wednesday.As I noted yesterday, the difference between a moderate and severe recession might be what happens with oil prices:

One of the keys to the base case is that oil prices decline in the 2nd half of 2008 (something I've been predicting for some time). This prediction is based on demand destruction, lower subsidies in certain Asian countries, weaker demand growth in China, and a few other reasons. The fundamentals of supply and demand for oil suggests a small decrease in demand could led to a fairly large decrease in price. If this happens, then that will hopefully lead to Kasriel's "sharp deceleration in inflation".Usually the headline measure of inflation (CPI) and the core inflation measure (CPI less food and energy) track pretty well with just short periods of divergence due primarily to changes in oil prices. But for the last few years oil prices have risen relentlessly, and CPI has been substantially above Core for an extended period as shown on the following graph.

Falling oil prices would move CPI below Core inflation and might keep the economy out of a severe recession (although the period of economic weakness would still linger for some time).