by Calculated Risk on 11/12/2008 09:37:00 PM

Wednesday, November 12, 2008

ABX and CMBX Cliff Diving

Check out the ABX-HE-AAA- 07-2 close today. More Cliff Diving!

Note: The ABX indices are based on credit default swaps (CDS) for various tranches of subprime mortgage-backed securities (MBS). For some background, here is a post at the Cleveland Fed back in March, 2007.

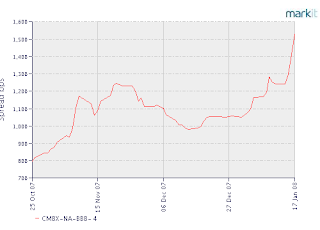

All of the CMBX indices are setting new record lows again.

Check out the CMBX-NA-BB-4 close today. To the moon, Alice!

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

Thursday, July 10, 2008

ABX and CMBX Cliff Diving Again

by Calculated Risk on 7/10/2008 06:23:00 PM

Check out the ABX-HE-AAA- 07-2 close today. More Cliff Diving!

Note: The ABX indices are based on credit default swaps (CDS) for various tranches of subprime mortgage-backed securities (MBS). For some background, here is a post at the Cleveland Fed back in March, 2007.

Most of the CMBX indices are setting new record lows again.

Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

Check out the CMBX-NA-BB-4 close today.

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down.

Thursday, January 17, 2008

Cliff Diving

by Calculated Risk on 1/17/2008 05:07:00 PM

Plenty of sites are covering the stock market, so I'll bring you the cliff diving for the ABX and CMBX indices, Commercial paper spread, and MBIA surplus notes.

From Reuters: MBIA's surplus notes plunge to 80 cents on dollar. So much for that 14% yield!

| Click on graph for larger image. This chart is the ABX-HE-AAA- 07-2 close today. Many of the ABX series are back to their record lows set in October and November. |

| All but one of the CMBX indices set new records today. Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down. The second graph is the CMBX-NA-BBB-4 close today. |

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies for commercial real estate is probably impacting the CMBX.

And finally, from the Federal Reserve: Commercial Paper Rates and Outstanding

The A2P2 spread is up to 85 bps (just one day, not the 5 day average). The spread is almost as high as in August, but still well below the peak at the end of the year.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that "fear" is very high. It is actually very rare for CP defaults, but they do happen (see table 5 in the above Fed link).

Friday, December 21, 2007

No Cliff Diving for 08-1

by Anonymous on 12/21/2007 01:48:00 PM

Apparently we're not going to have an ABX.HE 08-1 to kick around any time soon:

New York, NY- Markit, the leading provider of independent data, portfolio valuations and OTC derivatives trade processing and owner of the Markit ABX.HE index, today announced that the roll of the Markit ABX.HE has been postponed for three months. The Markit ABX.HE is a synthetic index of U.S. home equity asset-backed securities.I'm actually quite touched that they decided not to just re-write the rules to qualify any old deal they could scrape up. It's so . . . unusual for anything having anything to do with mortgages lately.

The new series, the Markit ABX.HE 08-1, was scheduled to launch on 19 January 2008. The decision to postpone its launch was taken following extensive consultation with the dealer community. It follows a lack of RMBS deals issued in the second half of 2007 and eligible for inclusion in the forthcoming Markit ABX.HE roll. The Markit ABX.HE 07-2 remains the on-the-run series until further notice.

Under current index rules, only five deals qualified for inclusion in the Markit ABX.HE 08-1. Markit and the dealer community considered amending the index rules to include deals which failed to qualify initially but decided against this approach at this time.

Markit and the dealer community remain fully committed to the index and will update the market as and when appropriate.

I don't know why some deals failed to qualify, but looking over the eligibility rules, I'd guess that the deals were either too small (under $500MM) or had a WA FICO greater than 660. Oh well. I guess I have to change my line: we're all prime now.

(Thanks, Buzz!)

Wednesday, November 21, 2007

ABX and CMBX: Your Daily Plunge!

by Calculated Risk on 11/21/2007 02:49:00 PM

See the ABX-HE-AAA- 07-2 close today.

Another day, another record low.

The CMBX indices are setting new records too.

Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

See the CMBX-NA-AAA-3 close today.

For some background, here is a post at the Cleveland Fed back in March:

the ABX.HE index is telling us something about credit default swaps (CDS). A CDS is like a derivative that gives you insurance. For example, a bank may wish to buy protection against default by RiskyCorp (perhaps because they’ve given RiskyCorp a loan). They do this by entering into a contract where they pay another firm (who is selling protection) a fixed amount, periodically, as long as RiskyCorp doesn’t default on its corporate bonds. (In general, the “credit event” might be something else, such as a major downgrade, missed payments, or so forth.) If RiskyCorp does default, the seller of protection makes a payment to the buyer of protection. This might be a cash payment equal to the value of the bond, it might be the bond itself, or potentially whatever the contracting parties agree to. We like to think of the “swap rate” or “swap spread” that the protection buyer must pay as an insurance premium.The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies (see previous post of Q3 data from the Fed) for commercial real estate is probably impacting the CMBX.

Notice that the more likely RiskyCorp is to default, the higher the insurance premium, that is, the higher the swap spread, so this market can give us some idea of how risky some firms are. In a frictionless market, the swap spread should be comparable to the risk premium on one of RiskyCorp’s corporate bonds (corporate bond yield minus the comparable riskless yield). Furthermore, because the CDSs are more standardized and generally more liquid than corporate bonds, you can see why Federal Reserve Vice Chairman Donald Kohn states that “instead of looking to the bond market to measure default risk, we are increasingly turning to the market for credit default swaps” (the full text of his remarks to the Board Conference on Credit Risk and Credit Derivatives is well worth reading).

Credit default swaps eventually became based on other types of assets, such as mortgage-backed securities, whose payoff is derived from a pool of mortgages (such asset-based swaps became known as ABCDS, for obvious reasons). Likewise, there was no reason to restrict your CDS so that it protected you against default from only one firm, and although such “single-name” CDSs still make up the bulk of the market, “multiname” CDSs are growing in popularity.

Mortgage-backed securities offer several different levels of risk or tranches. Tranches are ways of slicing up the payment stream from homeowners to give different levels of risk, so roughly speaking, the tranches first in line for payments are less risky than those further down the line.

At long last: the ABX.HE is a series of five indexes that track CDSs based on tranches of mortgage-backed securities comprised of subprime mortgages and home equity loans. The tranches differ by their ratings, from AAA (best credit) to BBB-, (least good credit). See MarkiT, which produces the indexes for the real details. For an example of how indexes work, see here.