by Calculated Risk on 4/02/2021 09:46:00 AM

Friday, April 02, 2021

Comments on March Employment Report

The headline jobs number in the March employment report was well above expectations, and employment for the previous two months was revised up.

Leisure and hospitality gained 280 thousand. In March and April of 2020, leisure and hospitality lost 8.2 million jobs, and then gained about 60% of those jobs back. However, leisure and hospitality lost jobs in December and January due to the winter surge in COVID cases - before gaining jobs in February and March - and are now down 3.1 million jobs since February 2020.

Construction added 110 thousand jobs in March, and State and Local education added 126 thousand jobs. Manufacturing added 53 thousand jobs.

Earlier: March Employment Report: 916 Thousand Jobs, 6.0% Unemployment Rate

In March, the year-over-year employment change was minus 6.720 million jobs. This will turn positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.

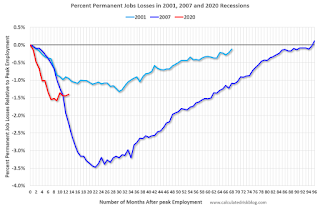

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the March report. (ht Joe Weisenthal at Bloomberg).

Earlier: March Employment Report: 916 Thousand Jobs, 6.0% Unemployment Rate

In March, the year-over-year employment change was minus 6.720 million jobs. This will turn positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the March report. (ht Joe Weisenthal at Bloomberg).

These jobs will likely be the hardest to recover.

This data is only available back to 1994, so there is only data for three recessions.

In March, the number of permanent job losers decreased slightly to 3.432 million from 3.497 million in February.

Prime (25 to 54 Years Old) Participation

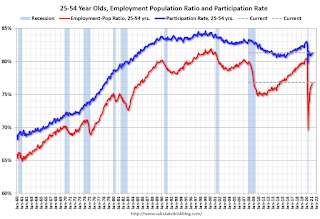

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased in March to 81.3% from 81.1% in February, and the 25 to 54 employment population ratio increased to 76.8% from 76.5% in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 10.7% from 11.1% in February. This is down from the record high in April 22.9% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, there are 4.218 million workers who have been unemployed for more than 26 weeks and still want a job.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was well above expectations, and the previous two months were revised up 156,000 combined. The headline unemployment rate declined to 6.0%.

This data is only available back to 1994, so there is only data for three recessions.

In March, the number of permanent job losers decreased slightly to 3.432 million from 3.497 million in February.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased in March to 81.3% from 81.1% in February, and the 25 to 54 employment population ratio increased to 76.8% from 76.5% in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 5.8 million, changed little in March but is 1.4 million higher than in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in March to 5.826 million from 6.088 million in February.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 10.7% from 11.1% in February. This is down from the record high in April 22.9% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.218 million workers who have been unemployed for more than 26 weeks and still want a job.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was well above expectations, and the previous two months were revised up 156,000 combined. The headline unemployment rate declined to 6.0%.

This was a strong report, but there are still 8.4 million fewer jobs than in February 2020, and 3.4 million people have lost jobs permanently.