by Calculated Risk on 2/25/2020 11:45:00 AM

Tuesday, February 25, 2020

FDIC: Fewer Problem banks, Residential REO Declined in Q4

The FDIC released the Quarterly Banking Profile for Q4 2019 today:

For the 5,177 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC), aggregate net income totaled $55.2 billion in fourth quarter 2019, a decline of $4.1 billion (6.9 percent) from a year ago. The decline in net income was led by lower net interest income and higher expenses. Financial results for fourth quarter 2019 are included in the FDIC's latest Quarterly Banking Profile released today.

...

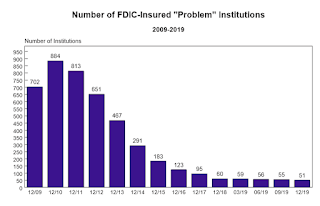

The Number of Banks on the "Problem Bank List" Remained Low: The number of problem banks fell from 55 to 51 during the fourth quarter, the lowest number of problem banks since fourth quarter 2006. Total assets of problem banks declined from $48.8 billion in the third quarter to $46.2 billion.

The Deposit Insurance Fund's Reserve Ratio Stood at 1.41 Percent: The Deposit Insurance Fund (DIF) balance totaled $110.3 billion in the fourth quarter, up $1.4 billion from the end of last quarter. The quarterly increase was led by assessment income and interest earned on investment securities held by the DIF. The reserve ratio remained unchanged from the previous quarter at 1.41 percent.

Mergers and New Bank Openings Continued in the Fourth Quarter: During the fourth quarter, three new banks opened, 77 institutions were absorbed by mergers, and three banks failed.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined slightly.

This graph from the FDIC shows the number of problem banks declined to 51 institutions from 60 at the end of 2018.

Note: The number of assets for problem banks increased significantly in 2018 when Deutsche Bank Trust Company Americas was added to the list (it must still be on the list given the assets of problem banks).

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $2.65 billion in Q4 2018 to $2.27 billion in Q4 2019. This is the lowest level of REOs since Q1 2006.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $2.65 billion in Q4 2018 to $2.27 billion in Q4 2019. This is the lowest level of REOs since Q1 2006.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, FDIC REOs are probably close to a bottom.