by Calculated Risk on 3/29/2019 04:27:00 PM

Friday, March 29, 2019

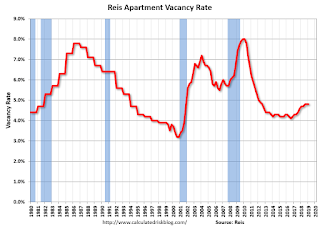

Reis: Apartment Vacancy Rate unchanged in Q1 at 4.8%

Reis reported that the apartment vacancy rate was at 4.8% in Q1 2019, unchanged from 4.8% in Q4, and up from 4.7% in Q1 2018. This ties the last two quarters as the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From economist Barbara Denham at Reis:

The apartment vacancy rate was flat in the quarter at 4.8%. In the first quarter of 2018 it was 4.7%, while at the start of 2017 it was 4.3%.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.5% in the first quarter. At $1,451 per unit (asking) and $1,380 per unit (effective), the average rents have increased 4.4% and 4.2%, respectively, from the first quarter of 2018.

...

Apartment occupancy growth had accelerated in 2018 after slowing a bit in 2017. At the same time, the housing market slumped in 2018 after gaining momentum in 2017. Recently, existing home sales jumped yet apartment occupancy growth was subdued. We had attributed the acceleration in the apartment market in 2018 to the tax cut at the end of 2017 that reduced the incentive to buy a home. Many have cited the drop in mortgage rates to the housing market jump in February.

A closer look at the numbers shows that the condo and coop sales were flat in the first two months of 2019 after falling in 2018. This is consistent with our apartment occupancy numbers and suggests that the housing market uptick was concentrated in less urban areas that do not compete as much with strong apartment construction. There are a number of factors impacting housing, but it is too early to say if the apartment market will suffer if the housing market has strengthened. The preliminary housing numbers from the National Association of Realtors are subject to change.

We still expect construction to remain robust in 2019 before completions decelerate in 2020. Occupancy should stay consistent with both supply growth and job growth, but the pent-up demand for buying a home could impact some markets more than others.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had mostly moved sideways for the last several years and moved up a little more recently.

With more supply coming on line - and somewhat less favorable demographics - the vacancy rate will probably increase over the next year or so.

Apartment vacancy data courtesy of Reis.