by Calculated Risk on 11/28/2018 07:00:00 AM

Wednesday, November 28, 2018

MBA: Mortgage Applications Increased in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 23, 2018. This week’s results include an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index decreased 28 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

“After several weeks of market volatility, 30-year fixed mortgage rates decreased four basis points to 5.12 percent last week. Homebuyers responded, with purchase applications 1.7 percent higher than a year ago, and after adjusting for the Thanksgiving holiday, they increased almost 9 percent from the previous week,” said Mike Fratantoni, MBA’s Chief Economist. “The rise in purchase activity was led by conventional purchase applications, which surged almost 12 percent, while government purchases were essentially unchanged over the week. This also pushed the average loan size for purchase applications higher, which likely meant there were fewer first-time homebuyers in the market last week.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 5.12 percent from 5.16 percent, with points decreasing to 0.46 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

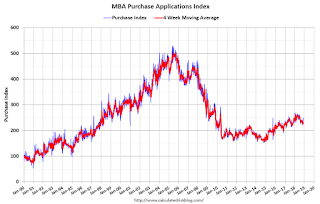

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.