by Calculated Risk on 10/24/2018 11:46:00 AM

Wednesday, October 24, 2018

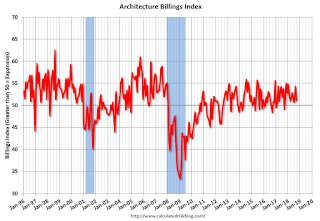

AIA: "Architecture firm billings slow but remain positive in September"

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture firm billings slow but remain positive in September

Architecture firm billings growth slowed in September but remained positive for the twelfth consecutive month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for September was 51.1 compared to 54.2 in August. However, continued strength in new projects coming into architecture firms points to billings growth in the coming months.

“Similar to the strong conditions we’ve seen nationally, architecture firms located in the Midwest and Southern regions of the country continued to report very strong billings in September,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, billings were soft at firms located in the Northeast again, where they have declined or been flat for the entire year so far.”

...

• Regional averages: Midwest (59.7), South (54.1), West (53.1), Northeast (46.6)

• Sector index breakdown: institutional (55.1), multi-family residential (54.9), mixed practice (53.4), commercial/industrial (50.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.1 in September, down from 54.2 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 12 consecutive months, suggesting a further increase in CRE investment into 2019.