by Calculated Risk on 5/24/2018 03:59:00 PM

Thursday, May 24, 2018

Housing Inventory Tracking

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Here is a table from housing economist Tom Lawler showing the year-over-year (YoY) change for National inventory from the NAR, and the YoY change for California from the CAR.

It appears the YoY declines are slowing nationally, and inventory has started to increase YoY in California.

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

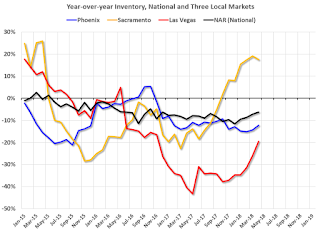

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento (through April), and also total existing home inventory as reported by the NAR (also through April 2018).

Click on graph for larger image.

Click on graph for larger image.This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 18% year-over-year in April (inventory was still very low), and has increased year-over-year for seven consecutive months.

Also note that inventory is still down in Las Vegas (red), but the YoY decline has been getting smaller.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory to be up YoY by the end of 2018 (but still be low).