by Calculated Risk on 5/02/2017 01:14:00 PM

Tuesday, May 02, 2017

Q1 2017 GDP Details on Residential and Commercial Real Estate

The BEA has released the underlying details for the Q1 advance GDP report.

The BEA reported that investment in non-residential structures increased at a 9.4% annual pace in Q1. This is a turnaround from early last year when non-residential investment declined due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration increased substantially in Q1, from a $44.7 billion annual rate in Q4 2016 to a $70.6 billion annual rate in Q1 2017 - but is still down from a recent peak of $151 billion in Q4 2014 (down by more than one-half).

Excluding petroleum, non-residential investment in structures increased at a 10% annual rate in Q3.

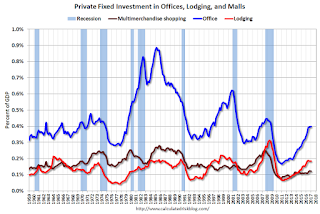

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q1, and is up 22% year-over-year - and is now almost as high as the housing bubble years as a percent of GDP.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was up year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q1. Lodging investment is up 15% year-over-year.

My guess is office and hotel investment growth will start to slow (office vacancies are still high, although hotel occupancy is near record levels). But investment growth is still very strong this year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $257 billion (SAAR) (about 1.4% of GDP), and was up in Q1 compared to Q4.

Investment in home improvement was at a $238 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.3% of GDP). Home improvement growth has been solid.