by Calculated Risk on 1/01/2017 11:18:00 AM

Sunday, January 01, 2017

December 2016: Unofficial Problem Bank list declines to 169 Institutions, Q4 2016 Transition Matrix

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources. Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for December 2016. During the month, the list fell from 173 institutions to 169 after five removals and one addition. Assets dropped by $15 billion to an aggregate $45 billion. A year ago, the list held 250 institutions with assets of $75 billion.

This month, actions have been terminated against Flagstar Bank, FSB, Troy, MI ($14.2 billion Ticker: FBC); First Central Savings Bank, Glen Cove, NY ($537 million); International Bank, Raton, NM ($302 million); North Alabama Bank, Hazel Green, AL ($95 million); and Home Federal Bank of Hollywood, Hallandale Beach, FL ($41 million).

The addition this month was Heartland Bank, Little Rock, AR ($219 million).

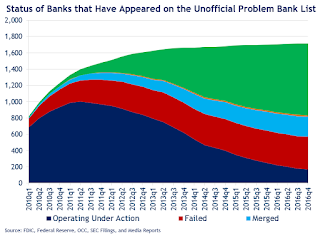

With it being the end of the fourth quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,716 institutions have appeared on a weekly or monthly list at some point. Only 9.8 percent of the banks that have appeared on the list remain today. In all, there have been 1,547 institutions that have transitioned through the list. Departure methods include 883 action terminations, 400 failures, 248 mergers, and 16 voluntary liquidations. Of the 389 institutions on the first published list, 18 or 4.6 percent still remain more than seven years later. The 400 failures represent 23.3 percent of the 1,713 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

During this fourth quarter, only eight banks were removed because of an improved financial condition. These eight removals represented only 4.5 percent of the 177 banks at the start of the quarter. This is the smallest number and rate of removal due to rehabilitation since the list was first published. Of note this quarter, is the removal of Flagstar Bank, FSB and its $14.2 billion in assets. This significantly narrows the asset differential to around $10 billion between the unofficial and the FDIC’s official figures. In its last release, the FDIC said there were 132 banks with assets of $35 billion on the official list. Subsequent to the release of the official figures, the FDIC placed First NBC Bank with assets of $4.9 billion under an enforcement action. Hence, we expect for the official figures to show an asset increase when they are released at the end of February 2017.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 170 | (63,869,745) | |

| Unassisted Merger | 40 | (9,818,439) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (1,348,079) | ||

| Still on List at 12/31/2016 | 18 | 5,889,603 | |

| Additions after 8/7/2009 | 151 | 39,069,010 | |

| End (12/31//2016) | 169 | 44,958,613 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 713 | 300,183,934 | |

| Unassisted Merger | 208 | 80,570,288 | |

| Voluntary Liquidation | 12 | 2,474,477 | |

| Failures | 243 | 119,858,467 | |

| Total | 1,176 | 503,087,166 | |

| 1Institution not on 8/7/2009 or 12/31/2016 list but appeared on a weekly list. | |||