by Calculated Risk on 10/07/2016 05:55:00 PM

Friday, October 07, 2016

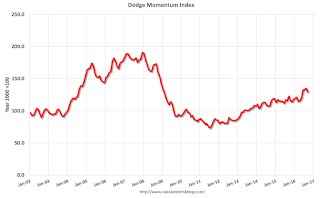

Leading Index for Commercial Real Estate "stumbles" in September

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data & Analytics: Dodge Momentum Index Stumbles in September

The Dodge Momentum Index fell 4.3% in September to 129.0 from its revised August reading of 134.8 (2000=100). The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The decline in September was the result of a 5.3% drop in institutional planning and a 3.6% decrease in commercial planning, retreating from the strong performance in August which benefitted from an influx of large projects ($100 million +) into planning. September’s decline follows five consecutive months of gains for the Momentum Index, and resumes for now the saw-tooth pattern that’s often been present in the data since 2014. Even with the recent volatility on a month-to-month basis, the Momentum Index continues to trend higher, signaling that developers have moved plans forward despite economic and political uncertainty. With the September release the Momentum Index is 5.1% higher than one year ago. The institutional component is 5.4% above its September 2015 reading, while the commercial component is up 4.9%

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 129.0 in September, down from 134.8 in August.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". In general, this suggests further increases in CRE spending over the next year.