by Calculated Risk on 9/09/2015 07:00:00 AM

Wednesday, September 09, 2015

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up Sharply YoY

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 4, 2015. ...

The Refinance Index decreased 10 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 41 percent higher than the same week one year ago. The annual change is inflated due to the shift in Labor Day from the first week in September last year to the second week this year.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.10 percent from 4.08 percent, with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

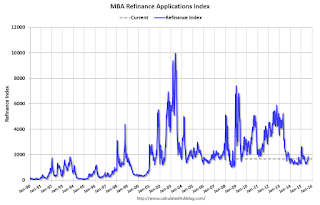

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

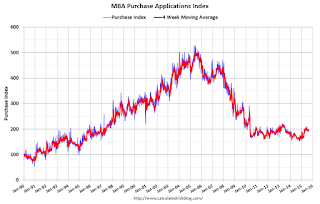

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 41% higher than a year ago - but is misleading due to the shift in timing of Labor Day.