by Calculated Risk on 6/22/2015 12:22:00 PM

Monday, June 22, 2015

A Few Random Comments on May Existing Home Sales

First, last month housing economist Tom Lawler pointed out the data in the South looked funny, see: The “Curious Case” of Existing Home Sales in the South in April. Sure enough, sales for April were revised up, with all of the upward revision coming in the South.

Second, as always, new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale.

Third, in general I'd ignore the median sales price because it is impacted by the mix of homes sold (more useful are the repeat sales indexes like Case-Shiller or CoreLogic). The NAR reported the median sales price was $228,700 in May, just below the median peak of $230,400 in July 2006. That is 9 years ago, so in real terms, median prices are close to 20% below the previous peak. Not close.

Inventory is still very low (up 1.8% year-over-year in May). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch over the next few months during the Spring / Summer buying season.

Note: I'm hearing reports of rising inventory in some mid-to-higher priced areas.

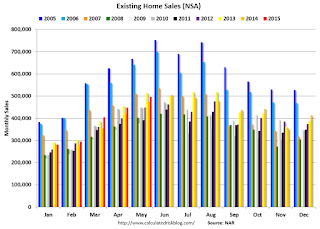

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in May (red column) were above May 2014, and were below May 2013 (NSA).

Earlier:

• Existing Home Sales in May: 5.35 million SAAR, Inventory up 1.8% Year-over-year