by Calculated Risk on 12/17/2014 04:48:00 PM

Wednesday, December 17, 2014

Zillow: Negative Equity declines further in Q3 2014, "Down by Almost Half Since 2012 Peak"

From Zillow: Negative Equity Down By Almost Half Since 2012 Peak, But There’s Still a Ways to Go

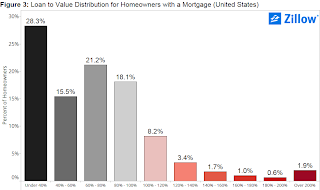

The national negative equity rate continued to decline in the third quarter, falling to 16.9 percent, according to the third quarter Zillow Negative Equity Report, down almost half from its 31.4 percent peak in the first quarter of 2012. More than 7 million previously underwater homeowners, those homeowners owing more on their home than it is worth, have been freed from negative equity since its peak.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q3 2014.

Negative equity fell from 21 percent in the third quarter of 2013 and 17.9 percent in the second quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Nationally, of the homeowners who are underwater, around half are only underwater by 20 percent or less, which is to say they are close to escaping negative equity. (Figure 3) On the other hand, 1.9 percent of owners with a mortgage remain deeply underwater, owing at least twice what their home is worth.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (8.2% in Q3 2014). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or their loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight to ten years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 5.2% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q3 negative equity report in the next couple of weeks. For Q2, CoreLogic reported there were 5.3 million properties with negative equity, and that will be down further in Q3 2014.