by Calculated Risk on 10/16/2014 05:21:00 PM

Thursday, October 16, 2014

CoStar: Commercial Real Estate prices increased in August

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Property Prices Sustain Upward Climb in August

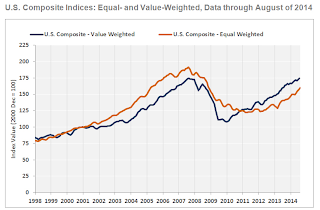

Fueled by better than expected job growth, demand continues to outstrip supply across major property types, resulting in tighter vacancy rates and continued investor interest in commercial real estate. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 1% and 1.5%, respectively, in August 2014.

...

The value-weighted U.S. Composite Index, which is heavily influenced by larger, core transactions, has now reached prerecession peak levels, and price gains have naturally slowed as a result. The Index increased 8.7% for the 12 months ending in August 2014, following 12% growth in the prior 12 months. Meanwhile, price growth in the equal-weighted U.S. Composite Index, which is influenced more by smaller non-core deals, accelerated to an annual rate of 13.6% in August 2014, up from an average of 8.7% in the prior 12 months.

...

Just 10.5% of all repeat sale transactions involved distressed assets in the first eight months of 2014, down from one-third of all repeat sale transactions in 2010.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is back to the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.