by Calculated Risk on 2/03/2014 08:15:00 AM

Monday, February 03, 2014

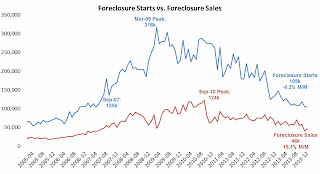

Mortgage Monitor: Foreclosure Starts Lowest Since April 2007

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for December today. According to LPS, 6.47% of mortgages were delinquent in December, up from 6.45% in November. BKFS reports that 2.48% of mortgages were in the foreclosure process, down from 3.44% in December 2012.

This gives a total of 8.95% delinquent or in foreclosure. It breaks down as:

• 1,964,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,280,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,244,000 loans in foreclosure process.

For a total of 4,488,000 loans delinquent or in foreclosure in December. This is down from 5,292,000 in December 2012.

Click on graph for larger image.

Click on graph for larger image.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

From BKFS:

• Delinquencies are now just 1.5x the pre-crisis average with foreclosures 4.6x (down from over 8)Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

• Foreclosure starts ended the year at the lowest level since April 2007 and pipelines are clearing in most states

• Sizeable delinquent inventories remain in the north- and south-east

The second graph from BKFS shows foreclosure starts. From BKFS:

The second graph from BKFS shows foreclosure starts. From BKFS: Black Knight found that 2013 marked the fourth consecutive year of significant, sustained improvement in the nation’s inventory of delinquent mortgages, and the second consecutive year of significant improvement for those in foreclosure. Delinquencies were just 1.5 times their pre-crisis average, with foreclosures down to 4.6 times their pre-crisis levels (declining from more than eight times the historical norm).There is much more in the mortgage monitor.

“In many ways, 2013 marked an abatement to crisis conditions in the U.S. mortgage market,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “Delinquencies neared pre-crisis levels, foreclosure inventory declined 30 percent over the year, new problem loan rates improved in both judicial and non-judicial foreclosure states, and foreclosure starts ended the year at the lowest level since April 2007."

emphasis added