by Calculated Risk on 1/30/2014 09:34:00 AM

Thursday, January 30, 2014

Q4 GDP: Solid Report, Positives Looking Forward

The advance Q4 GDP report, with 3.2% annualized growth, was slightly above expectations. Personal consumption expenditures (PCE) increased at a 3.3% annualized rate - a solid pace.

However the Federal Government subtracted 0.98 percentage points from growth in Q4, and residential investment subtracted 0.32 percentage points. Imagine no Federal austerity - Q4 GDP would have been above 4%. Luckily it appears austerity at the Federal level will diminish in 2014, and of course I expect that residential investment will make a solid contribution this year.

Change in private inventories made another positive contributions in Q4 (added 0.42 percentage points). I expect inventories will probably be a drag in 2014.

On a Q4-over-Q4 basis, real GDP increased 2.7% (above the Fed's December projections of 2.2% to 2.3%). On an annual basis, real GDP increased 1.9%. Note: See GDP: Annual and Q4-over-Q4 for the difference in calculations.

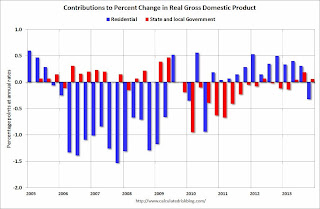

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local governments have added to GDP for three consecutive

quarters now.

I expect state and local governments to continue to make small positive contributions to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.

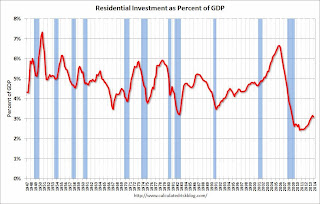

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report, and there are several positives going forward: RI should make a positive contribution in 2014, the drag from the Federal Government should diminish, state and local governments should make a small positive contribution again this year, and investment in equipment and software and non-residential structures should also be positive in 2014.